The Biden administration’s new share buyback tax will have little impact on the broader stock market. It might even help you. I refer to the new special tax of 1% on the repurchase of shares that came into force on January 1.

This tax has set off alarm bells in some corners of Wall Street, with the theory that buybacks were one of the biggest bolsters behind the bull market of the last decade, and anything that weakens that support could drive prices much higher. low.

Even more alarm bells went off after President Joe Biden wired his intention to quadruple the federal tax on buybacks, to 4%.

Read: Biden’s State of the Union: Here are key propositions from his speech

While this proposal is considered dead on Capitol Hill, the focus on possibly raising this 1% tax makes it less likely that it will be struck down anytime soon.

Tax applies to net repurchases

However, stock market bulls should not worry. One reason is that the new excise tax, either 1% or 4%, applies to net repurchases, repurchases that exceed the number of shares the corporation may have issued.

As has been widely reported for years, the shares many companies are buying back are often barely enough to make up for the new shares they issue as part of company executive compensation. As a result, the net repurchases, on which the new tax will be applied, are an order of magnitude less than the gross repurchases.

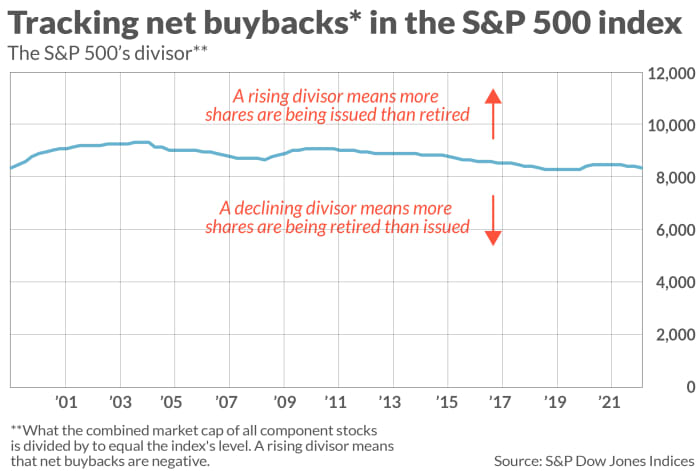

The chart below provides the historical context. Plots the SPX of the S&P 500,

divisor, which is the number used to divide the combined market capitalization of all component companies to get the level of the index itself. When more shares are issued than are repurchased, the divisor goes up; otherwise the divisor falls.

Notice on the chart that although there have been some year-over-year fluctuations in the divisor, the level of the divisor at the end of 2022 was virtually unchanged from where it was at the top of the internet bubble.

There is much irony in the application of the excise tax to net repurchases. Much of the political rhetoric that led to the creation of the tax was based on the complaint that companies were buying back their shares simply to reduce the share dilution that would otherwise occur when executives receive shares as part of their compensation packages. . But it is precisely when shares are repurchased and matching shares are issued that the tax would not apply.

Buyback tax could encourage higher dividends

The reason the new share buyback tax could help the stock market goes back to the impact it could have on companies’ dividend policy. Until now, the tax code provided an incentive for companies to buy back shares instead of paying dividends when they wanted to return cash to shareholders. By at least partially removing that incentive, companies in the future can turn to dividends more than before. The Tax Policy Center estimates that the new 1% buyback tax will lead to “an increase of approximately 1.5 percent in corporate dividend payments.”

This would be good news because, dollar for dollar, a higher dividend yield has more upside consequences than a higher buyback yield. (The repurchase yield is calculated by dividing the repurchases per share by the share price.) To show this, I compared the predictive abilities of any of the returns. I looked at quarterly data going back to the early 1990s, which is when the total volume of buybacks in the market started to become significant.

The accompanying table reports the r-squares of regressions in which the different returns are used to predict the performance of the S&P 500 over subsequent 1- or 5-year periods. (The r-square measures the degree to which one data set explains or predicts another.) Notice that the r-squares are markedly higher for the dividend yield than for the buyback yield.

| When predicting the performance of the S&P 500 over the next year | By predicting the performance of the S&P 500 over the next 5 years | |

| dividend yield |

4.2% |

54.9% |

| buyback yield |

1.0% |

10.2% |

The bottom line? While the new buyback tax is unlikely to have much of an impact on the stock market, the impact it does have could be more positive than negative.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a fixed fee to be audited. He can be contacted at brand@hulbertratings.com

Further: Biden points to share buybacks: do they help him as an investor?

Also read: The bond market is issuing a warning that US stocks could fall