Today I’m going to look at Costco and Target, two large retail chains. Shares of Costco (COST), the retail giant, are up 63% over the past year, while Target (TGT) is up 39% over the same period. Both stocks have performed well, but which is the better opportunity for investors going forward? Let’s examine that question.

I am neutral on Costco due to its high valuation. As for Target, I am bullish on this stock due to its cheap valuation, attractive dividend yield, and long history of dividend growth. Additionally, sell-side analysts see Target as having considerably more upside potential over the next 12 months.

The configuration

Costco is a beloved company among investors, and rightly so. Its stock has generated attractive returns for its shareholders over the years, reaching nearly 900% over the past decade. Costco is often cited as a well-run company with an attractive business model due to the recurring annual dues paid by its members.

Target has generated a total return of 224% over the past decade. Target is no slouch, but it has lagged significantly behind Costco’s performance over the past 10 years. However, this may create a more attractive situation for an investment in Target stock today, as we’ll discuss below.

Huge gap in ratings

While Costco is a great company with a strong track record of performance, it is currently trading at a fairly high multiple. Costco has an off-cycle fiscal year ending in August and will soon report its Q4 2024 earnings results. The company is trading above 50 times consensus earnings estimates for 2025. This sky-high multiple leaves little room for error down the road if the company disappoints investors in the fourth quarter or during the next fiscal year.

Target, meanwhile, trades at a much more reasonable valuation of 14.8 times forward earnings estimates, well below Costco’s multiple and also significantly below the S&P 500.Santa Clara Stock Exchange) forward valuation of 24x. One can argue that Costco is a higher quality business than Target based on its recurring membership fees, but a valuation three times as expensive seems like too big a difference.

Furthermore, despite Costco’s reputation for quality, Target is a higher-margin company, with gross margins of 26.1%, roughly double Costco’s gross margins of 12.5%. Target’s profit margin of 4.2% is also notably higher than Costco’s 2.8%. In my view, Target’s significantly lower valuation gives the stock more downside protection and more room to surprise on the upside.

Two stocks with strong dividend growth

Costco is a dividend-paying stock, but its 0.5% yield is pretty inconsequential. That said, Costco deserves credit for its solid dividend growth, having increased its dividend rate for 19 consecutive years.

Meanwhile, Target’s dividend yield is 2.9%. This is nearly six times higher than Costco’s current yield and more than double the yield of the S&P 500. Target has an even more impressive track record of consistently paying and increasing its dividends than Costco. Target is a dividend king that has increased its payout for 55 consecutive years.

Both companies also maintain relatively conservative payout ratios, meaning both dividends look safe for the foreseeable future. While Costco has done a good job of increasing its dividend, Target’s yield is significantly higher and its consistent track record of dividend growth is even better, supporting my bullish view on the stock.

Is COST stock a buy according to analysts?

As for Wall Street, COST gets a Strong Buy consensus rating based on 17 Buy ratings, five Hold ratings and no Sell ratings assigned over the past three months. The average price target for COST shares of $936.25 implies an upside potential of around 4.0% from current levels.

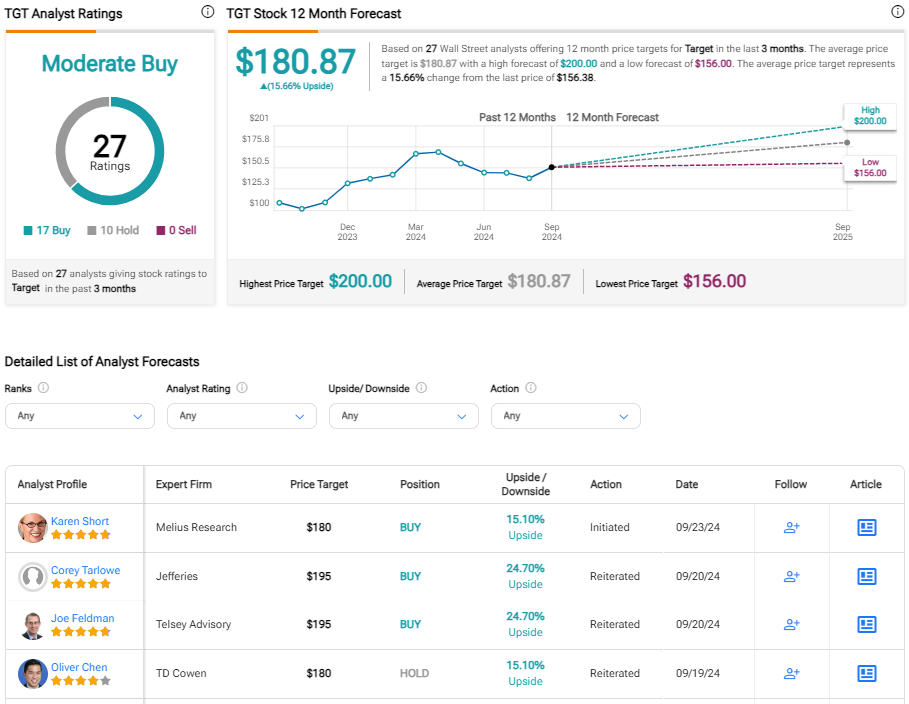

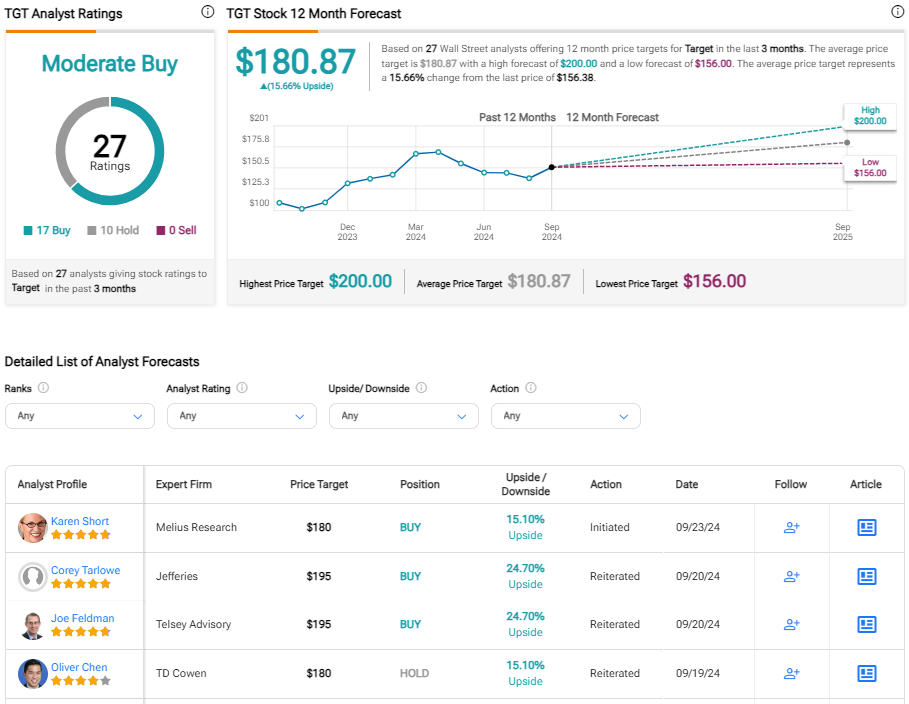

Is TGT a stock worth buying, according to analysts?

At the same time, TGT earns a Moderate Buy consensus rating based on 17 Buy, 10 Hold, and zero Sell ratings assigned over the past three months. The average price target for TGT stock of $180.87 implies an upside potential of around 16% from current levels.

Smart decisions

As you can see using TipRanks’ stock comparison tool below, both Costco and Target receive Outperform ratings from TipRanks’ Smart Score system.

Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to ten, based on eight key market factors. Scores of eight, nine or ten are considered equivalent to an Outperform rating.

Cocsto’s Outperform-equivalent Smart Score of nine is impressive, but Target stands out with a perfect Smart Score of 10.

Target stock appears to be the preferred investment option

Costco is a great company and has been a great performer for its shareholders for many years. However, I am neutral on the stock at this time as this strong performance has pushed its valuation to over 50 times forward earnings, giving the stock little room for error going forward.

Target trades at a much more attractive valuation of less than 15 times forward earnings, offers a higher dividend yield, and a longer track record of dividend growth. I am bullish on Target given its inexpensive valuation, attractive dividend yield, and 55 consecutive years of dividend growth. Costco is a good stock with a reliable track record of performance, but right now I consider Target to be the better investment choice based on my evaluation of the two options.

Divulgation