Typically, a dividend increase for a large-cap stock isn’t very large. These companies typically have a lot of shares outstanding, so even a modest increase in shareholder payout could mean additional expenses in the millions, possibly even billions of dollars. So, for the most part, when one of these titans announces a dividend increase, it’s more of a blip than a jump.

That was certainly not the case with telecommunications. T-Mobile US (NASDAQ:TMUS) Earlier this month, the company approved a 35% dividend increase. That’s a pretty generous increase; let’s take a closer look and find out if it helps make the stock a good buy.

Improved results and unexpected FCF gain

In mid-September, T-Mobile’s board of directors announced that its next quarterly dividend will be $0.88 per share. This surely pleased shareholders who had previously received a payout of “merely” $0.65. For investors who like to take advantage of these situations, there is still plenty of time to take advantage of this dividend increase, as it will be paid on December 12 to investors of record as of November 27.

T-Mobile is likely feeling good that its cash flow is flowing strongly. Looking back at its second-quarter earnings report from late July, there’s one item that stands out clearly: non-GAAP (adjusted) free cash flow (FCF). At $4.4 billion, this represented a whopping 54% year-over-year increase and marked an all-time high for the company. Other financial metrics rose nicely, but not as sharply, with its core services revenue advancing 4% to $16.4 billion, and overall net income increasing a hefty 32% to $2.9 billion.

FCF growth is the engine that drives dividend increases, hence the company’s confidence in boosting the payout by more than a third. In fact, T-Mobile has had plenty of gas in the tank for increases even before the second-quarter FCF increase, as quarterly spending across its few dividend rounds (it started paying out only in late 2023) was $769 million at most.

Fortunately for the company’s shareholders, management has raised its FCF guidance for the full year 2024. This should help management meet its target of annual dividend growth of approximately 10%.

Playing catch up

T-Mobile’s management might think it’s playing catch-up. After all, the two rivals it’s always comparing itself to… Verizon Communications and AT&T — have paid dividends consistently and reliably for years. Not only that,, But the pair have long since ventured into high-yield dividend territory and stayed there (despite significant changes to corporate structure, as in the case of AT&T). Verizon keeps its investors happy with a payout that yields more than 6%, while AT&T isn’t far behind at 5.1%.

While T-Mobile’s 35% increase is impressive on many levels, even at the new enhanced tier its distribution would only generate 1.7%.

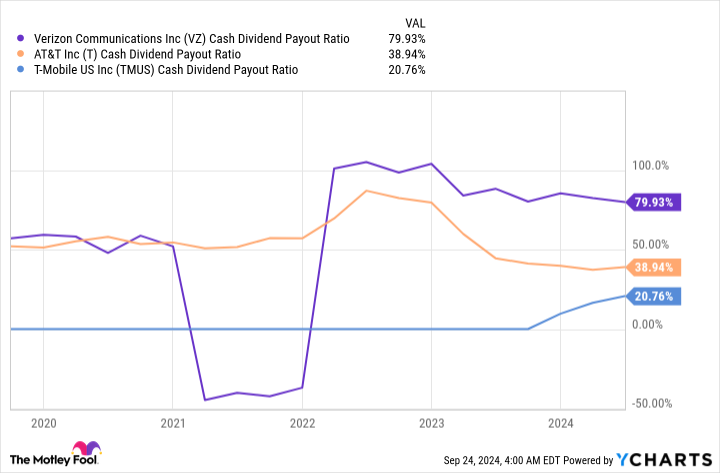

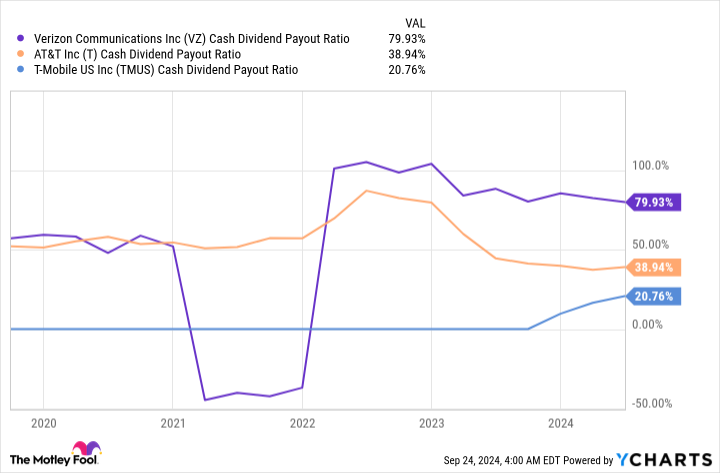

But we can expect this difference in returns to narrow before long, assuming T-Mobile keeps moving forward. If we take a look at its cash dividend payout ratio (i.e. the percentage of FCF it devotes to those dividend payments), it reveals a figure notably lower than that of AT&T or (especially) Verizon:

VZ Cash Dividend Payout Ratio Data According to YCharts

Meanwhile, in next-generation mobile technology, T-Mobile is better positioned than its two peers. It has managed to build out its 5G infrastructure to the point of being a leader; according to a July analysis by telecom research firm OpenSignal, the company is “untouchable” when it comes to 5G availability, with T-Mobile 5G subscribers connected to the technology nearly 68% of the time when they are online. That percentage is nearly six times higher than AT&T’s and about nine times higher than Verizon’s.

In fact, of the 15 categories tracked by OpenSignal, T-Mobile took home gold in nine of them, including 5G coverage experience and quality consistency.

AT&T and Verizon are clearly determined to close these gaps, but 5G isn’t cheap or easy to deploy. AT&T plans to spend $11.5 billion to $12.5 billion in the second half of this year on capital expenditures, and you can bet a big chunk of that will go toward 5G. In the same period last year, AT&T’s outlays totaled $11.2 billion. Verizon is also spending more, at $8.9 billion to $9.4 billion, up from $8.7 billion in the second half of 2023. Is it any wonder they’re both deep in debt?

Let’s face it, T-Mobile also has to spend to win, but its burden is not as heavy. The company estimates that its capital expenditure in the second half will be $4.2 billion, compared to $4 billion in the same period last year.

In short, T-Mobile operates in a sector considered indispensable to many consumers, is effectively improving its fundamentals without being burdened by spending targets as much as others, and has a dividend with room to grow at inspiring rates. All of that makes its stock quite attractive, in my opinion.

Should you invest $1,000 in T-Mobile US right now?

Before buying T-Mobile US stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and T-Mobile US wasn’t among them. The 10 stocks that made the cut could produce monster returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $756,882!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of September 23, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

This Telecom Stock Just Announced a Massive Dividend Increase. Should You Buy It? Originally published by The Motley Fool