There are few things investors enjoy more than receiving a dividend payment every quarter. However, one popular JPMorgan ETF, the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), takes this approach and does it best by paying investors a dividend on a monthly basis.

Not only that, but JEPI’s dividend yield is a whopping 11.8% on a rolling basis, which is more than seven times the average S&P 500 return of 1.65% and almost three times the return that the investors can get from 10-year Treasury bonds. Now, let’s take a look at the growing popularity of JEPI, its strategy, how it achieves this double-digit payout, and the holdings that make up this attractive ETF.

growing popularity

The JPMorgan Equity Premium Income ETF has rapidly raked in more than $21 billion in assets under management (AUM) and has become one of the most discussed ETFs on the market since it burst onto the scene in May 2020. JEPI was one of the most popular ETFs of 2022, generating record inflows for an actively managed ETF of nearly $13 billion. Just last week, JEPI was the top ETF in the market in terms of attracting new capital, generating more than $500 million in weekly income.

The ETF’s popularity can be attributed to its double-digit dividend yield, its monthly dividend, and the fact that it comes from a top-tier backer, JPMorgan. The 11.8% dividend yield and payout schedule hold great appeal to many investors: Holders essentially receive nearly 1% of their total investment each month in the form of a dividend.

What is JEPI ETF exactly?

JEPI’s strategy is to generate income by limiting volatility and downside. According to JPMorgan, JEPI “generates income through a combination of put options and investment in US large-cap stocks, seeking to generate a monthly income stream from associated option premiums and stock dividends.” JEPI also “seeks to deliver a significant portion of the returns associated with the S&P 500 Index with less volatility.”

JEPI does this by investing up to 20% of its assets in ELNs (equity-linked notes) and by selling call options with exposure to the S&P 500. This strategy worked well last year, as JEPI fell just 3.5% versus a much bigger drop. 19.6% drop for the S&P 500.

However, it should be noted that this strategy may also limit some of JEPI’s upside when stocks are rising. For example, the S&P 500 and Nasdaq are up 6.2% and 13.1% year-to-date, respectively, while the JEPI is down 0.6% so far in 2023. Said This, for investors who are more interested in income than capital appreciation, it’s hard to beat JEPI. Still, there is a place for both in investors’ portfolios, which is why I own JEPI as part of a balanced portfolio.

JEPI shares

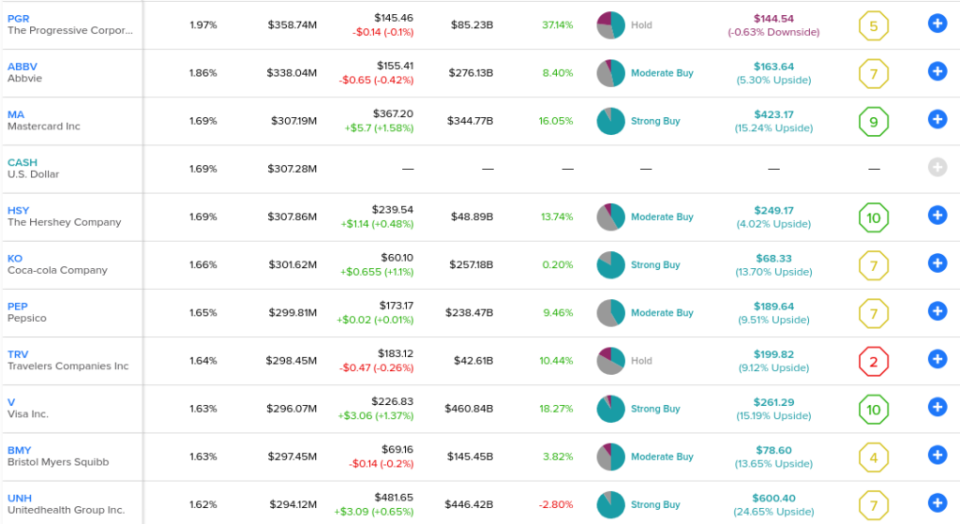

JEPI is well diversified, with holdings spread across 115 US-based stocks. Its top 10 holdings represent just 17.1% of assets, with no single stock representing more than 1.97% of the fund.

The main holdings of the JEPI ETF are made up of a mix of stocks from traditionally stable and defensive industries known for their dividends. The consumer staples segment is well represented in the top 10 through soft drink giants Coca-Cola and Pepsi, as well as the candy company Hershey. Pepsi and Coca-Cola are dividend kings that have been paying and increasing their dividend payments for 50 and 60 years, respectively, so these are the types of stocks you want to own in a dividend ETF.

Finance is also well represented: Progressive, an insurer, is the largest holding company, and is joined by another insurance company, Travelers, in the top 10. Meanwhile, payment networks such as Visa and Mastercard also feature.

Additionally, the healthcare industry has a strong presence in major holdings through stocks like AbbVie and Bristol Myers. The healthcare industry is traditionally viewed as a defensive business, and healthcare spending is less correlated with the broader economy, making this an advantageous sector for a dividend fund.

Note that JEPI also owns some non-dividend stocks, such as Amazon and Alphabet. You likely own these types of names to generate income using your derivatives (options) and gain more exposure to the upside potential of growth stocks and the S&P 500 as a whole.

Below is a look at the top JEPI ETF holdings, taken from the ETF holdings page:

What is the target price for JEPI shares?

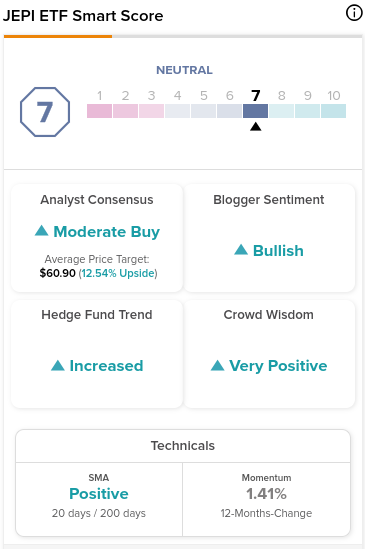

In addition to this double-digit dividend yield, the JPMorgan Equity Premium Income ETF also has some room for improvement, according to analysts. JEPI’s average stock price target of $60.90 is 12.5% higher than JEPI’s current price. Combine this upside potential with JEPI’s 11.8% yield and, in theory, you arrive at an attractive one-year return for the ETF.

TipRanks uses proprietary technology to compile analyst forecasts and price targets for ETFs based on a combination of the individual returns of the underlying assets. Using the Analyst Forecast tool, investors can view an ETF’s consensus price target and rating, as well as the highest and lowest price targets.

TipRanks calculates a weighted average based on the combination of all ETF holdings. The average price forecast for an ETF is calculated by multiplying each individual holding’s target price by its weight within the ETF.

ETFs also earn Smart Score ratings, with JEPI having an ETF Smart Score of 7 out of 10. In addition, JEPI looks attractive based on a number of other TipRanks indicators, including bullish blogger sentiment, rising share of hedge funds and the positive wisdom of the crowd.

In addition to these attractive features, JEPI also has a reasonable expense ratio of 0.35%.

JEPI risks

The main risk of an ETF like this is that, as discussed above, JEPI’s approach means it could lag the broader market during a bull market, as evidenced by underperformance this year against the S&P 500 and the Nasdaq.

However, it never hurts to add some ballast to your portfolio. The market has been volatile recently, and if the market worsens as 2023 progresses, JEPI should hold up well, as it did last year.

The other risk here is that, as a fairly new ETF, JEPI does not have a long track record of returns, but the portfolio managers running the fund, Hamilton Reiner and Raffaele Zingone, have 36 and 32 years of experience, respectively. and JPMorgan is a Tier 1 asset manager, so this is not a concern that I am losing sleep over.

For investors seeking reliable monthly income, JEPI is hard to beat and its double-digit performance stands out in today’s market environment. I own JEPI and see it as a key pillar of my portfolio that gives me some protection against loss, exposure to a large part of the US economy, and best of all, a steady stream of monthly payment-yield. average of 11.8% over the course of the year.

Divulgation