Since the Internet began to proliferate three decades ago, Wall Street and investors have been waiting for the next big innovation that could alter the growth trajectory of American companies. The artificial intelligence (AI) revolution appears to be answering the call for game-changing growth.

With AI, software and systems are used instead of humans to oversee or carry out tasks. What makes this technology so widely useful is the ability for software and systems to learn and evolve without human supervision.

While estimates for AI growth vary widely, last year analysts at PwC published a report estimating that the technology would add $15.7 trillion to the global economy by 2030. With such a large potential market, there are likely to be several big winners, which is why we’ve seen investors pile into AI stocks.

However, optimism around AI stocks is not universal among Wall Street’s brightest and wealthiest investors.

Nvidia’s top billionaire salesman dumped more than 29 million shares (split-adjusted) in Q1

According to Form 13F filings filed with the Securities and Exchange Commission (13Fs provide a snapshot of what Wall Street’s most successful money managers were buying and selling in the past quarter), more than half a dozen billionaire money managers dumped shares of the AI leader. Nvidia (NASDAQ: NVDA) during the first quarter, but no billionaire appeared to be hitting the sell button harder than Coatue Management’s Philippe Laffont.

Given that Nvidia has since completed a 10-for-1 stock split, Laffont’s fund sold the equivalent of 29,370,600 Nvidia shares, or roughly 68% of Coatue’s previous stake in the company.

Even though Nvidia has a veritable monopoly on AI-powered graphics processing units (GPUs) in high-end computing data centers, and enjoys otherworldly pricing power as demand for AI-powered GPUs outstrips supply, Laffont likely had several viable reasons for running for the exit.

To state the obvious, it’s possible that he and his team have simply been locking in some of their profits. Nvidia stock has gained nearly $3 trillion in market value since the start of 2023, which is a level of growth we’ve simply never witnessed before.

A more important concern for Nvidia and Laffont may be history. There hasn’t been a new innovation or technology in 30 years (including the advent of the Internet) that has avoided a bubble in its early stages. Investor euphoria over new innovations systematically ignores that all new innovations need time to mature. AI is unlikely to break this trend, which would ultimately expose Nvidia to serious downsides.

Nvidia is also facing its first real competition in AI-accelerated data centers. In addition to third-party competitors that are launching their AI GPUs, Nvidia’s major customers are also developing AI GPUs for their data centers. All of this translates into a reduced shortage of AI GPUs and decreased pricing power for AI leader Nvidia.

But while Philippe Laffont and his team were busy selling Nvidia shares in the quarter ended March, they couldn’t stop buying shares of four other supercharged growth stocks.

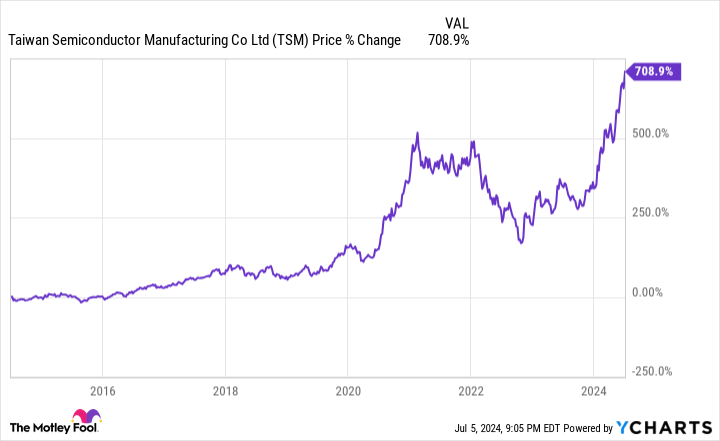

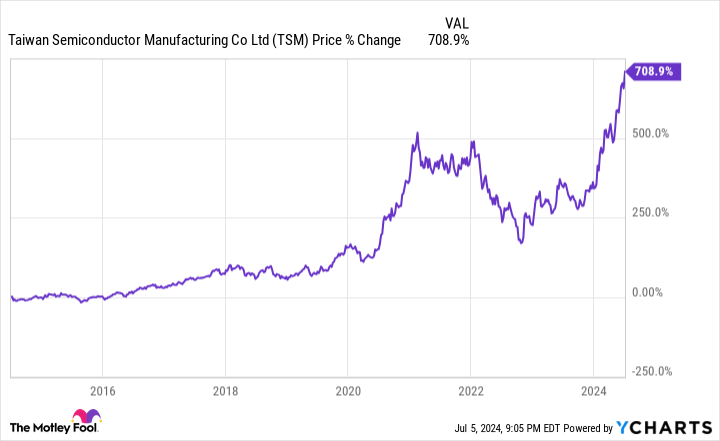

Semiconductor manufacturing in Taiwan

One of the most interesting moves made by billionaire Philippe Laffont and his investment team during the first quarter was the purchase of more than 10 million shares (10,027,552, to be precise) of the world’s leading chip manufacturing company. Semiconductor manufacturing in Taiwan (NYSE: TSM).

Taiwan Semi, which is now Coatue’s fifth-largest position by market value (as of March 31), serves most of the major tech companies and semiconductor titans, including Nvidia. With demand for AI-powered GPUs swamping supply, chipmaking companies like Taiwan Semiconductor, which are responsible for packaging the high-bandwidth memory that makes high-computing data centers run, should enjoy a deep order book.

Furthermore, Taiwan Semi is steadily reducing the geopolitical risk that had previously weighed on its valuation. The foundry giant opened its first plant in Japan earlier this year and expects to begin production at a new facility in Arizona sometime in 2025. This means that geopolitical tensions between China and Taiwan will not be as potentially detrimental to its future capacity.

Sales force

A second supercharged growth stock that Laffont and his investment team were buying instead of Nvidia during the quarter ending in March is the cloud-based customer relationship management (CRM) software solutions provider. Sales force (NYSE: CRM)Laffont more than doubled Coatue Management’s stake in Salesforce by acquiring 2,556,774 shares in the first three months of the year.

The main reason Salesforce has managed to become Coatue’s fourth-largest holding company probably has to do with the company’s seemingly impenetrable lead in cloud-based CRM software. A recent IDC report notes that Salesforce has been the world’s number one CRM software sales player for 12 consecutive years. Furthermore, its 21.7% global CRM market share is more than three times that of its next closest competitor (Microsoft by 5.9%).

In addition to sustained double-digit growth for the cloud-based CRM software, CEO and co-founder Marc Benioff has orchestrated a string of money-spinning acquisitions, including MuleSoft, Tableau Software, and Slack Technologies. The bolt-on acquisitions expand the company’s ecosystem of services and provide abundant cross-selling opportunities.

Alphabet

The third high-octane growth stock Laffont was busy buying as he sent AI giant Nvidia’s stock to the chopping block. Alphabet (NASDAQ: GOOGL)(NASDAQ:GOOG)the parent company of internet search engine Google, streaming platform YouTube, self-driving company Waymo and cloud infrastructure services platform Google Cloud. Coatue’s first-quarter 13F filing shows the fund’s position in Alphabet (GOOGL) Class A stock grew by 138%, or 2,597,338 shares.

As with Taiwan Semi and Salesforce, Alphabet’s appeal may be as simple as its impenetrable moat in internet search. For more than nine years, Google has accounted for at least a 90% monthly share of internet searches worldwide. In most cases, this gives the company exceptional ad-pricing power, which translates into abundant operating cash flow.

In the second half of this decade, Google Cloud will likely be Alphabet’s fastest-growing segment. Enterprise cloud spending is still in its early stages of growth, and Google Cloud made the shift to recurring earnings last year. Since cloud services margins are notably higher than advertising margins, this segment should provide a nice boost to Alphabet’s cash flow in the coming years.

Paypal

The fourth supercharged growth stock that Nvidia’s billionaire top salesman was a big buyer of during the quarter ending in March is the financial technology (“fintech”) giant. PayPal Holdings (NASDAQ: PYPL)Laffont oversaw the addition of 8,014,159 PayPal shares, making it Coatue’s 16th largest holding by market value, as of March 31.

Despite increasing competition in the digital payments space, many of PayPal’s key performance metrics are moving in the right direction. Specifically, payment transactions grew 11% year-over-year to $6.5 billion, total payment volume increased 14% in constant currency to nearly $404 billion, and engagement across active accounts continues to increase. During the trailing 12-month (TTM) period ending March 31, the average active account completed 60 payments, up from an average of 40.9 payments over the trailing 12 months for active accounts at the end of 2020.

Plus, new CEO Alex Chriss has a keen understanding of what small businesses need to succeed. He’s overseeing the rollout of a new advertising platform for PayPal and has been keeping a close eye on spending to boost margins.

Should You Invest $1,000 In Nvidia Right Now?

Before you buy Nvidia stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 stocks that made the cut could yield outsized returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $771,034!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of July 8, 2024

Alphabet executive Suzanne Frey is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet and PayPal. The Motley Fool has positions in and recommends Alphabet, Microsoft, Nvidia, PayPal, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: January 2026 $395 call options on Microsoft, January 2026 $405 call options on Microsoft, and June 2024 $62.50 call options on PayPal. The Motley Fool has a disclosure policy.

Forget Nvidia: The Billionaire Top Salesman of the Artificial Intelligence (AI) Leader Is Buying These 4 Supercharged Growth Stocks Instead was originally published by The Motley Fool