The average return on energy stocks is 3.2%. S&P 500 Index 1.2% Yield. The midstream energy giant Enterprise Product Partners (NYSE:EPD) The yield is 7%, twice that of the average energy stock and more than five times that of the broader market. And Enterprise’s unit price is just $30, so you can buy shares for less than $500 if you want.

Enterprise Products Partners has come back from the brink

Midstream players like Enterprise own large energy infrastructures such as pipelines, storage and transportation assets. These are difficult to replace or displace and are vital to energy sector operations. They are also very expensive to build. Leverage is therefore a major issue in the midstream sector.

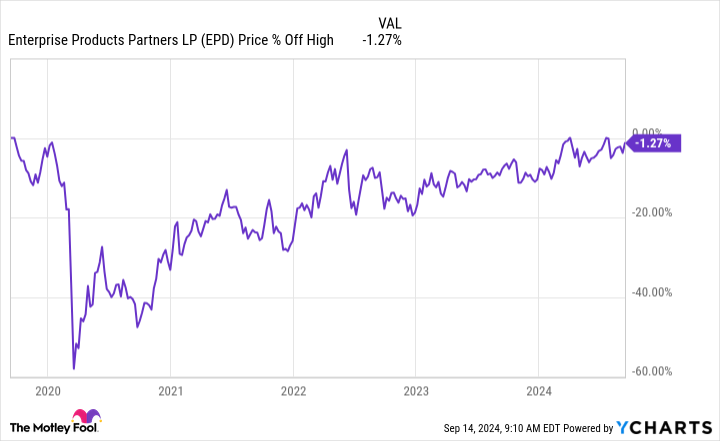

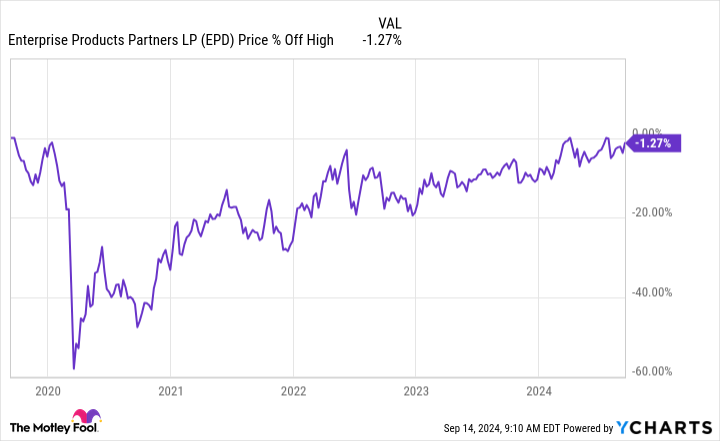

That affected the entire sector when interest rates were on the rise. Higher rates basically meant higher operating costs. That was a key reason why Enterprise’s unit price was weak after the market crashed during the early days of the COVID pandemic. That drop, ironically, was caused by concerns that energy demand would decline along with economic activity. However, the vast majority of Enterprise’s cash flows are driven by rates, not energy prices.

Essentially, Enterprise is paid for the use of its assets. The price of the raw materials flowing through its system is far less important than the demand for energy. Energy demand tends to remain robust even when oil prices are weak because oil, natural gas and the products they are transformed into are so important to the global economy. Now that rates are likely to fall, investors have finally figured out the backstory. Enterprise stock is almost back to where it was before the pandemic.

The company is still performing very well

That said, this master limited partnership (MLP) still has a massive yield. But don’t worry, it’s not a sign of weakness. It’s simply a combination of the sector (middle-tier entities tend to pay high yields) and the MLP structure, which is specifically designed to pass income on to unit holders. Despite the unit price rally, Enterprise remains an attractive option if you’re looking for a high-yield investment.

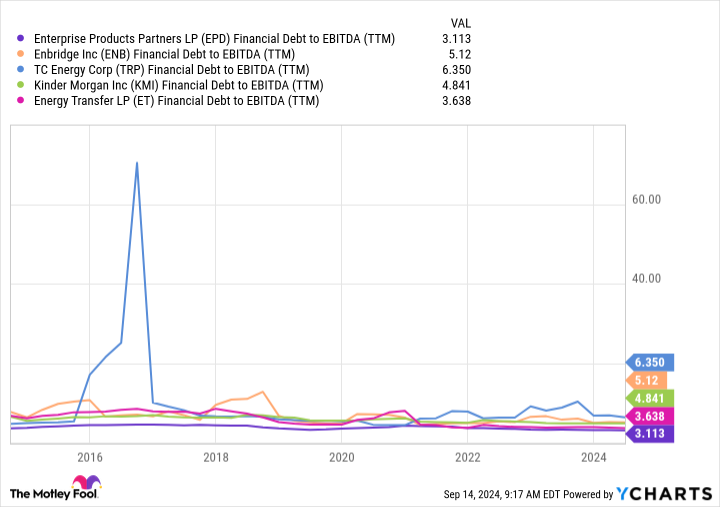

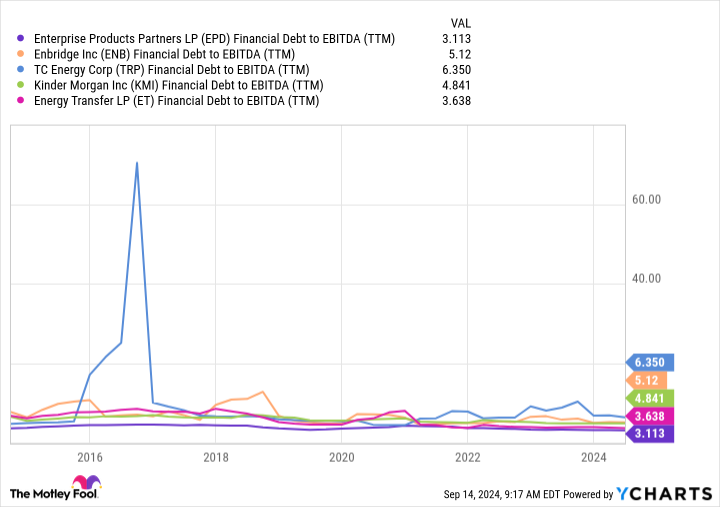

It’s not just about performance, though. Remember that Enterprise’s core operation tends to provide relatively consistent cash flows throughout the entire energy cycle. But there’s more to it. For example, Enterprise’s balance sheet is investment-grade rated. That’s great, but there’s another important detail that sets it apart from its closest peers. Enterprise has long operated at a very conservative level of leverage, appearing near the bottom of the debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) list year after year.

Management’s fiscally conservative approach doesn’t end there. Enterprise’s distributable cash flow also covers its distribution 1.7 times, providing tremendous headroom to weather adversity before a distribution cut is considered. And then there’s management’s commitment to growing the distribution, which has increased annually for 26 consecutive years. That’s an impressive streak considering the inherent volatility of the energy sector.

Enterprise Products Partners is an income investor’s best friend

There are reasons why you might want to select a different energy stock or even a midstream investment (e.g., more attractive growth opportunities). But if what matters to you is a high yield from a company that looks like it will pay you well in both good and bad times, then Enterprise should be on your investment list. While yield is likely to make up the bulk of your return over time, you’d be hard-pressed to find a better overall choice if you’re trying to maximize the income your portfolio generates.

Should You Invest $1,000 in Enterprise Product Partners Right Now?

Before you buy Enterprise Products Partners stock, please consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce outsized returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $722,320!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of September 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

The Best High-Yield Stocks to Buy with $500 Right Now was originally published by The Motley Fool