Everyone wants to find the next one. tesla (NASDAQ:TSLA). But investing in the electric vehicle (EV) space can be complicated. Many EV companies have gone bankrupt over the years and separating the good from the bad can be difficult.

Fortunately, Tesla established a clear blueprint for success. And right now, there’s an electric vehicle stock that looks extremely attractive. But there is only one investment strategy that is likely to be successful.

This is how Tesla became a huge success

In 2006, Tesla CEO Elon Musk revealed “Tesla Motors’ Secret Master Plan” to the public. “As you know, Tesla Motors’ initial product is a high-performance electric sports car called the Tesla Roadster,” his essay began. “However, some readers may not know that our long-term plan is to produce a wide range of models, including family cars at affordable prices.”

Musk summarized Tesla’s master plan:

Today, Tesla is a great symbol of success when it comes to executing long-term visions. The Tesla Roadster was a success, but given its price of more than $100,000, its market was always small.

Tesla needed to demonstrate its manufacturing skills and show the public that electric vehicles could be interesting and exciting. It used this success to design, build, and deliver two new models: the Model S and Model X. These models were still expensive, but they introduced Tesla to hundreds of thousands of new owners.

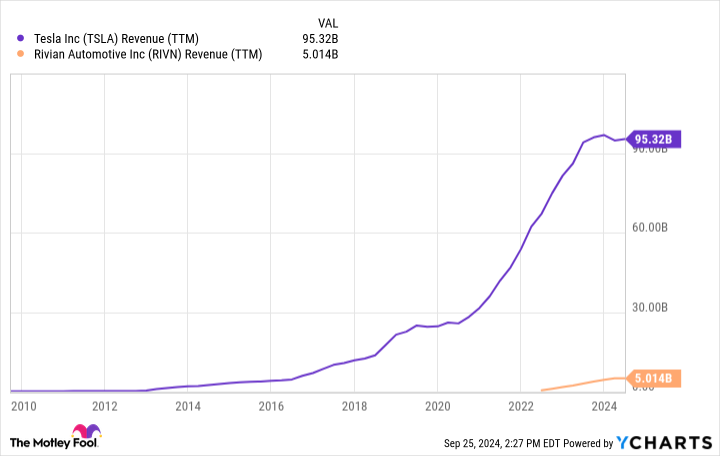

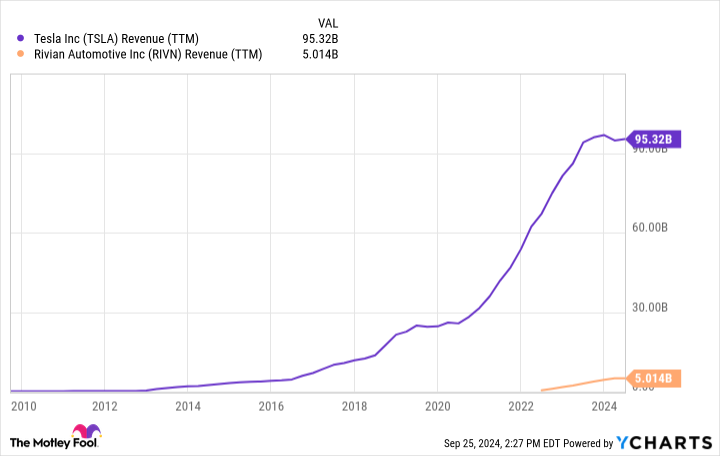

Tesla then used its reputation and access to capital to introduce two new mass-market models, the Model 3 and Model Y. These two models, with much more affordable prices, allowed Tesla to increase its revenue by more than 1,000% during the last decade. .

Tesla’s master plan worked wonders for its valuation. The company is currently worth around $800 billion. Meanwhile, another company is valued at just $11 billion, yet it is executing Tesla’s proven master plan flawlessly.

Rivian could be the next big electric vehicle stock

When it comes to following Tesla’s model of success, few electric vehicle companies look as attractive as rivian (NASDAQ:RIVN).

In 2018, Rivian announced the debut of its R1T and R1S models. Like previous Tesla models, the R1T and R1S were ultra-luxurious, high-quality, no-compromise vehicles, with prices that could easily exceed $100,000 with certain options. Consumer feedback was fantastic. Consumer Reports found that Rivian has the highest levels of customer satisfaction and loyalty of any automaker, electric or otherwise. About 86% of Rivian owners said they would buy another Rivian. No other brand surpassed the 80% mark.

What will Rivian do with its new reputation and sales base? Exactly what Tesla did: build more affordable cars. Earlier this year, the company introduced three new models: R2, R3 and R3X. All are expected to debut with starting prices below $50,000. It was reaching this price that helped put Tesla on the map for millions of people. If Rivian can execute it, it should prove very successful.

If Rivian can replicate Tesla’s success, why is its market cap around $10 billion? First of all, its new models aren’t expected to hit the road until 2026 at the earliest. Secondly, the necessary manufacturing facilities are not even complete yet. Third, the company continues to lose money at a rapid rate as vehicle manufacturing is capital-intensive. However, management expects to reach positive gross profits by the end of 2024. Finally, Rivian is trying to compete in a market segment (electric vehicles) that has seen many bankruptcies over the years.

It’s clear that the market is skeptical of Rivian’s plans, even though it is running a proven growth model and has demonstrated its ability to make vehicles that customers love. The next few years, however, will be crucial. Rivian will become a household name like Tesla if it can execute, an outcome that will likely see a rapid expansion in its valuation.

There is no guarantee that the company will retain its ability to access capital markets affordably or that it will quickly bring its manufacturing capabilities online. You will have to market your vehicles in a hyper-competitive industry. However, it’s this uncertainty that provides patient investors with a lucrative entry point into Rivian stock right now. If you can be patient, Rivian’s rise could eventually mirror Tesla’s.

Should I invest $1,000 in Rivian Automotive right now?

Before you buy shares in Rivian Automotive, consider this:

He Varied and Dumb Stock Advisor The analyst team has just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when NVIDIA made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $743,952!*

Stock Advisor provides investors with an easy-to-follow success plan, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. He Stock Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 actions »

*Stock Advisor returns from September 23, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Tesla. The Motley Fool has a disclosure policy.

The Best Electric Vehicle (EV) Stock to Buy with $1,000 Right Now was originally published by The Motley Fool