Rising Treasury yields appeared on Tuesday to finally catch up with a previously resilient stock market, leaving the Dow Jones Industrial Average and other major indexes with their worst day so far in 2023.

“Yields are jumping along the curve… This time it looks like market rates are catching up with fed funds,” veteran technical analyst Mark Arbeter, president of Arbeter Investments, said in a note. Generally, market rates tend to lead the way, he noted.

Since the beginning of the month, fed funds futures traders have priced in a more hawkish Fed after initially doubting the central bank would hit its forecast for a top federal funds rate above 5%. Some merchants are now even considering the external possibility of a top rate close to 6%.

The yield on the 2-year Treasury note TMUBMUSD02Y,

jumped 10.8 basis points to 4.729%, its highest closing in a US session since July 24, 2007. The 10-year Treasury yield TMUBMUSD10Y,

it rose 12.6 basis points to 3.953%, its highest level since November 9.

“At this point, the bond market has all but abandoned optimistic expectations for limited further hikes and a series of rate cuts in the second half of 2023,” Daniel Berkowitz, chief investment officer at Prudent Management Associates, said in comments sent by email.

Meanwhile, the US dollar is also up, with the ICE US Dollar Index adding 0.2% to the February rebound. Arbeter also noted that breadth indicators, a measure of how many stocks are participating in a rally, had previously deteriorated, with some measures reaching oversold levels.

“Just another perfect storm against the equity markets in the short term,” Arbeter wrote.

Rising yields can be negative for stocks as it increases borrowing costs. More importantly, higher Treasury yields mean that the present value of future earnings and cash flow are more discounted. That can weigh heavily on technology and other so-called growth stocks whose valuations are based on earnings in the far future. Those stocks took a hit last year but led gains in an early 2023 rally, holding up resilient over the past week even as yields extended a rebound.

Yields have been rising after a string of better-than-expected economic data, which has boosted expectations for rate hikes from the Fed.

Meanwhile, Tuesday’s weak guidance from Home Depot Inc. HD,

and Walmart Inc.WMT,

it also contributed to the weak tone of the stock market.

Home Depot plunged more than 7%, becoming the biggest loser among the components of the Dow Jones Industrial Average DJIA,

The drop came after the home improvement retailer reported a surprise decline in fiscal fourth-quarter same-store sales, led by a surprise drop in fiscal 2023 profit and earmarked an additional $1 billion for pay more to their associates.

“While Wall Street expects resilient consumers after last week’s strong retail sales report, Home Depot and Walmart are much more cautious,” José Torres, a senior economist at Interactive Brokers, said in a note.

“This morning’s data offers more mixed signals on consumer demand, but during a traditionally weak seasonal business period, investors are moving towards a glass-half-empty view against the backdrop of a year that has delivered exactly the opposite. so far, a glass half full. perspective,” he wrote.

The Dow Jones plunged 697.10 points, or 2.1%, to close at 33,129.59, while the S&P 500 SPX,

it fell 2% to close at 3,997.34, ending below the 4,000 level for the first time since January 20. The drop slashed the S&P 500’s annual gain to 4.1%, according to FactSet, which is less than half the 9% year-to-date gain it had enjoyed at its Feb. 2 peak.

The Nasdaq Composite COMP,

it fell 2.5%, trimming its year-to-date gain to 9.8%. The losses left the Dow slightly negative for the year, down 0.5%. It was the worst day for the three major indices since December 15, according to Dow Jones Market Data.

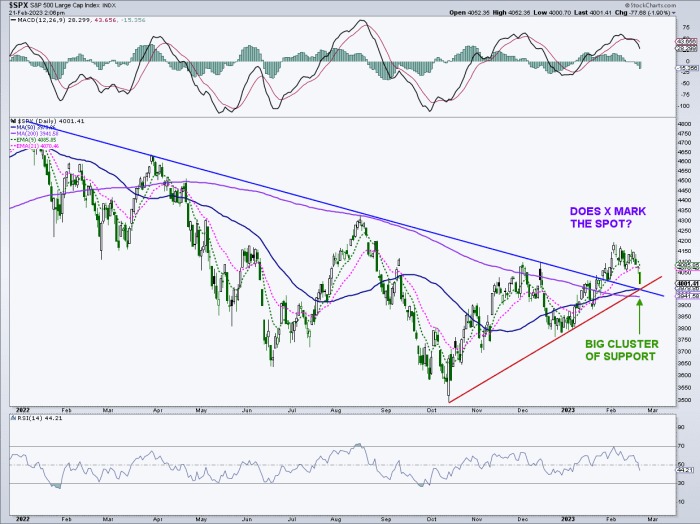

Arbeter identified a “very interesting cluster” of support just below Tuesday’s low for the S&P 500, with a pair of trend lines converging along with the index’s 50-day and 200-day moving averages, all near 3,970 (see chart below).

Arbeter Investments LLC

“If that zone does not represent the pullback lows, we have more problems ahead of us,” he wrote.