You can not deny that Nvidia (NASDAQ: NVDA) Apple’s stock value has been on a tear since early last year. At the time of writing, its shares have soared more than 750%, driven by the potential implications of generative artificial intelligence (AI). The ability to streamline time-consuming tasks and automate routine processes promises to boost productivity and could unleash a wave of increased profits for companies that embrace this cutting-edge technology.

Nvidia’s graphics processing units (GPUs) are the gold standard, providing the computing power needed for AI processing. This has unleashed a surge in demand for the company’s high-end processors, causing its business and financial results to soar, leading to its recent 10-for-1 stock split.

While some investors fear that the easy money has been made, others believe that the best is yet to come. One analyst suggests that Nvidia has a decisive advantage that will allow it to stay ahead of the competition and generate “cash flow” that will benefit shareholders.

Let’s see if the analyst’s argument is valid and what it means for investors.

A long history of success

To understand where this “cash flow” comes from, it’s helpful to take a step back and look at how Nvidia got to where it is today.

Nvidia’s latest-generation processors have long been the industry standard for serious gamers. The company controlled 88% of the desktop GPU market in the first quarter, according to data compiled by Jon Peddie Research.

However, Nvidia adapted that same technology to send data across the ether, becoming the go-to processor for data centers. Estimates suggest the company controls up to 92% of the data center GPU market, according to IoT Analytics. Nvidia is also the undisputed leader in machine learning processing (an established branch of AI), with an estimated 95% of that market, according to data provided by New Street Research.

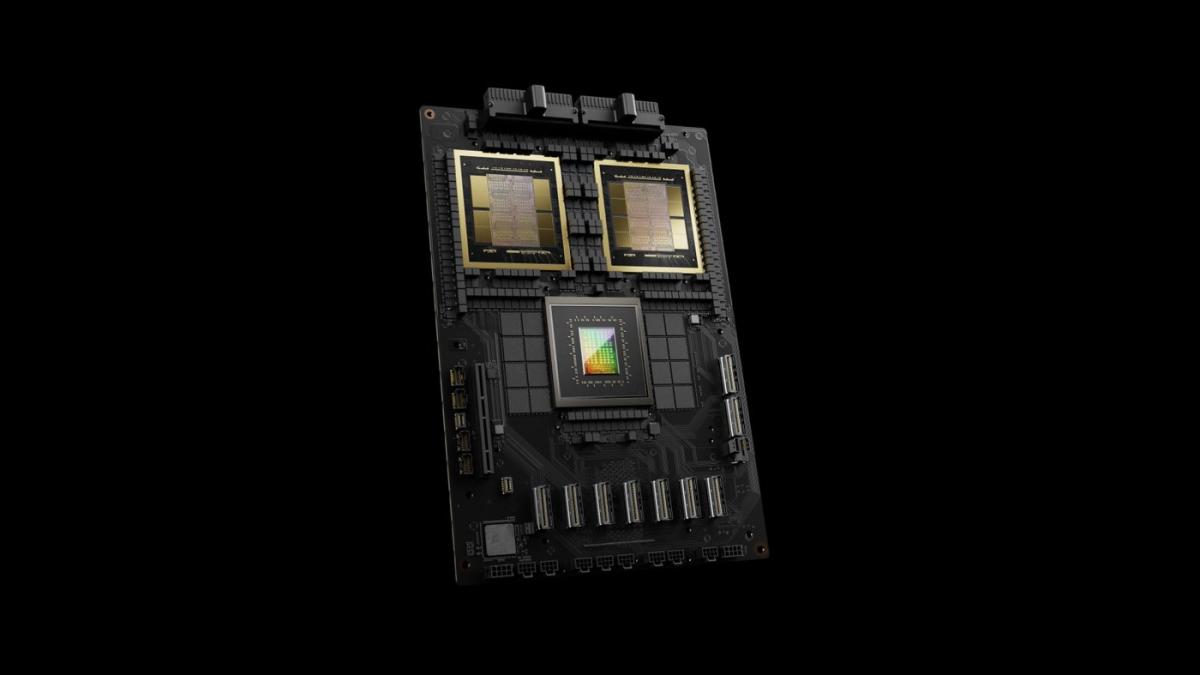

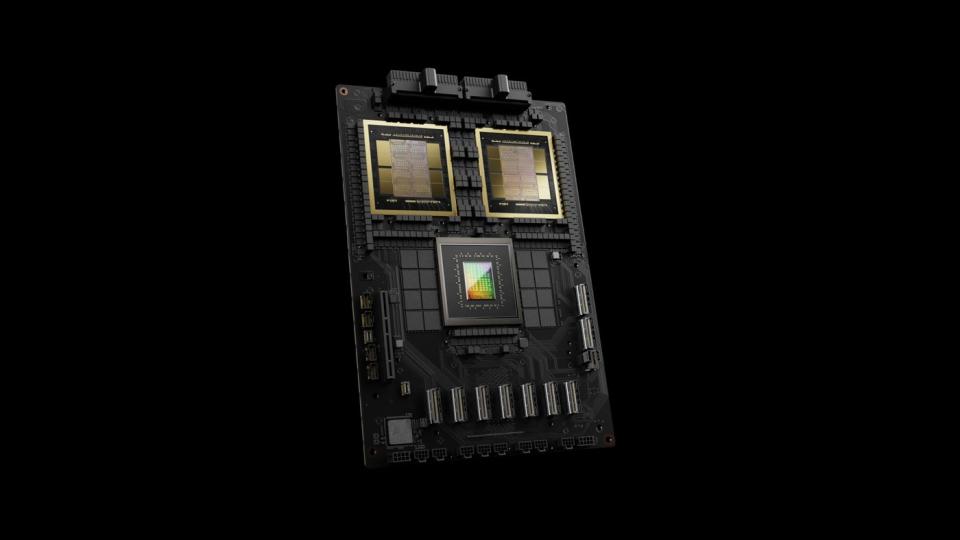

With much of generative AI processing happening in the cloud and data centers, Nvidia has solidified its position as a leader. The company plans to launch its Blackwell processor family later this year, and CEO Jensen Huang has said, “The Blackwell Architecture platform will likely be the most successful product in our history.” If that’s the case — and I think it is — the best could be yet to come.

Furthermore, while the popular narrative is that Nvidia is on the cusp of competing, so far (despite years of opportunity) no serious competitor has emerged.

A “cash cow”

Ben Reitzes, an analyst at Melius Research, believes Nvidia has a decisive advantage that some investors may be overlooking and that will keep the company at the forefront of technology. Nvidia not only offers chips tailor-made for AI, but also the built-in software that squeezes every last ounce of performance out of these AI-focused processors. This “full-stack” approach, or the combination of hardware and software, gives Nvidia a key advantage that will be hard for rivals to match, particularly given the company’s long track record of leadership in this field.

“What they’ve done is built a computer language and an ecosystem that allows you to monetize AI, and they’re obviously succeeding in doing that,” Reitzes said.

The analyst goes on to point out that Nvidia’s pace of research and development (R&D) makes it difficult for competitors to keep up. The company has recently increased its already relentless pace of innovation, with CEO Jensen Huang stating that the company is now “on a one-year pace,” releasing new processors every year instead of every two. “They’re going 150 miles an hour while everyone else is going 100. It’s going to be hard to catch up,” Reitzes said.

As a result of accelerated AI adoption and Nvidia’s dominant position, the company is estimated to generate $270 billion in cash over the next three years, potentially unleashing a wave of returns for shareholders in the form of share buybacks and higher dividend payments.

The analyst notes that even with increased R&D spending, the cash inflow will far outweigh any potential use, suggesting the majority will be returned to shareholders.

Investors are already seeing evidence of that shift. Late last year, Nvidia announced a new $25 billion share buyback plan. And in conjunction with the announcement of its stock split in May, the company increased its dividend payout by 150%. That said, Nvidia currently uses less than 1% of earnings to fund the dividend, and even at its highest rate, the yield is a measly 0.03%.

This shows that there is still plenty of opportunity for Nvidia to return money to shareholders, and with the AI adoption tsunami underway, the company will have an increasing amount of resources to do so. Plus, given its competitive advantage, a rival is unlikely to take Nvidia’s crown, at least not in the near future.

Should You Invest $1,000 In Nvidia Right Now?

Before you buy Nvidia stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 stocks that made the cut could yield outsized returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $757,001!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of June 24, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in Nvidia and recommends it. The Motley Fool has a disclosure policy.

Nvidia’s 1 Killer Upside Will Produce a “Large Amount of Cash” for Shareholders Following Its 10-for-1 Stock Split, According to a Wall Street Analyst. was originally published by The Motley Fool