It’s no secret that semiconductor stocks have been particularly big winners amid the artificial intelligence (AI) revolution. With stock prices on the rise, several high-profile chip companies have opted to split their stocks this year. Some AI chip stocks you may recognize include: Nvidia (NASDAQ: NVDA), Supermicrocomputer (NASDAQ: SMCI)and Broadcom (NASDAQ:AVGO).

In fact, each of these stocks has worked wonders in many portfolios over the past few years. However, I consider one of these chip stocks to be the better choice compared to its peers.

Let’s take a look at the full picture for Nvidia, Supermicro, and Broadcom and determine which AI chip stock could be the best buy-and-hold opportunity for long-term investors.

1. Nvidia

Over the past two years, Nvidia has not only been the biggest name in the chip space, but it has also become the definitive indicator of demand for AI in general. The company specializes in the design of sophisticated chips, known as graphics processing units (GPUs), and services for data centers. In addition, Nvidia’s Compute Unified Device Architecture (CUDA) provides a software component that can be used in conjunction with its GPUs, giving the company an enviable and lucrative end-to-end AI ecosystem.

While everything looks great, investors can’t afford to get too excited given Nvidia’s current dominance. The table below breaks down Nvidia’s revenue and free cash flow growth trends over the past few quarters.

|

Category |

Second quarter of 2023 |

Third quarter of 2023 |

Fourth quarter of 2023 |

First quarter of 2024 |

Second quarter of 2024 |

|---|---|---|---|---|---|

|

Revenue |

101% |

206% |

265% |

262% |

122% |

|

Free cash flow |

634% |

Not material |

553% |

473% |

125% |

Data source: Nvidia Investor Relations.

Admittedly, it’s hard to criticize a company that consistently generates triple-digit revenues and profits. My concern with Nvidia isn’t about the level of its growth, but about its pace.

In the company’s second quarter of fiscal 2025 (ended July 28), Nvidia’s revenue and free cash flow increased 122% and 125% year over year, respectively. This is a noticeable slowdown from recent quarters. It’s fair to point out that the semiconductor industry is cyclical, and a factor like that could influence growth in a given quarter. Unfortunately, I think there’s more going on beneath the surface with Nvidia.

That is, Nvidia faces increasing competition from direct industry forces, such as Advanced Microdevicesand tangential threats from its clients, namely, Tesla, Goaland AmazonIn theory, as competition in the chip space increases, customers will have more choice.

This leaves Nvidia with less leverage, which will likely reduce some of its pricing power. In the long run, this could come at a high cost to Nvidia’s revenue and earnings growth. For these reasons, investors might want to consider some alternatives to Nvidia.

2. Supermicrocomputer

Supermicro is an IT architecture firm specializing in the design of server racks and other data center infrastructure. In recent years, the growing demand for semiconductor chips and data center services has served as a bellwether for Supermicro. In addition, the company’s close partnership with Nvidia has proven especially beneficial.

That said, I do have some concerns regarding Supermicro. As an infrastructure company, the company is highly dependent on the capital investment needs of other companies. This makes Supermicro’s growth susceptible to external variables, such as demand for data center services, chips, server racks, and more. Furthermore, Supermicro is far from the only IT architecture specialist in the market.

Competition of Dell, Hewlett Packardand Lenovo (to name just a few) bring their own levels of expertise to the market. As a result of competing in such a commoditized environment, Supermicro may be forced to compete on price, which impacts profit generation.

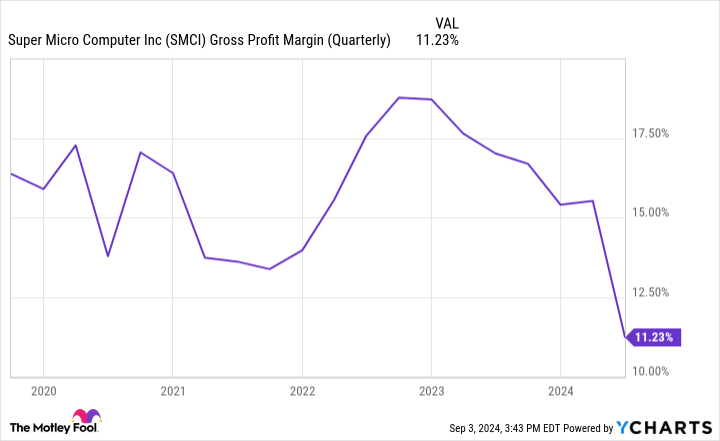

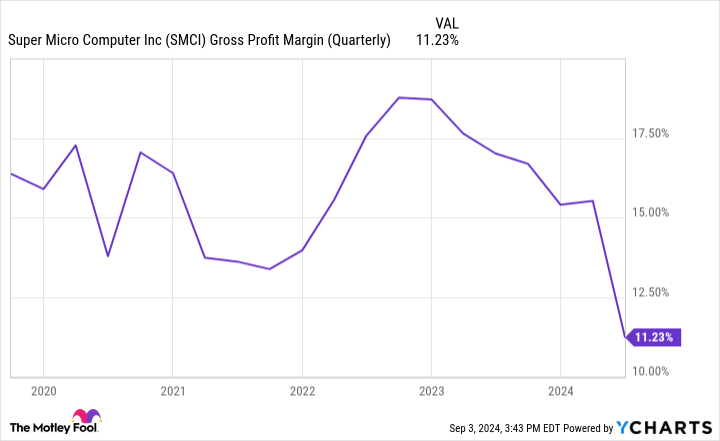

Infrastructure companies don’t have the same margin profile as software companies, for example. Since the company’s gross margins are quite low and declining, investors should be cautious. While Supermicro’s management attempted to assure investors that the margin deterioration is the result of some supply chain bottlenecks, the latest news might indicate that gross margin is the least of the company’s concerns.

Supermicro was recently the subject of a brief published by Hindenburg Research. Hindenburg alleges that Supermicro’s accounting practices have some flaws. Following the brief report, Supermicro responded in a press release explaining that the company is delaying its annual filing for fiscal year 2024.

Given the unpredictability of demand prospects, fluctuating margin and earnings dynamics, and allegations surrounding its accounting practices, I believe investors now have better options in the chip space.

3. Broadcom

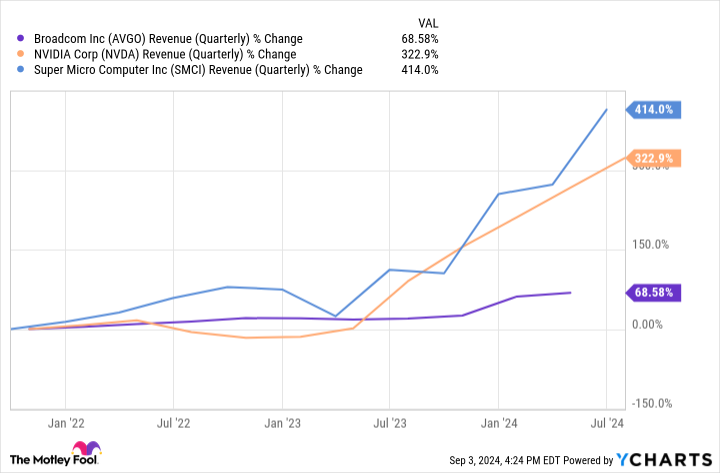

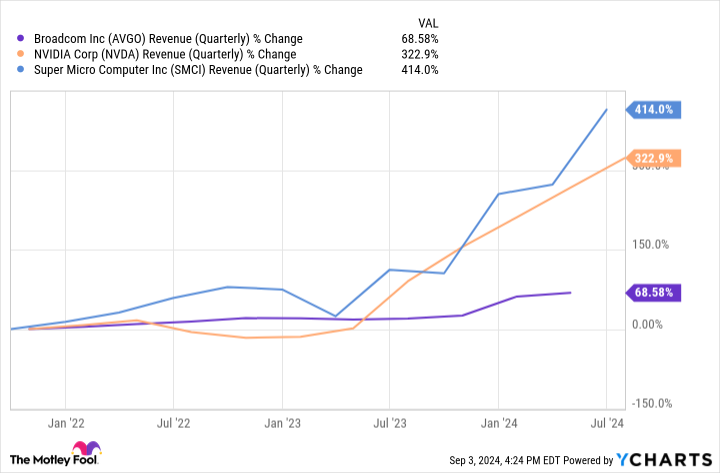

By elimination, it’s clear that Broadcom is my top buy-and-hold pick among chip stocks right now. However, this isn’t because Broadcom’s returns this year have lagged behind those of its peers. The underlying reasons why Broadcom stock has paled in comparison to other chip stocks might shed some light on why I think its best days are ahead.

I view Broadcom as a more diversified company than Nvidia and Supermicro. The company operates in a number of growth markets, including semiconductors and infrastructure software. Grand View Research estimates that the total addressable system infrastructure market in the US was valued at $136 billion in 2021 and was expected to grow at a compound annual rate of 8.4% between 2022 and 2030.

Systems infrastructure includes opportunities in data centers, communications, cloud computing and more. With corporations of all sizes increasingly relying on digital infrastructure to make data-driven decisions, I see Broadcom’s role in network connectivity and security as a huge opportunity and believe its recent acquisition of VMware is particularly smart and will help unlock new growth potential.

Looking at the growth trends in the chart above, it’s obvious that Broadcom isn’t experiencing the same level of demand as Nvidia and Supermicro right now. I believe this is because Broadcom’s position in the broader AI space hasn’t yet seen proportional growth compared to the massive purchase of chips and storage solutions.

While I’m not saying that Nvidia or Supermicro are bad choices, I think their futures look more uncertain than Broadcom’s right now. I think Broadcom is in the early stages of a new growth frontier that includes many different themes (and AI is just one of them). For these reasons, I consider Broadcom to be the best choice discussed in this article, and I think long-term investors have a lucrative opportunity to buy and hold shares.

Should you invest $1,000 in Broadcom right now?

Before buying Broadcom stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and Broadcom wasn’t one of them. The 10 stocks that made the cut could yield outsized returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $630,099!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions with Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has positions with and recommends Advanced Micro Devices, Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Nvidia, Super Micro, or Broadcom? Meet the AI-powered stock split that I think is the best buy-and-hold for the next 10 years. Originally published by The Motley Fool