Palantir Technologies (NYSE:PLTR) is quickly becoming the go-to provider of artificial intelligence (AI) software platforms for businesses and governments around the world. This is evidenced by the company’s recent acceleration in growth as well as the improvement in its revenue pipeline. Both metrics point to better times ahead.

Investors have taken notice and have been buying Palantir stock in droves. The stock is up an impressive 76% so far in 2024, and the following analysis offers clues as to why that is.

Palantir’s artificial intelligence software platform has gained impressive traction

When Palantir released its second-quarter results last month, the company reported a 27% year-over-year increase in revenue to $678 million. This is a solid improvement from the 13% year-over-year growth the company posted in the same period last year, as well as an acceleration from its first-quarter revenue growth of 21%.

The company’s customer base has seen a significant increase, as has the size of the deals it has closed with its customers. Palantir management attributed its improving growth profile to the increasing adoption of its Artificial Intelligence Platform (AIP). This is a software platform that helps businesses and governments integrate generative AI into their processes to help improve operational efficiency.

From helping customers build their own applications based on large language models (LLMs) to helping them speed up their daily workflows with the help of generative AI, the utility of Palantir’s AIP seems to have struck a chord with customers. This explains why the company raised its revenue growth forecast for 2024 and expects its top line to grow 24% this year to $2.75 billion.

More importantly, Palantir appears capable of sustaining its extraordinary growth over the long term, considering it ended the previous quarter with $4.3 billion in remaining transaction value (RDV). The metric refers to the total remaining value of Palantir’s contracts at the end of a period, and it was up 26% year over year in the second quarter.

This AI hardware giant is making inroads into the AI software market

So Palantir appears to be on track to make the most of the massive end-market opportunity offered by the generative AI software market. However, there is another way for investors to take advantage of the growing demand for AI software, and a closer look might lead investors to think that it may be a better AI software stock than Palantir.

Nvidia (NASDAQ: NVDA) Nvidia has been the go-to choice for enterprises looking to acquire high-end AI hardware to train AI models, resulting in outstanding revenue and profit growth for the company in recent months. What’s interesting is that CFO Colette Kress’ comments on the recent earnings conference call suggest that Nvidia is starting to make a dent in the enterprise AI software market as well. According to Kress, “We expect our software, SaaS, and support revenue to approach a $2 billion annual run rate by the end of this year, with Nvidia AI Enterprise contributing significantly to growth.”

CEO Jensen Huang also commented, noting that customers can deploy Nvidia AI Enterprise software for $4,500 per graphics processing unit (GPU) per year. With Nvidia’s AI GPUs priced at $30,000 or more for a single chip depending on configuration, enterprise customers looking to build and deploy AI models are getting a good deal through Nvidia’s AI software platform.

Nvidia offers its customers multiple AI software offerings. For example, the company’s AI Foundry platform, which launched in July of this year, is a one-stop solution that allows customers to build and deploy custom generative AI models. Nvidia offers popular base models that its customers can modify, enabling them to quickly move AI applications—including chatbots, content creation tools, and document processing tools—into production.

Nvidia also offers customizable, pre-trained AI workflows that can be used to extract data from PDF files or deployed to create customer service workflows, accelerate drug discovery in the medical field, or build custom generative AI applications tailored to an organization’s needs. What’s worth noting is that the adoption of Nvidia’s software solutions is increasing at a dramatic rate thanks to AI.

In its February earnings call, Nvidia management noted that its software and services offerings reached an annual revenue run rate of $1 billion in the fourth quarter of fiscal 2024. The company’s software and services revenue run rate is therefore set to double in the space of a single year. That’s significantly faster than the pace at which Palantir’s top line is expected to grow this year.

Add to this the fact that Nvidia is benefiting greatly from the growing demand for its AI chips, which drove 122% year-over-year growth in the company’s revenue in the second quarter of fiscal 2025 to $30 billion, and it’s easy to see that the chipmaker is the most diversified bet in the AI space. Another point worth noting here is that Nvidia stock is trading at 28 times sales, which is lower than Palantir’s sales multiple of 29.

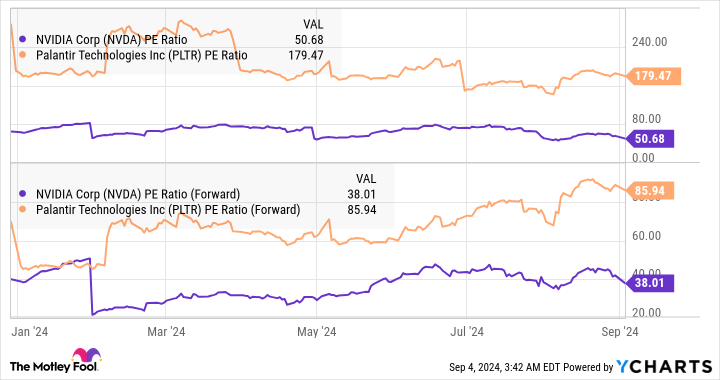

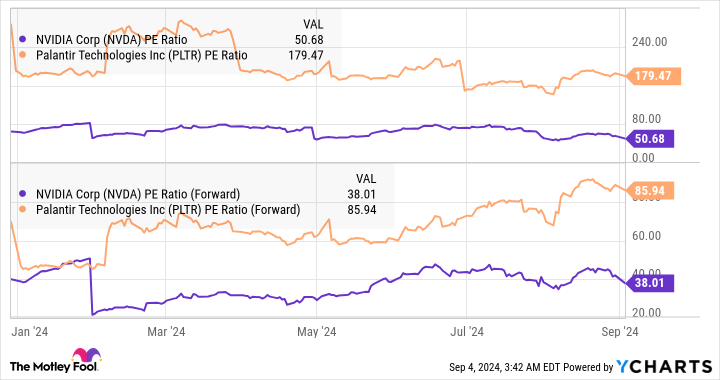

What’s more, Nvidia is the more attractive AI stock when we compare the earnings multiples of both companies.

Therefore, investors looking for a cheaper alternative to Palantir to take advantage of the growing AI software market would do well to take a closer look at Nvidia, especially considering that the latter already has a thriving AI hardware business that makes it a better growth stock to buy right now.

Should You Invest $1,000 In Nvidia Right Now?

Before you buy Nvidia stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 stocks that made the cut could yield outsized returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $630,099!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in Nvidia and Palantir Technologies and recommends them. The Motley Fool has a disclosure policy.

Meet the AI Stock That Could Become the Next Palantir — or Even Better was originally published by The Motley Fool