NextEra Energy (NYSE: NEE) It has a dividend yield of around 2.7% currently. Income investors and those with a value bias probably won’t want to buy its shares, but if you like dividend growth stocks, the 10% annualized payout growth NextEra Energy has achieved over the last decade will likely make your juice flow.

And if management is right, the future looks as good as the past for dividend growth.

Why some people won’t like NextEra Energy

NextEra Energy has a major problem: Wall Street knows it is a very well-run utility. That’s why the yield is 2.7%, which is below the 3% average for the utility sector, using the Vanguard Utilities Index ETF (NYSEMKT: VPU) as agent.

Sure, NextEra yields more than the 1.3% you’d get from an S&P 500 index fund, but it’s simply not a high-yield stock. Dividend investors and those with a value bias (noting that yields have been, at best, middle-of-the-road over the past decade) will likely want to look at utilities with higher yields.

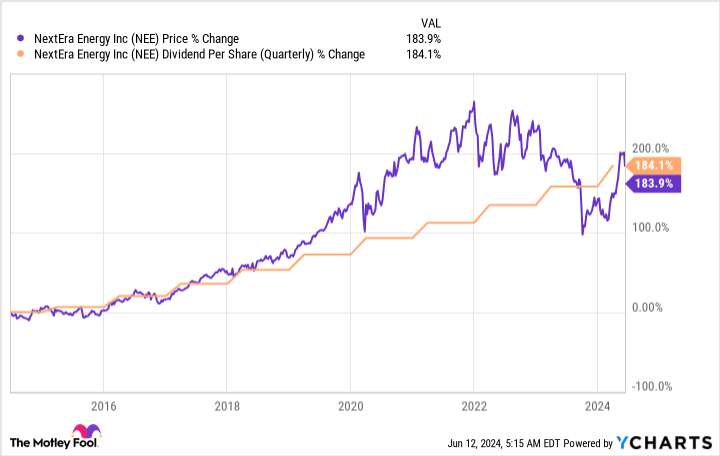

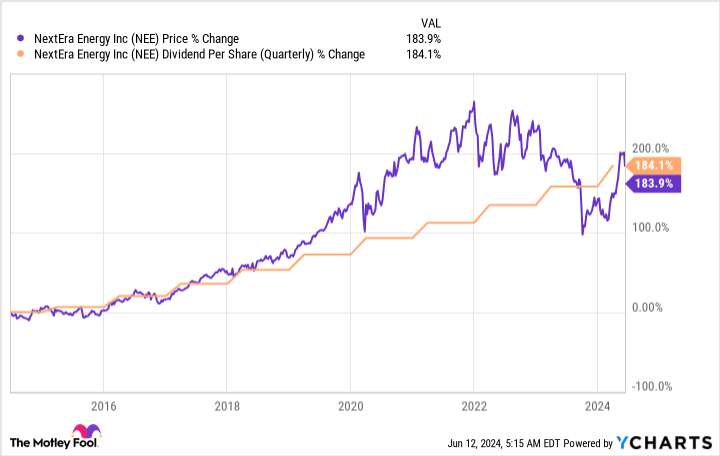

That said, the current dividend yield is not the reason to buy NextEra Energy. Dividend growth is the real story: Dividends have increased more than 180% in the last 10 years.

The stock has also risen almost exactly the same amount over that period, leading to a pretty impressive total return of over 260%, with dividends reinvested. That’s better than the S&P 500 index, which had a total return of around 225% over the same period. Back up a second: NextEra, a utility company, outperformed the S&P 500!

But there is another figure that may be interesting to you: the return on the purchase price. If you bought NextEra Energy in 2013 at its most expensive, you would have paid $22.4375 per share, adjusted for a 4-for-1 stock split in 2020. The annualized dividend in the fourth quarter of 2013 was $0.66 per share, for a purchase yield of approximately 2.9%.

At the end of the second quarter of 2024, the annualized dividend was $2.06 per share, which would mean its yield based on purchase price rose to a whopping 9.2% or so in just over a decade. If you like dividend growth, you’ll love NextEra Energy.

The future looks bright for NextEra Energy

NextEra Energy has achieved this dividend growth by building a large renewable energy business in addition to its regulated utility operations in Florida. It is evident that the business model has worked well based on dividend growth.

And NextEra believes the next few years will be as good as the last decade. Right now, the company calls for earnings growth of between 6% and 8% annually until at least 2027. That will lead to dividend growth of 10% annually until at least 2026.

What supports that perspective? Management expects electricity demand in the United States, driven by demand for renewable energy, to increase materially in the coming years.

Some numbers will help: between 2000 and 2020, electricity demand increased by only 9%, but between 2020 and 2040, NextEra believes demand will increase by 38%. This is a drastic change in what has historically been considered a fairly sleepy sector.

But the really important part of the story here is that NextEra Energy’s clean energy expertise, built over decades, positions it well to benefit from the push toward renewable energy it expects. And if you buy NextEra today, you can benefit along with the company.

NextEra Energy is always expensive

If you bought the stock in 2013, when it had a 2.9% dividend yield, you’d probably be a pretty happy dividend growth investor today. But that yield is pretty close to the current yield of 2.7%, suggesting NextEra Energy has been an expensive stock for a long time. However, if you’re looking for dividend growth, this utility has shown that paying for quality can work very well in the long run.

Should I invest $1000 in NextEra Energy right now?

Before you buy NextEra Energy stock, consider this:

He Varied and Dumb Stock Advisor The analyst team has just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when NVIDIA made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $808,105!*

Stock Advisor provides investors with an easy-to-follow success plan, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. He Stock Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 actions »

*Stock Advisor returns from June 10, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions and recommends NextEra Energy. The Motley Fool has a disclosure policy.

Is NextEra Energy Stock a Buy? was originally published by The Motley Fool