In an uncertain time like this, investors need a clear signal about their stock options, something that will give a definitive indication of quality. The sheer volume of market data, a veritable flood even in calm market conditions, rises to a deafening cacophony when volatility increases. A reliable guide is necessary.

And that brings us to the corporate experts. These are the officers of the company, the CEOs, the Executive Vice Presidents, the CFOs…the officers who hold high positions and are responsible to shareholders and boards of directors for generating profits and returns. Their positions give them an inside look at how the company works, and that gets them a step up when they start trading their own stock. To maintain a level playing field, market regulators require experts to publish their trades, and investors can use published trading data to inform their own decisions.

Investors can watch these moves using TipRanks’ Insiders Hot Stocks tool. We’ve used that tool to do just that, and we found a couple of stocks that have recently shown multi-million dollar insider transactions, and those are purchases that insiders don’t make lightly. Furthermore, these names show solid upside potential and ‘Buy’ ratings from Street analysts.

Enovix Corporation (ENVX)

We’ll start with Enovix, an innovative company working to design and manufacture the next generation in energy storage, specifically, advanced batteries that use a combination of silicon anodes, 3D architecture, and anti-swell restraints. The company’s battery designs, in prototypes, have enabled higher power densities, which are necessary for modern electronics, from mobile devices like tablets and laptops to the largest scale of electric vehicles.

Silicon anodes are at the heart of the company’s technology. Silicon anodes offer the potential to double the storage capacity of batteries compared to current graphite anode technology. Enovix has used this high energy density to develop a line of new, small batteries for everything from laptops to smartphones and portable electronic devices.

Enovix has seen two major business developments during March. Both refer to the end of manufacturing, with the first development related to the company’s next-generation line of cars. This is the design of the firm’s new assembly line, called ‘Gen2 Autoline’. The Gen2 design was approved by the company’s board of directors and will, in the future, enable greater automation, higher parallelism rates, and integrated metrology. Overall, Gen2 is seen as an important step towards expanding Enovix’s activities.

The second major development will build from Gen2; Enovix has announced site approval for its first high-volume production battery assembly facility. The new assembly line is called ‘Fab 2’ and will be installed in Penang, Malaysia. From Enovix’s perspective, this location provides several advantages, including an educated and skilled workforce, in a business-friendly jurisdiction, not far from the production plants run by potential client companies.

This puts some context behind the series of insider purchases made by Board Member Thurman Rodgers over the past month. Rodgers has purchased a total of 500,000 shares of ENVX, which paid a total of $5,381,551.

In addition to internal interest, this action has caught the attention of Cantor analyst Derek Soderberg, who writes: “We believe the Gen2 design approval marks an important milestone for Enovix. The result of this, we believe, reduces execution risk and should add to investor confidence in the story. We continue to believe that Enovix is a highly disruptive company with a multi-year technology leadership position to take part in the important and growing market for lithium-ion batteries.”

Believing that Enovix has a bright future, Soderberg rates the stock Overweight (ie, Buy), with a $25 price target to indicate strong 103% growth potential this year. (To see Soderberg’s history, click here)

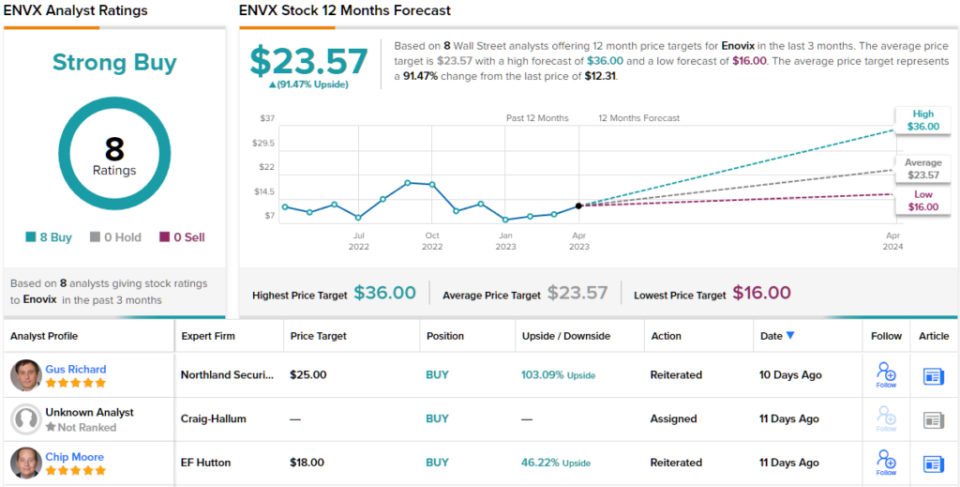

It’s clear Wall Street has no doubts about this, as the consensus Strong Buy rating is based on 8 unanimous positive analyst reviews. Enovix shares are trading at $12.31 and the $23.57 average price target implies a one-year upside gain of 91%. (See Enovix Stock Forecast)

Stifel Financial Corporation (SF)

Now we turn to the world of finance, where Stifel Financial has a strong reputation as an independent investment bank, financial services company, and wealth and asset manager. The firm boasts a market capitalization of $6 billion, and as of the end of February, Stifel could boast $1.3 billion in additional monthly bank deposits and had more than $401 million in total client assets.

Stifel is strongly committed to returning capital to shareholders, and it does so through a combination of share buybacks and dividend payments. In the last quarter of 2022, the Company repurchased approximately $75.2 million of common shares, contributing to a total of $192.4 million in common share repurchases for the full year. On the dividend front, Stifel recently increased the payout. In the latest statement, the company set a payment of 36 cents per common share, 20% higher than the previous payment. This new payment was sent on March 15, and the annualized rate of $1.44 per common share gives a return of 2.4%.

In its recent financial results for 4Q22, the Stifel report showed downward trends. Net revenue came in at $1.12 billion, down 14% from the prior year and missed consensus estimates of $1.14 billion. In the bottom line, non-GAAP EPS came in at $1.58, versus a forecast of $1.64, for a miss of 3.6%. These results came at the same time that the company’s overall Institutional Group segment experienced a 45% decline in net revenue. On a positive note, net income from the company’s Global Wealth Management segment increased 10% to $744.3 million year-over-year. This positive result was driven by a 105% YoY gain in quarterly interest margin.

Going back to the insiders, we found that two company officials made over a million dollar stock purchases in SF in the last month. Company co-chairman James Zemlyak spent $1.12 million to buy 20,000 shares, and CEO Ronald Kruszewski bought 20,174 shares for $1.16 million.

In his coverage of JMP Securities, Devin Ryan, a highly rated 5-star analyst, underscores management’s strong belief in the company’s long-term prospects.

“Management remains quite adamant about the company’s long-term growth potential, and with an estimated $1.2 billion of excess capital capacity over the next year, we see a number of opportunities to further support us, including share repurchases. more aggressive. Ultimately…we continue to argue that Stifel represents one of the most compelling risk/reward opportunities in our coverage at current levels, as it has received little credit for the growth it has generated to date and remains well positioned to grow from here,” Ryan said. .

Looking ahead, Ryan sees a lot of potential and rates Stifel’s stock an Outperform (ie Buy). His price target, set at $95, implies a gain of ~69% over the one-year time horizon. (To see Ryan’s history, click here)

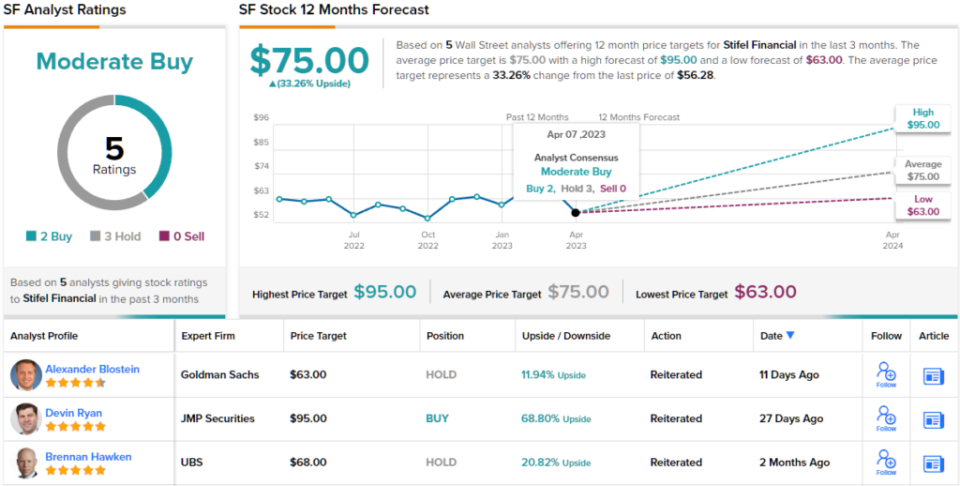

Overall, SF shares have 5 recent analyst reviews, with a 2-3 breakdown favoring Holds over Buys, for a Moderate Buy consensus rating. Shares are trading at $56.28 and the $75 average price target suggests 33% upside over the next 12 months. (See Stifel Stock Forecast)

To find good stock trading ideas at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the noted analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.