(Bloomberg) — The global flight from risk assets continued Wednesday after fears about the U.S. economy and a pullback by Big Tech triggered a sharp drop in U.S. stocks.

Most read on Bloomberg

Europe’s Stoxx 600 index fell 0.9%, with technology stocks such as ASML Holding NV suffering the biggest losses. Futures contracts for the S&P 500 fell 0.5% after the gauge suffered its worst day since the Aug. 5 market crash. Asian chipmakers tumbled, in line with Tuesday’s drop in Nvidia Corp., sending a regional equity benchmark down more than 2%.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or wherever you listen.

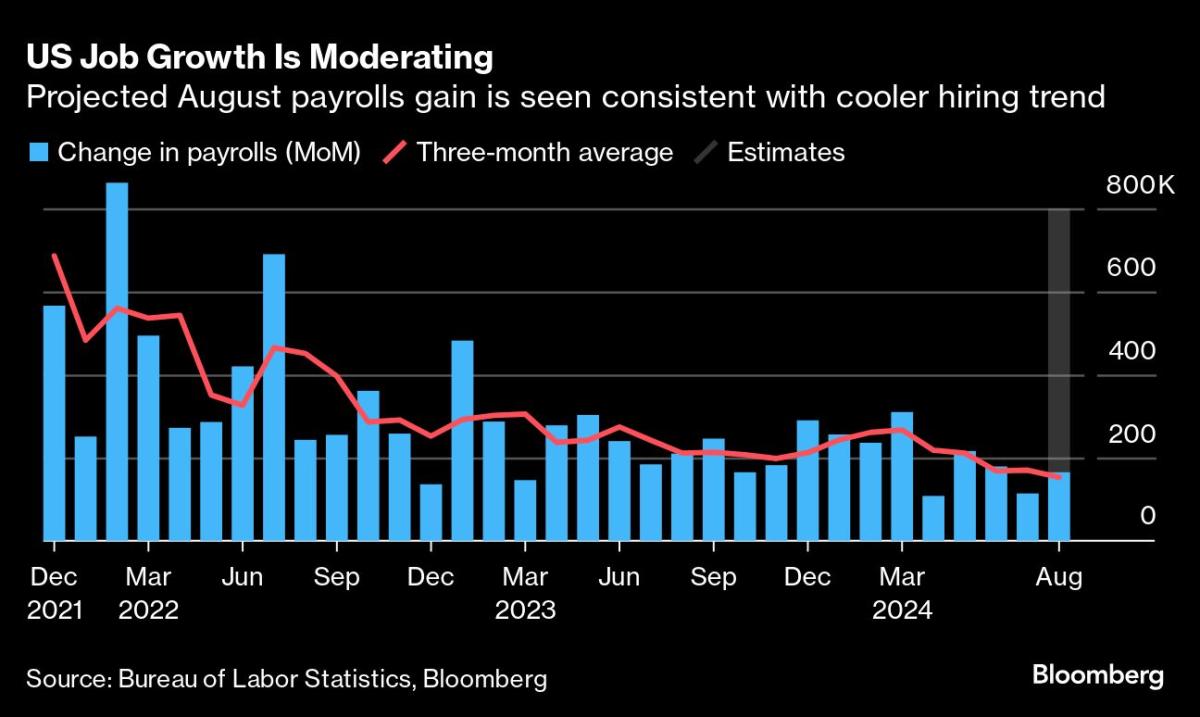

Traders are bracing for more volatility as they await data that will give clues about whether the U.S. economy is on the brink of a recession and how the Federal Reserve might approach monetary policy easing. Wednesday’s U.S. job openings report is expected to show a further cooling of the labor market, following data yesterday that indicated a fifth straight month of contraction in manufacturing activity.

As the market focus shifts from inflation to concerns about economic growth, negative macroeconomic data increasingly translates into pain for stocks and other risk assets. For now, traders expect the Federal Reserve to cut rates by more than two full percentage points over the next 12 months, the steepest drop outside of a recession since the 1980s.

“The market will be nervous about payrolls data this week and a host of other employment indicators,” Mohit Kumar, chief economist at Jefferies International, said in a note to clients. “It is prudent to have some hedges as we expect increased volatility in the coming weeks.”

Ten-year Treasury yields fell two basis points to extend Tuesday’s declines. A gauge of the dollar snapped a five-day winning streak, while the yen rose. Oil edged lower after a nearly 5% drop on Tuesday amid weak demand and concerns about oversupply.

Key events of this week:

-

Eurozone Services PMI and PPI, HCOB, Wednesday

-

Canada rate decision, Wednesday

-

US Jobs, Factory Orders, Beige Book, Wednesday

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US Nonfarm Payrolls, Friday

-

Fed’s John Williams speaks on Friday

Some of the main movements in the markets:

Stocks

-

The Stoxx Europe 600 fell 0.9% as of 8:17 a.m. London time.

-

S&P 500 futures fell 0.5%

-

Nasdaq 100 futures fell 0.8%

-

Dow Jones Industrial Average futures fell 0.3%

-

The MSCI Asia Pacific index fell 2.4%

-

MSCI emerging markets index fell 1.6%

Coins

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.1% to $1.1057.

-

The Japanese yen rose 0.3 percent to 145.02 per dollar.

-

The offshore yuan rose 0.1% to 7.1136 per dollar.

-

The pound was little changed at $1.3113.

Cryptocurrencies

-

Bitcoin fell 2.9% to $56,499.86

-

Ether fell 3.1% to $2,385.25

Captivity

-

The yield on 10-year Treasury bonds fell two basis points to 3.82%.

-

The yield on 10-year German bonds fell three basis points to 2.25%.

-

The yield on 10-year British bonds fell two basis points to 3.97%.

Raw materials

-

Brent crude fell 0.8% to $73.18 a barrel

-

Spot gold fell 0.3% to $2,486.61 an ounce

This story was produced with assistance from Bloomberg Automation.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP