Over the past month, the S&P 500 and Nasdaq have enjoyed solid gains, and global markets are largely on track to end September on a positive note.

The long-term bullish trend, which has been brewing for almost two years, recently gained momentum thanks to the Federal Reserve.

With a bold 50 basis point rate cut, the Federal Reserve began what many expect to be a continued cycle of monetary easing.

Markets are already anticipating another rate cut at the next meeting.

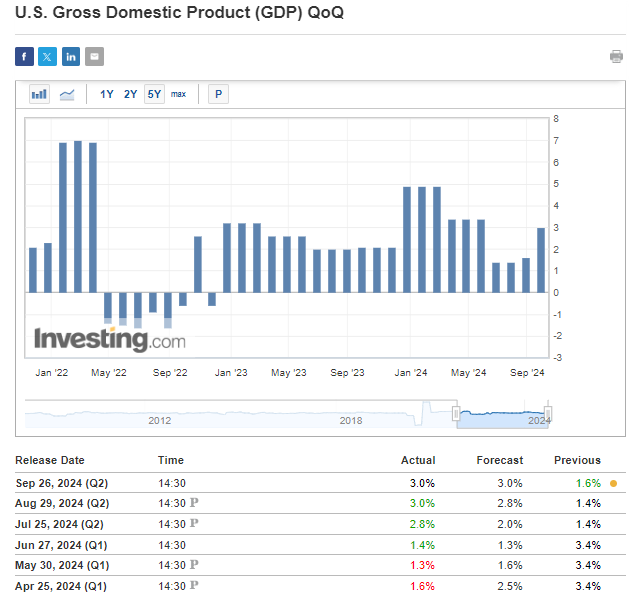

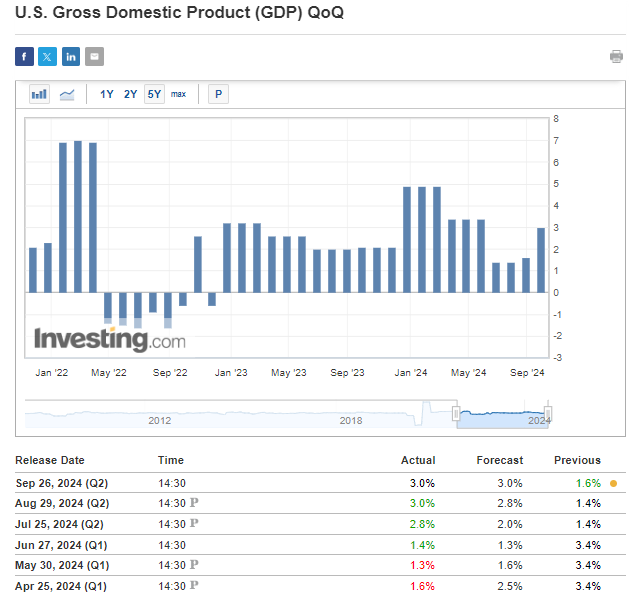

Importantly, recent economic data shows no signs of an imminent recession, suggesting that these rate cuts are not a bailout attempt but rather a calculated measure to stimulate growth.

The People’s Bank of China also contributed to the positive sentiment by cutting interest rates, unlocking more than $140 billion in lending capacity to help achieve its 5% growth target for the year.

As markets look to end the week at highs, let’s take a look at how the technical picture is shaping up for key indices.

S&P 500: Retracement in sight?

The S&P 500 has been a model of strength and recently surpassed its previous all-time highs.

This breakout indicates solid market demand, largely driven by expectations of further rate cuts and favorable economic conditions.

From a technical perspective, this move has firmly established 5,720 points as a critical support level.

If the current pullback extends, this zone may act as the first line of defense for the bulls, offering an opportunity for traders to re-enter the market.

Beyond 5,720 points, a deeper correction could target the 5,660 level, where the uptrend line crosses.

This convergence of support levels suggests that any decline will likely be limited, allowing the broader uptrend to remain intact.

On the upside, the round number at 5,900 points represents the next significant resistance level.

If the bullish momentum continues, the market could quickly move towards this psychological barrier, setting the stage for further gains.

The bulls have clear objectives ahead, and both technical indicators and sentiment favor continued upside.

Nasdaq aims for new peaks

The Nasdaq, although slightly behind the S&P 500, has shown signs of strength. The index recently surpassed a key resistance level around 18,000 points, a sign that momentum is building.

This break above an important psychological level marks a crucial moment for the index as it paves the way for a retest of the all-time high near 18,600 points.

From a technical perspective, the NASDAQ’s next objective is clear: attack this previous peak.

If a pullback occurs before the Nasdaq reaches 18,600, traders should keep an eye on support at the 18,000 level, which previously acted as resistance.

This zone now serves as a key inflection point for both short-term traders and long-term investors.

If the index surpasses 18,600, the next logical target for the bulls will be 19,000 points.

A sustained rally towards 19,000 would further reinforce the uptrend, with technical indicators such as the RSI and moving averages indicating continued bullish momentum.

DAX surges with near-vertical gains

The German DAX leads the pack this month with a return of 3.34%, reflecting almost vertical gains after surpassing 19,000 points.

In case of a shallow correction, support is expected around the previous highs of 18,900 to 19,000 points, keeping the bullish momentum intact.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.

Related articles

US Stock Market Shows Resilience Amid Mixed Signals from E-Mini Indices

China Tech Stocks Rising: What Top Investors Know and You Don’t