He S&P 500 The index is a well-known benchmark composed of approximately 500 stocks that are large, profitable American companies. Cloud-based cybersecurity company Strike crowd (NASDAQ:CRWD) will be included starting June 24. And this company has absolutely earned the honor of inclusion.

CrowdStrike went public in 2019. And during the company’s fiscal 2019 year (which ended in January of that year), it generated revenue of just $250 million. Fast forward to fiscal year 2024 (which ended in January of this year), and it generated revenue of more than $3 billion. In short, CrowdStrike has grown tremendously in just five years as a public company.

The quality of CrowdStrike’s growth is also noteworthy. There are companies that have grown by a comparable amount, but few have simultaneously achieved massive profitability. Free cash flow has skyrocketed. And in its fiscal first quarter of 2025, CrowdStrike achieved a whopping 35% free cash flow margin – that’s incredible.

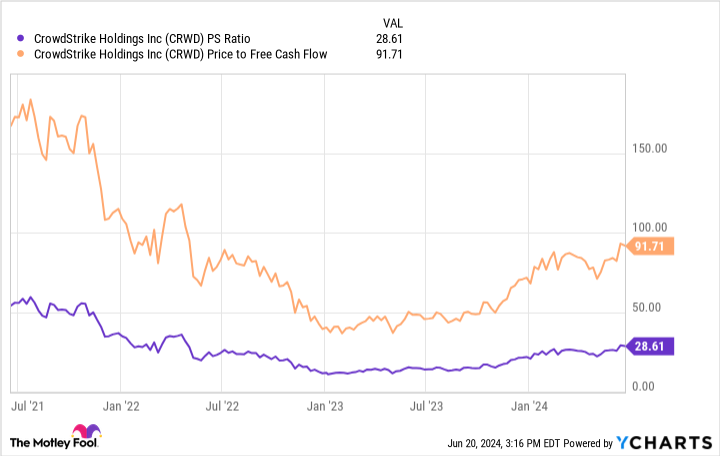

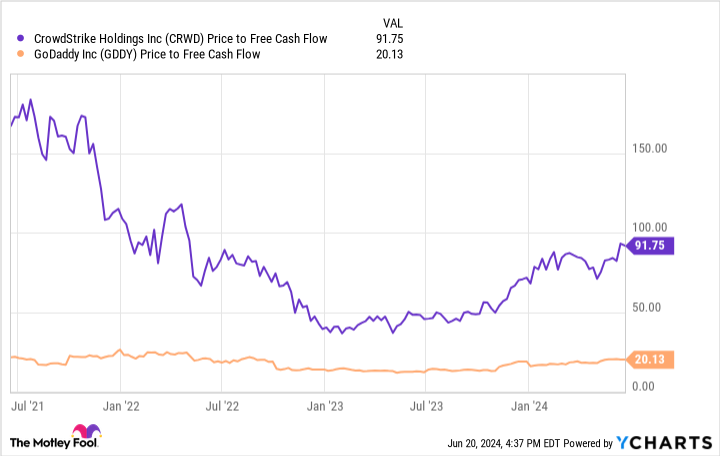

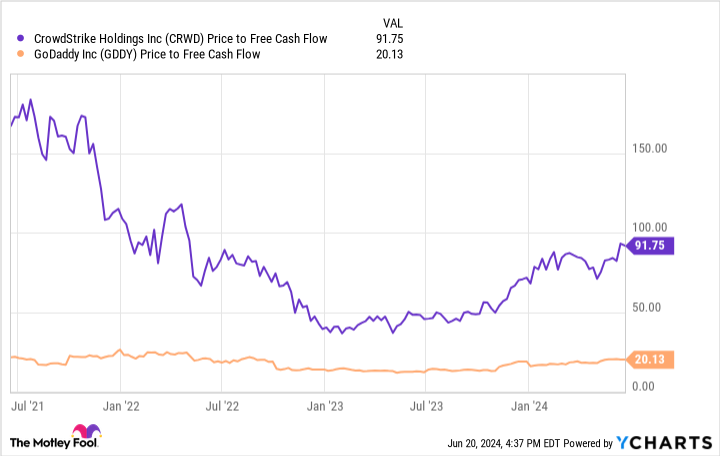

However, CrowdStrike could be criticized as an investment due to its high valuation. Paying more for an investment, even for shares of a company excellent business, can negatively impact future returns. And trading with a price-to-sales (P/S) ratio of nearly 30 and a price-to-free cash flow ratio of nearly 100, CrowdStrike stock is expensive today.

To be fair, it may still work for investors. The cybersecurity space is a huge opportunity and CrowdStrike is one of the top players. Therefore, its long-term growth and benefits can justify its valuation.

However, for investors concerned about this current valuation risk, the website company Go daddy (NYSE: GDDY) will be included in the S&P 500 along with CrowdStrike. And today it is a much better buy, as I will explain.

Why Investors Should Watch GoDaddy Stock

Over the past three years, GoDaddy stock has quietly risen about 60%, which is nearly double the S&P 500’s 31% return. And when investors consider the material things that drive the stock up, the stock from GoDaddy are rising for the right reasons. .

For starters, GoDaddy continues to grow even though it has been around for a long time. In 2022, the company’s revenue grew 7% year over year and 4% in 2023. Then, in the first quarter of 2024, revenue grew another 7% compared to the prior-year period.

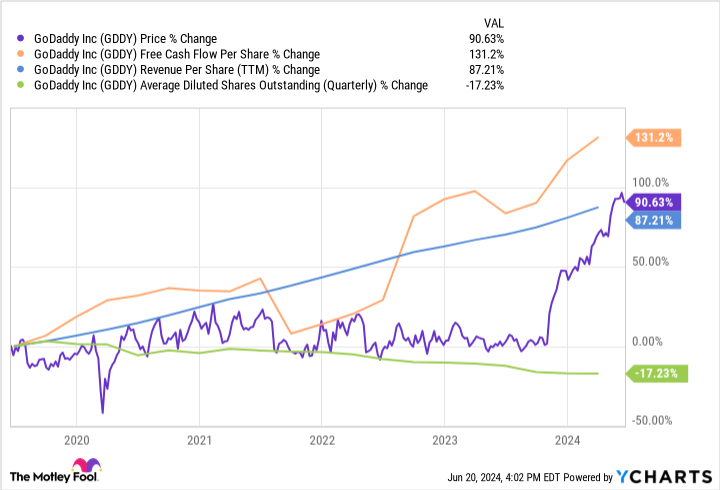

Some investors might scoff at a single-digit growth rate for GoDaddy. And in isolation, it’s true that the company’s revenue growth didn’t move the needle much. But its free cash flow has fared much better because of where the growth is coming from (more on that in a moment). Let’s consider that free cash flow growth outpaced revenue growth in 2022, 2023, and the first quarter, which is a strong trend at the moment.

Additionally, by using its cash flow to buy back shares, GoDaddy has reduced its share count, increasing its free cash flow per share. This is important for individual shareholders because their ownership stakes become more valuable.

In short, GoDaddy reduced its share count, increased its revenue, and increased its free cash flow. And its free cash flow per share has risen faster than its share price, meaning its recent market-beating performance is justified.

The real question for investors today is whether GoDaddy can continue to grow revenue and free cash flow while reducing its share count. And I think the answer is “yes.”

GoDaddy makes most of its money from domain name services – this is its core service, and 92% of its customers in 2023 purchased a domain name from the company. However, GoDaddy offers more and more services to start, grow, and market a business, including products for building websites, accepting payments, and more.

These complementary products are a no-brainer for GoDaddy and have increased profit margins; This explains why free cash flow is growing faster than revenue. And the company’s recent artificial intelligence (AI) tools are further driving adoption of its newest products, according to management.

As a result, GoDaddy expects free cash flow growth to continue to outpace revenue growth. Management expects to generate cumulative free cash flow of $4.5 billion through the end of 2026. Additionally, management is still authorized to repurchase $1.1 billion of shares at the end of the first quarter, to further reduce the share count.

GoDaddy stock, trading at just 20 times its free cash flow, is a much better bargain than CrowdStrike stock, as the chart below shows.

It’s not as exciting or as high-growth as CrowdStrike. But GoDaddy is growing its free cash flow at a respectable rate and the valuation is quite reasonable. This combination of profitable growth and fairly priced shares could lead to strong stock returns from here, which is why I think investors should take a close look at GoDaddy stock now.

Should you invest $1000 in GoDaddy right now?

Before you buy shares in GoDaddy, consider this:

He Varied and Dumb Stock Advisor The analyst team has just identified what they believe are the 10 best stocks for investors to buy now… and GoDaddy was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when NVIDIA made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow success plan, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. He Stock Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 actions »

*Stock Advisor returns from June 10, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions and recommends CrowdStrike. The Motley Fool recommends GoDaddy. The Motley Fool has a disclosure policy.

CrowdStrike stock is being added to the S&P 500. But this other new addition to the S&P 500 could be a better buy at a bargain price. was originally published by The Motley Fool