In the wake of the Silicon Valley Bank failure last month and the resulting banking crisis, economists and market pundits are now turning their attention to the big picture, and sadly, the picture is bleak.

Cathie Wood, founder and director of ARK Investment, has noted that the velocity of money is slowing and the odds of a “hard landing” are increasing.

In his opinion, we are more likely to see the economy suffer a sharp recession in the near future, caused by a confluence of high interest rates, a slowdown in the movement of money through the economy and, worst of all, a credit crunch. while banks are facing a solvency crisis.

“The Fed has made a big mistake. Credit default swaps have been warning us of an upcoming banking crisis since January 2022… We are moving from a liquidity crisis to an insolvency crisis. A liquidity crisis is abrupt, with bank runs, and these appear to be under control. When it comes to solvency, these banks still have problems. The first problem is what everyone now understands: an interest rate mismatch… this will affect earnings,” Wood said.

Although Wood is preparing for the worst, he won’t be leaving the stock market. Recently, Wood has been loading up on two stocks that fit a certain profile; offer game-changing potential and one that might be too cheap to ignore – both are currently changing hands for less than $5. According to TipRanks, the world’s largest database of analysts and research, both also boast a strong triple-digit upside potential, indicating the possibility of doubling or more in the future.

Butterfly Net (BFLY)

Wood’s first choice is Butterfly Network, a medtech company that operates in the ultrasound niche. While ultrasound technology has long been known in the field of medical imaging, Butterfly has taken it to a new level by specializing in the development of handheld and portable ultrasound scanner technology. They take advantage of the miniaturization made possible by modern semiconductor chips to create ultrasound imaging systems that are easier to use, more affordable, and lower cost than older systems.

Butterfly’s systems are currently available in the US, Australia, UK and much of Europe where they are building a strong reputation for quality. The systems have found use in a wide range of medical applications, from their traditional strongholds of OB/GYN and cardiovascular care to emergency rooms and nursing care, and even primary care offices and veterinary hospitals.

Butterfly recently achieved a significant milestone by gaining FDA approval for its AI-enabled lung imaging tool earlier this month. The Auto B-line counter can potentially transform the way medical professionals perform assessments in adults with possible decreased lung function, allowing for faster diagnosis and treatment. The system, based on machine learning, was trained by accessing a database of more than 3.5 million anonymized ultrasound images.

While this FDA approval bodes well for Butterfly, the company’s recent 4Q22 quarterly report was mixed. Revenue, at $19 million, was essentially flat year-over-year, but missed Street’s estimate of $19.93 million. On the other hand, the EPS loss of 17 cents per share was better than analysts’ forecast loss of 22 cents per share for the fourth quarter.

The result is a 41% drop in shares over the last 12 months.

Cathie Wood must see a lot to like here. Through her ARKG (ARK Genomic Revolution) fund, she bought 3,741,000 shares this month alone. That brings Wood’s total stake in BFLY to more than 12.9 million shares, currently valued at $31.86 million.

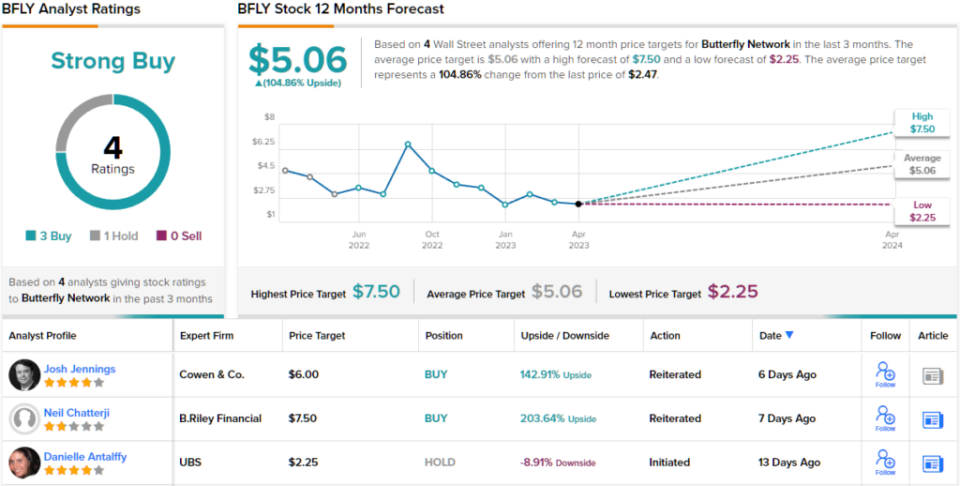

Mirroring Wood’s positive stance, Cowen analyst Joshua Jennings makes the bullish case.

“BFLY made significant progress in each of its four strategic growth pillars throughout 2022 and is now best positioned to capitalize on the high-growth portable I/O market opportunity in 2023 and beyond. Revenue growth guidance for 2023 assumes ~20% growth at the midpoint and reflects a building sales funnel and the impact of new business strategies over the course of the year,” Jennings opined.

Kumar adds an Outperform (i.e. Buy) rating to his comment and rounds out his stance with a $6 price target, signaling his confidence in a 143% upside over the next 12 months. (To view Jennings’ track record, click here)

Overall, the 4 recent analyst reviews on this stock include 3 Buys vs. a single Hold, giving BFLY its Strong Buy consensus rating. The stock is currently trading at $2.47 and its $5.06 average price target implies ~105% upside potential by the end of this year. (See BFLY Stock Forecast)

SomaLogic, Inc. (SLGC)

For the second of Wood’s picks, let’s turn to SomaLogic, a clinical diagnostics company that focuses on proteomics, the large-scale study of proteins and their application to biomarker discovery. The Boulder-based company offers a research platform that fosters the discovery of “effective and safer” treatments to improve diagnoses and patient outcomes. SomaLogic’s approach combines assay services with diagnostics to create one of the most extensive clinical proteomics databases in the world.

Through its work with proteins, SomaLogic’s research in proteomics has the potential to revolutionize the precision medicine niche. The company is working to address unmet medical needs across a wide variety of diseases, and its work is applicable to medical professionals in direct care delivery, research, and even data analysis.

In a development investors will be watching closely, SomaLogic last month announced a series of changes to its senior levels of management. These included the appointment of four new members to the company’s Board of Directors, including Jason Ryan to the role of Chairman of the Board. In addition, SomaLogic also announced that Adam Taich, former Executive Vice President of Life Sciences, has served as Interim CEO. The company’s previous CEO, Roy Smythe, resigned effective March 28.

At the same time the company announced sweeping management changes, it also released financial results for the fourth quarter and full year of 2022. On the top line, quarterly revenue fell 18% to $18.8 million, though this figure exceeded the forecast at $1.77. million, or 10%. In summary, the company’s fourth-quarter earnings, its GAAP EPS, came in at 26 cents a share. This was a whiff for two reasons; coming in well below the 16-cent EPS loss reported in the prior-year quarter, and missing the forecast by 5 cents.

The stock has experienced a brutal drop of 60% in the last 12 months. Cathie Wood, however, must think that the healthcare disruptor offers good value right now. She picked up 1,422,263 shares in the last two weeks, making the purchases through the ARKG fund. She now has a total interest in SomaLogic of 11,810,923 shares, currently valued at $32.24 million.

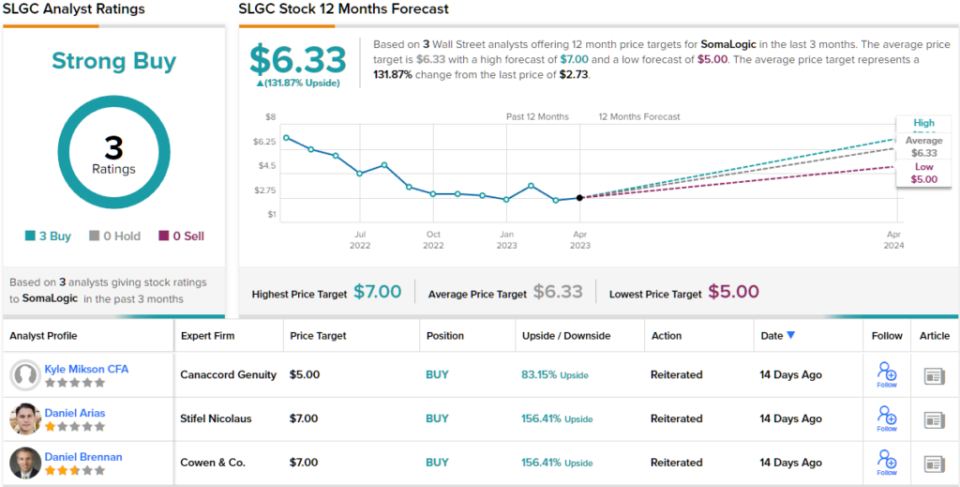

Wood is not the only bull here. Canaccord Genuity analyst Kyle Mikson has taken an optimistic outlook here, writing: “In our view, SomaLogic appears poised for strong revenue growth and improved profitability over time as the company benefits of his recent initiatives. The shares offer substantial upside potential for our target price.”

Quantifying this, Mikson gives the stock a Buy rating and a $5 price target, implying an 83% upside over the next 12 months. (To view Mikson’s history, click here)

Overall, the Strong Buy consensus rating here is unanimous, based on 3 recent analyst reviews, all positive. The stock has a trading price of $2.73 and its $6.33 average price target suggests a ~132% upside over the one-year horizon. (See SLGC Stock Forecast)

To find good stock trading ideas at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.