-

There are growing signs that the US economy is about to enter a full-blown recession, Bank of America said.

-

The bank cited worrisome signs in manufacturing and the labor market, saying investors are not paying attention to risks.

-

“Investors are too optimistic about rate cuts and not pessimistic enough about the recession,” BofA said.

Fears of an impending recession have reached fever pitch this year, with everyone from Wall Street market strategists to corporate CEOs warning of a slowdown in the US economy.

But so far, no recession has materialized, as the job market and consumer spending have remained fairly resilient.

But according to Bank of America, there are many signs that a recession has not been avoided. These are the 12 charts that indicate the US is about to enter a full-blown recession, according to Bank of America’s Michael Hartnett.

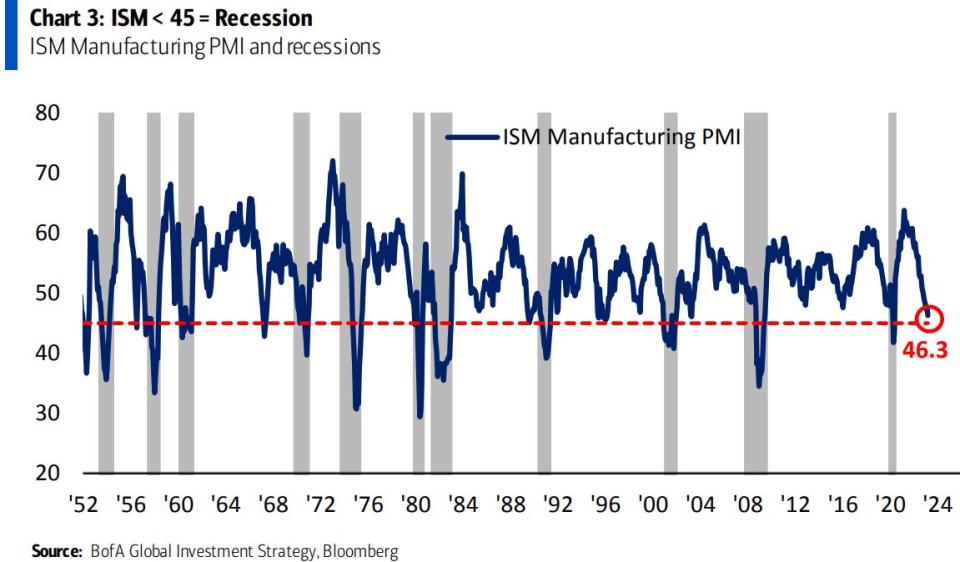

1. A drop in manufacturing activity

“The ISM for March was 46.3, the lowest since May 2020. In the last 70 years, when the ISM manufacturing fell below 45, a recession occurred 11 out of 12 times (the exception was 1967)” BofA said.

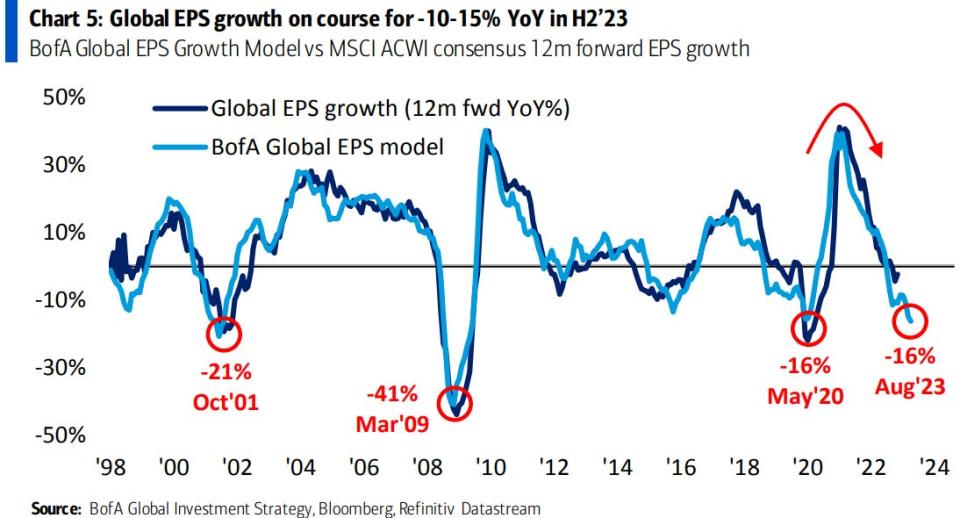

2. A decline in manufacturing often coincides with lower profits

“Manufacturing ISM new orders component at 44.3. New orders < 45 have coincided with EPS recessions (see 1991, 2001, 2008, 2020)," BofA said.

3. The global earnings model suggests an imminent fall

“The BofA Global EPS growth model currently predicts EPS to fall -16% year-over-year in August. The model is driven by Asian exports, global PMIs, China financial conditions, the US yield curve, and China’s financial conditions.” USA,” BofA said.

4. The rise in the yield curve usually precedes a recession

“The 2-year/10-year US Treasury yield curve flattens and inverts in anticipation of a recession. Yield curves rise immediately when recessions begin. The US Treasury yield curve. The 2-year/10-year rate has risen from -110 basis points to -50 basis points in the last 4 weeks,” BofA said.

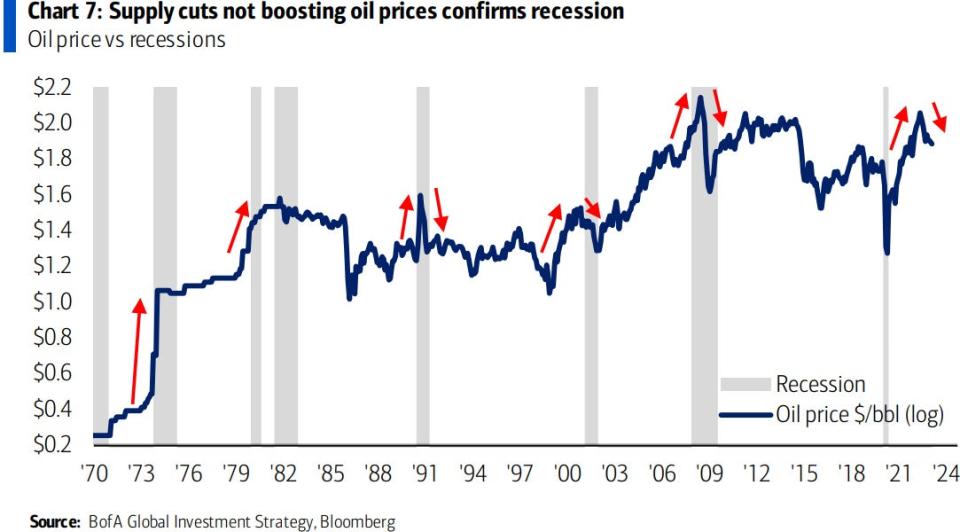

5. The price of oil shows concern about a recession

“Oil prices historically rise in recessions and fall during recessions. The latest OPEC+ production cuts underscore recession concerns, with limited upward pressure from China reopening so far,” BofA said.

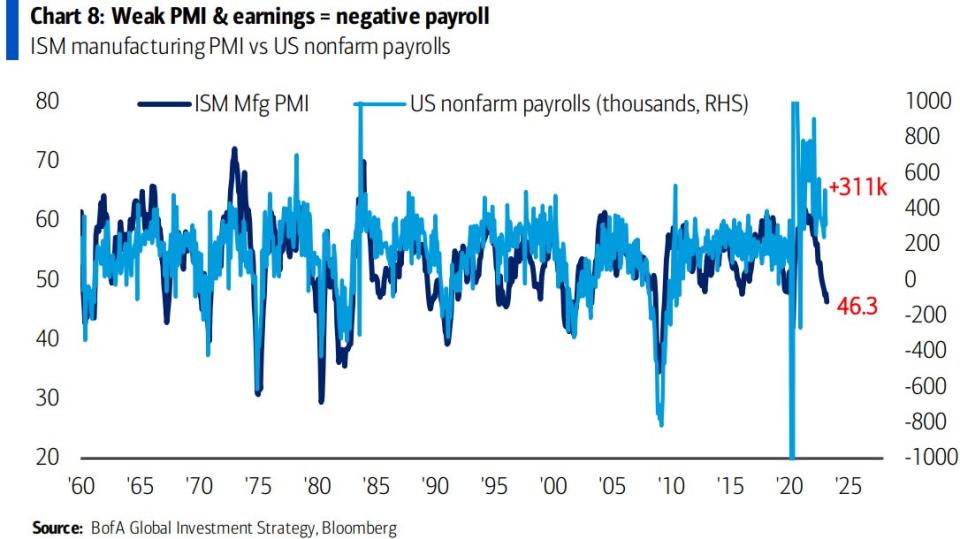

6. The labor market often follows manufacturing activity

“The weak ISM manufacturing PMI suggests that the US labor market will weaken in the coming months,” BofA said, adding that it viewed the February and March jobs report as “the last strong payroll reports of 2023.” “.

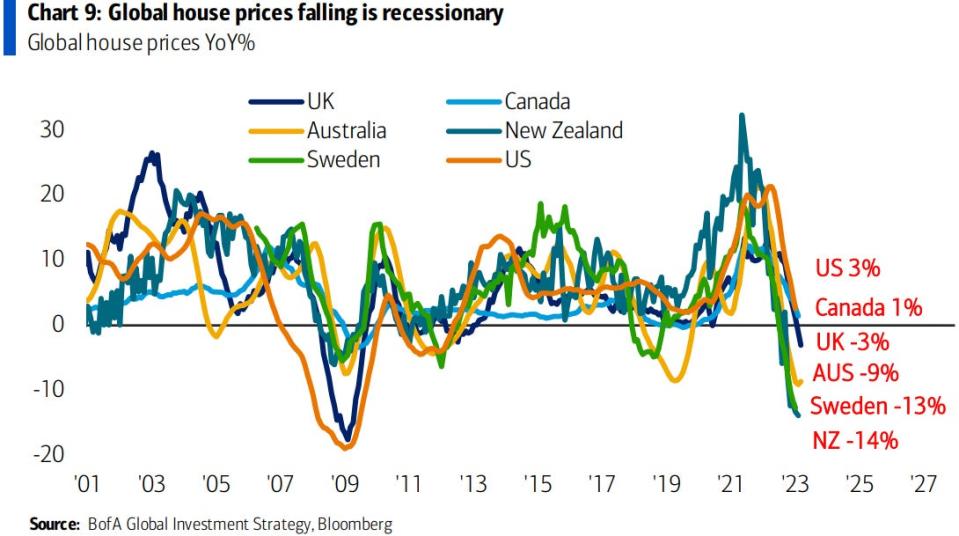

7. Global house prices are falling

“Global house prices turn negative as higher rates hit real estate in the US, UK, Canada, Sweden, Australia and New Zealand,” BofA said.

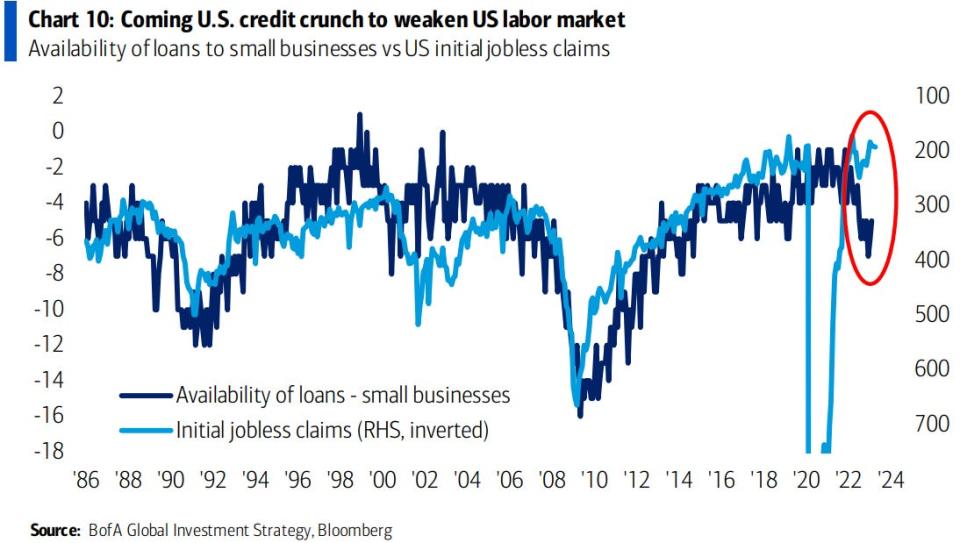

8. A credit crunch will hurt the job market

“U.S. banks have been tightening small business lending standards in recent quarters. The credit crunch will intensify and is highly correlated with demand for small business workers. Should the SLOOS report May show a drop in loan availability to -10 or below = unequivocal credit crunch”, BofA said.

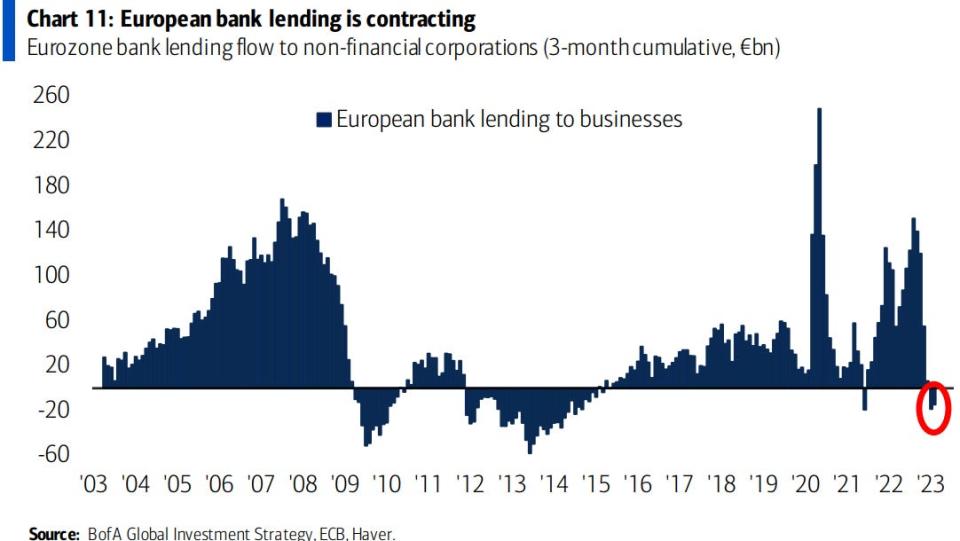

9. A drop in European bank lending

“Eurozone bank lending fell three months in a row (very rare outside of the Great Financial Crisis, euro debt crisis, COVID). The $14 trillion eurozone economy is highly dependent on bank credit” BofA said.

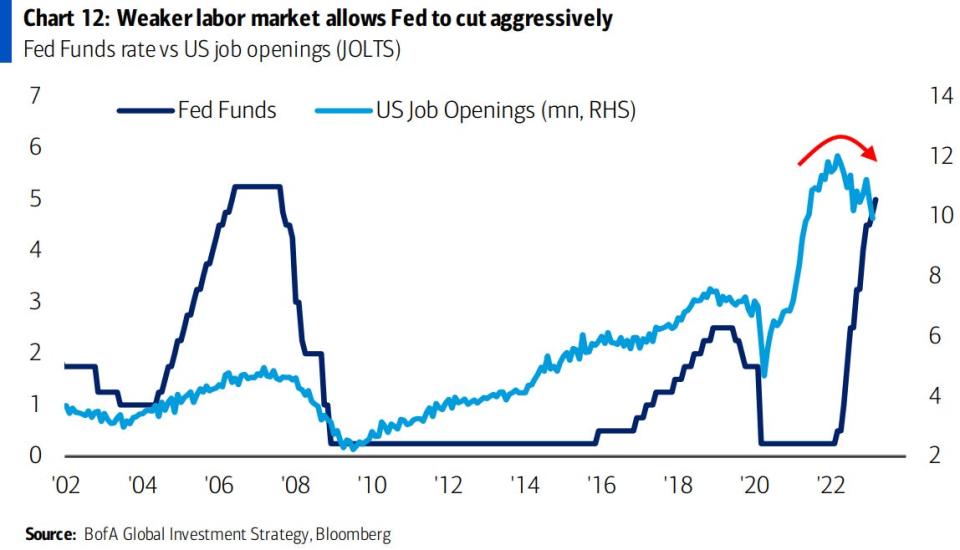

10. Weak labor market leads to big cuts in interest rates

“Dropping US job openings = weaker job market = lower fed funds rate. The yield curve is likely to slope very dramatically in the next six to 12 months as the Fed cuts ahead of the election, but the long-term decline is inhibited by inflation and tax shenanigans,” BofA said.

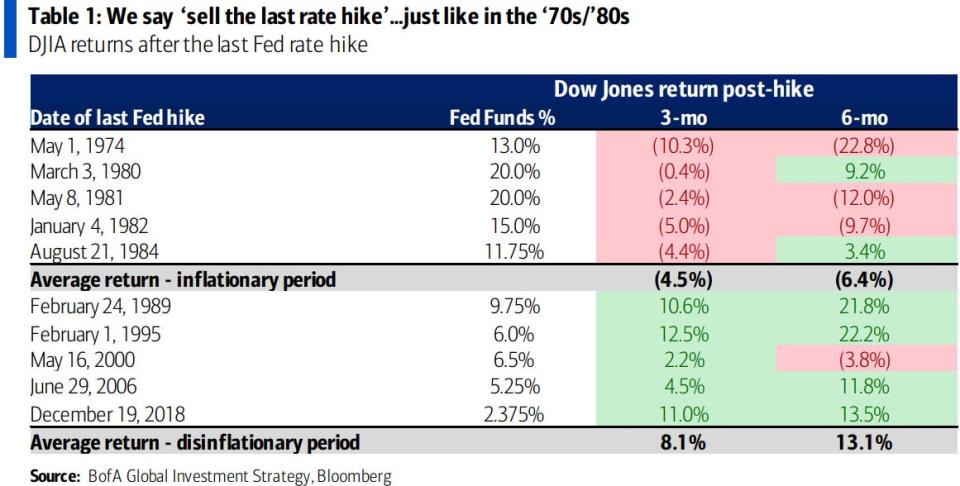

11. Stocks fell after the last Fed rate hike in inflationary periods

“Our view: Sell the last rate hike. Investors are too bullish on rate cuts and not pessimistic enough on the recession. ‘Sell the last hike’ was the right strategy for stocks in the inflationary 70s/80s , ‘buy last rise’ worked in the disinflationary market of the 1990s,” BofA said.

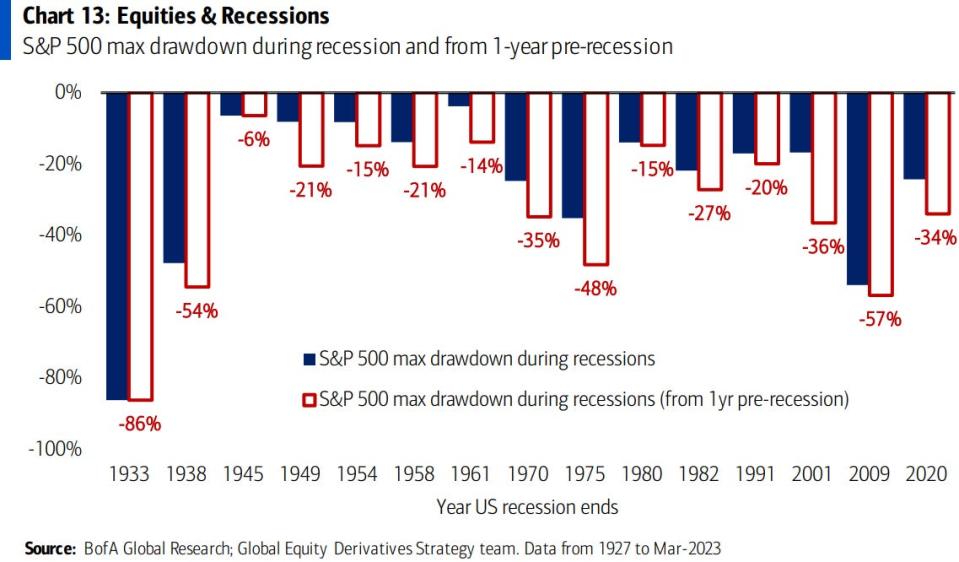

12. Stocks and recessions don’t mix well.

“Reliably negative downturns for stocks throughout history and insufficiently discounted up front. Plenty of room for more S&P 500 declines,” BofA said.

Read the original article on Business Insider