Current market conditions are characterized by uncertainty, which requires investors to be aware of the various cross currents that can affect stocks and other trading instruments. The recent banking crisis triggered by the bankruptcy of SVB has contributed to a climate of uncertainty, with persistently high interest rates and inflation. Additionally, a cooling job market could be an indication of a slowing economy.

What is needed here is a clear signal that market players can use to separate sound investments from ‘noise’. In uncertain times, the usual scoreboards aren’t entirely reliable, but the TipRanks Smart Score tool can cut through the data clutter and shed light on solid opportunities.

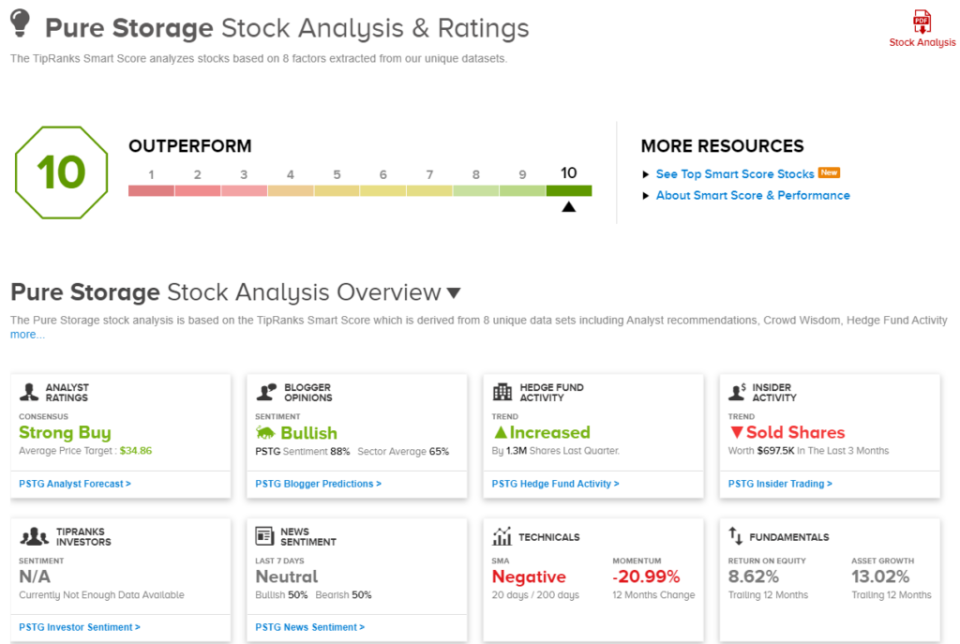

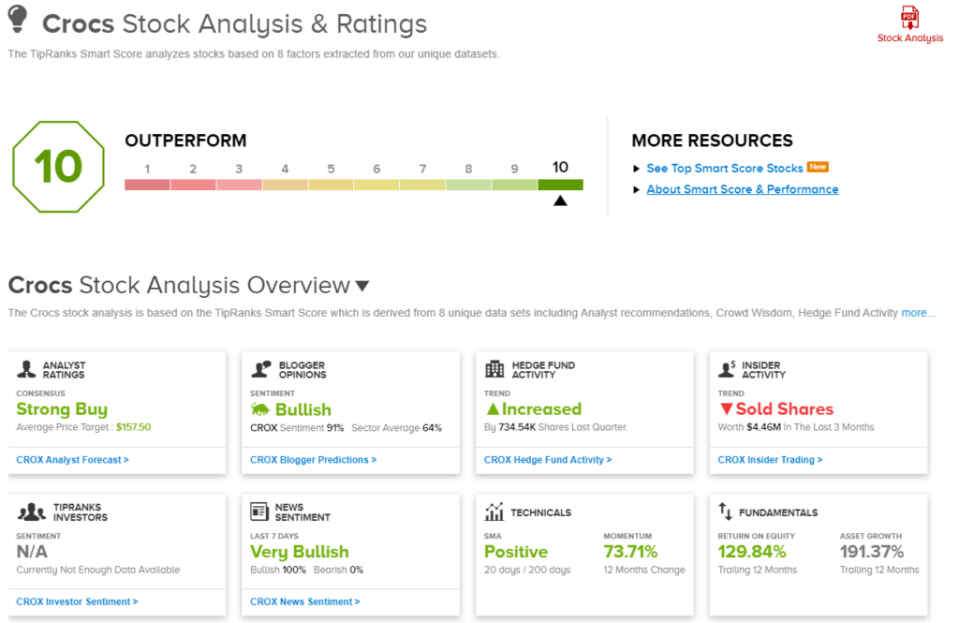

The tool uses a set of algorithms to collect, collate, and sort the volume of market data, generated by thousands of publicly traded stocks, and then uses that data to rate the stocks based on a set of 8 known factors. as precise. predictors of future performance. The 8 factors are then scored together, giving each stock a single-digit rating on a scale of 1 to 10. It’s a simple and intuitive scoreboard that tells investors at a glance how the stock is likely to move. .

The ‘Perfect 10’ is the highest Smart Score rating, and does not correspond to any stock. These are the stocks that deserve a second look from investors, the stocks that hit the mark. We’ve opened up the TipRanks database to pull the details for two of these perfect 10; These are blue-chip stocks that offer investors solid earning opportunities in the coming months.

pure storage, inc. (PSTG)

The first ‘perfect 10’ stock we’ll turn to is Pure Storage, a company focused on a vital niche in the digital world, computer memory chips. Pure Storage offers a range of flash-based and cloud-ready memory chips and systems suitable for entry-level to enterprise-level applications. The company’s memory systems can support large-scale cloud computing, and customers can find everything from solid-state flash drives to large-scale FlashStack servers supporting data center activities. Pure Storage boasts that its memory systems are 85% more energy efficient than competitive products.

Pure Storage has a customer base of over 15,000 and has achieved significant business achievements in recent months. Last March, Pure Storage announced that its FlashBlade unified fast file and object storage solution had been chosen by the Australian Genome Research Center as the key to accelerating data throughput in the genomics pipeline. Earlier this year, in January, Pure Storage made an even bigger impact, releasing the news that it is partnering with Meta on the AI Research SuperCluster (RSC). Meta chose Pure Storage to take advantage of FlashArray and FlashBlade memory systems.

These announcements marked a strong fiscal year. Pure Storage last month reported its financial results for the fourth quarter and fiscal 2023, which ended in February. The company reported $810.2 million at the top line for the quarter, up 14% year-over-year and in line with expectations. In summary, the GAAP EPS of 22 cents was 15 cents above forecast, while the non-GAAP number of 53 cents far exceeded the expectation of 39 cents. In a major metric looking ahead, the company had $1.1 billion in ARR from subscription services quarterly, for a 30% year-over-year gain.

While these results were seen as positive, investors were spooked by the company’s forward-looking guidance, which predicted fiscal 2024 revenue to grow in ‘mid to high’ single digits, versus a Street expectation of 13%. .

The guidance error did not stop 5-star Wedbush analyst Matt Bryson from presenting a bullish outlook on the stock.

“PSTG proved us wrong, as revenue beat expectations quite consistently, helped in small part by PSTG’s inclusion in the FB/Meta build of their AI supercomputer. In addition, more subdued expense growth (with relatively high operating expenses having been a key criticism of PSTG since its inception and a criticized part of the story) has led to a significantly improved earnings outlook,” Bryson opined.

“With recent results suggesting that the good parts of the PSTG story are still intact (no apparent company-specific issues); Management has, in our opinion, a largely de-risked guidance for FQ1’24/FY2024, with various catalysts in the medium term (PSTG’s new FlashBlade//E, lower NAND prices, etc.); and with PSTG trading well below historical valuations, we see an attractive opportunity to invest in PSTG at current levels,” the analyst added.

Quantifying this stance, Bryson gives PSTG shares an Outperform (i.e. Buy) rating, while setting a $34 price target that implies a ~33% upside for the year ahead. (To view Bryson’s history, click here)

Overall, PSTG stock earns a Strong Buy rating from the analyst consensus, based on 15 recent analyst reviews breaking down 14-to-1 in favor of Buys over Holds. The stock’s average price target of $34.86 implies a 36% one-year lead over the current trading price of $25.62. (See PSTG Stock Analysis)

Crocs, Inc. (CROX)

Next up, we have a well-known shoe brand that needs no introduction: Crocs. We’re all familiar with the foam clogs that made the company famous, but Crocs now offers a much broader range of shoes and styles to complement the iconic (eponymous) clog, from sandals to sneakers and even formal footwear.

A look at some numbers will show how Crocs has grown, from its start at a Florida boat show in 2001, where it sold 200 pairs, to its current incarnation posting more than $3 billion in annual sales. Crocs can be found in 85 countries, and the company sells more than 100 million pairs of shoes, of all types, annually. All of this makes Crocs one of the top ten non-athletic shoe brands in the world.

Crocs’ strong market position has led to strong quarterly and full-year results. The company beat expectations in its fourth quarter and fiscal 2022 financial report, with strong quarterly results. The top line of $945.2 million beat the forecast by $6 million, while the non-GAAP EPS bottom line of $2.65 came in 42 cents, or 18% ahead of the forecast. Full-year revenue of $3.6 billion increased 53% year-over-year and was a record for the company.

Looking ahead, Crocs’ guidance for the first quarter and full year 2023 also beat consensus estimates. First-quarter guidance for adjusted diluted EPS was set at $2.06 to $2.19 per share, where Street had expected $2.04. For the full year, the EPS guidance of $11 to $11.31 was well above the consensus figure of $10.90. The company expects strong sales in 1Q23, with year-over-year revenue growth of between 27% and 30%.

By covering this stock for B. Riley, analyst Jeff Lick makes a clear case for investors to go long on CROX.

“We view Crocs as a multi-year core holding that should deliver absolute and relative returns in 2023 and beyond. Crocs’ guidance for 1Q23 and FY23 seems achievable and beatable. We see numerous tipping points and potential catalysts in 2023 and 2024 that could fuel a relative multiplex and lift investor sentiment. Crocs is also becoming a significant outlet in the area of branding, media ownership and celebrity development,” Lick said.

“Ultimately,” the analyst summarized, “we see the current challenging consumer and retail environment as a potential source of opportunity, as consumers seek value and affordable luxuries, while retailers consolidate their merchandising strategies and rely on proven partners to an even greater degree than usual. .”

These bullish comments support the analyst’s Buy rating on the stock, and his price target, set at $157, suggests Crocs will see ~29% stock appreciation this year.

Zooming out, we find that Crocs earns a Strong Buy consensus rating from Wall Street analysts, based on 6 recent buys vs. 2 holds. The shares are currently priced at $121.86 and their $157.50 average price target implies a 29% upside over the one-year time horizon. (See CROX stock analysis)

To find good stock trading ideas at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the noted analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.