Advanced Micro Devices, Inc. (NASDAQ:AMD) CEO Lisa Su shared insight into the near-term outlook for graphics processing units (GPUs), almost to the point of mocking rivals. Nvidia Corporation (NASDAQ:NVDA) and hyperscalers like Amazon.com Inc (NASDAQ:AMZN) and Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) Google.

As AI models become more standardized, there is potential to create custom chips that offer greater power efficiency, smaller sizes, and lower costs.

According to the WSJ report, Su highlighted this opportunity, noting that while GPUs remain the best choice for large language models due to their efficiency in parallel processing, there is likely to be a shift to a wider range of chip architectures in the future.

Read also: Nvidia, AMD and Broadcom shares rise as Fed rate cut boosts AI chip sector

Recent reports indicated that AMD is focusing on mid-range and mainstream GPUs, abandoning the premium gaming GPU market led by Nvidia.

Nvidia’s GPUs, designed for gaming graphics, have been instrumental in helping the company reach a valuation of $1 trillion and counting.

Tech investor James Anderson expects Nvidia to reach a market cap of $50 trillion within the next decade. JPMorgan Analyst Harlan Sur expects AMD’s data center GPU revenue to grow by $5 billion in the current fiscal year.

Su emphasizes that the future of AI computing will involve a mix of different types of chips, including GPUs and new specialized chips.

To put this into context, major cloud service providers like Amazon and Google have developed their custom AI chips for internal use.

Rival hyperscalers, including Oracle Corporation (NYSE:ORCL) and Amazon have been collaborating lately, which BofA Securities Analyst Justin Post expects to unlock demand for infrastructure and applications, implying increased demand for AI chips.

AMD shares have gained more than 60% over the past 12 months versus Nvidia’s 175%.

Investors can gain exposure to the semiconductor sector through Nasdaq Trust’s First Semiconductor ETF (NASDAQ:FTXL) and Columbia Semiconductor and Technology ETF (NYSE:SEMI).

Price Actions: AMD shares were up 0.28% at $156.39 in premarket trading at last check Monday.

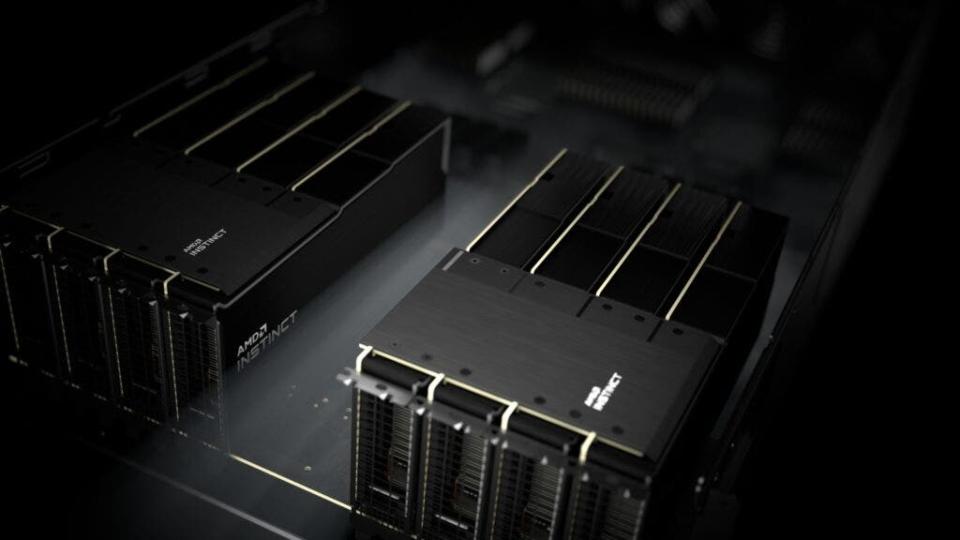

Photo courtesy of AMD

Next up: Transform your trading with Benzinga Edge’s unique market trading tools and insights. Click now to access exclusive information that can put you ahead in today’s competitive marketplace.

Want to get the latest stock analysis from Benzinga?

AMD CEO Predicts Custom Chips Will Overtake GPUs, Sees Shift in Demand for AI Chips: Report originally published on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.