(Bloomberg Opinion) — Nearly $1.5 trillion of U.S. commercial real estate debt is due before the end of 2025. The big question facing these borrowers is who is going to lend them.

Bloomberg’s Most Read

“Refinancing risks are in the spotlight” for property owners, from office buildings to shops and warehouses, Morgan Stanley analysts, including James Egan, wrote in a note last week. “The wall of maturity here is loaded in front. So are the associated risks.”

The investment bank estimates that valuations of commercial and office properties could fall as much as 40% from maximum to minimum, increasing the risk of defaults.

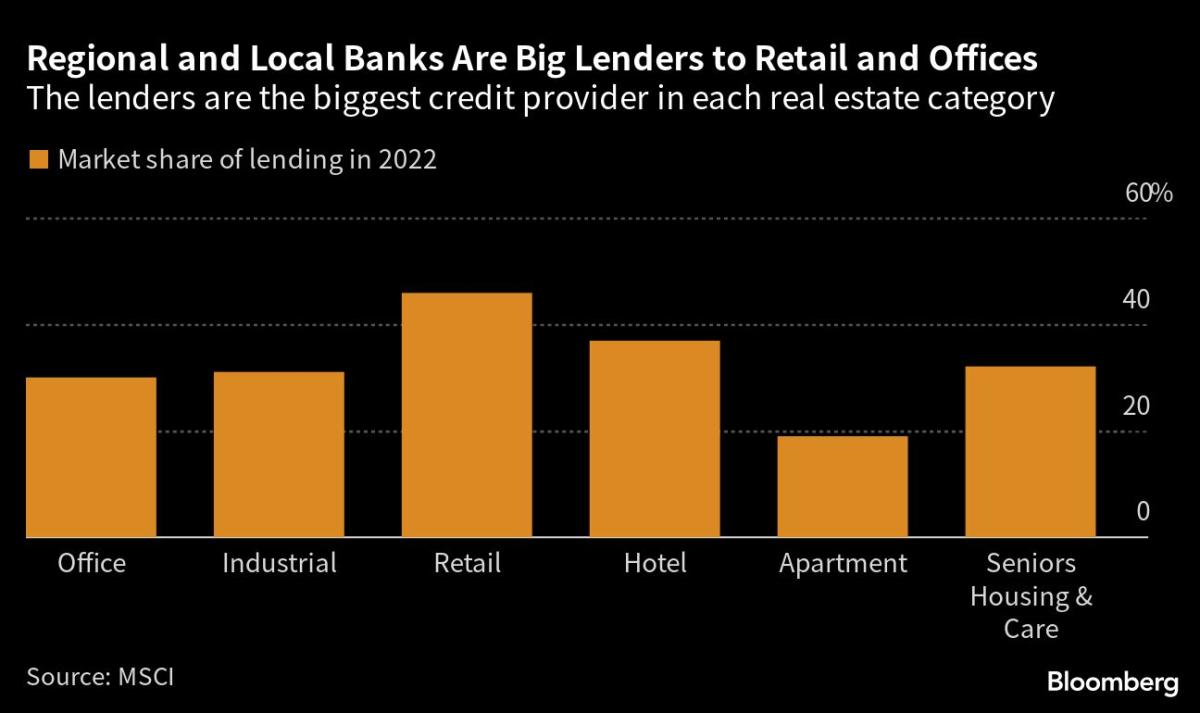

Adding to the headache, small and regional banks, the largest source of credit for the industry last year, have been rattled by the outflow of deposits following the demise of Silicon Valley Bank, raising concerns that it will affect their ability to provide financing to borrowers.

The wall of debt is bound to get worse before it gets better. Maturities increase over the next four years, peaking at $550 billion in 2027, according to the MS note. The banks also own more than half of the agency’s commercial mortgage-backed securities (bonds backed by real estate loans and issued by US government-sponsored entities such as Fannie Mae), increasing their exposure to the sector. .

“The role that banks have played in this ecosystem, not only as lenders but also as buyers,” will compound the wave of refinancing that is due, the analysts wrote.

Rising interest rates and concerns about defaults have already affected CMBS deals. Sales of non-government-backed securities fell about 80% in the first quarter from a year earlier, according to data compiled by Bloomberg News.

In the midst of the darkness, there is some good news. Conservative credit standards in the wake of the financial crisis provide borrowers, and in turn their lenders, with some degree of protection against falling values, the analysts wrote.

Sentiment toward multi-family housing also remains much more positive as rents continue to rise, one reason Blackstone Real Estate Income Trust performed positively in February, even as a growing number of investors file withdrawal applications. . The availability of agency backed loans will help the owners of those properties when they need to refinance.

Still, when apartment blocks are excluded, the scale of the problems facing banks becomes even starker. Up to 70% of other commercial real estate loans maturing in the next five years are held by banks, according to the report.

“Commercial real estate needs to be listed again and alternative ways to refinance debt are needed,” the analysts said.

Meanwhile, European property issuers have the equivalent of more than 24 billion euros outstanding for the rest of the year, Bloomberg Intelligence analyst Tolu Alamutu wrote in a note.

“We are definitely seeing real estate companies go to great lengths to reduce leverage: cut investment programs, more joint ventures, bond buybacks, and where possible, dividend cuts,” he said in an email. “Disposals are also a key focus. Some recent comments from real estate issuers suggest that it is still not easy to sell large portfolios.

Elsewhere:

-

Investors snapped up Europe’s first subordinated bond sale in nearly a month after the market for such debt was effectively shut down by Swiss regulators’ decision to liquidate $17 billion in Credit Suisse AG junior notes. Meanwhile, a global index linked to so-called contingent convertible bank bonds rallied, reaching levels seen before the Credit Suisse bond call.

-

A corner of China’s 954 billion yuan ($139 billion) credit market has shown that smaller banks are not without their own challenges. Capital bond issuance by urban and rural commercial banks during the first three months of 2023 plunged 70% from a year earlier, data compiled by Bloomberg shows.

-

A group of Canadian Pacific Railway Co. creditors is trying to get $2.4 billion in bonds paid early, and at a premium, after they say the company missed a deadline tied to the Kansas City Southern acquisition, reported Bloomberg News on Thursday. The efforts are being challenged by the company, which says its requirements have been met.

-

Sound Point Capital Management is buying Assured Guaranty’s collateralized loan obligation platform, forming a $47 billion credit investment firm that will be the fifth largest CLO manager globally.

-

China Evergrande Group, the developer at the heart of the nation’s real estate crisis, said it has signed restructuring support agreements with some dollar bondholders backing its proposed debt restructuring. Meanwhile, another Chinese builder, Shimao Group Holdings Ltd., is distributing draft restructuring offers to advisers to an ad-hoc group of bondholders.

–With the assistance of Bruce Douglas, Kevin Kingsbury and James Crombie.

Bloomberg Businessweek Most Read

©2023 Bloomberg L.P.