-

An incredibly rare bullish stock market indicator just blinked, suggesting more upside potential ahead.

-

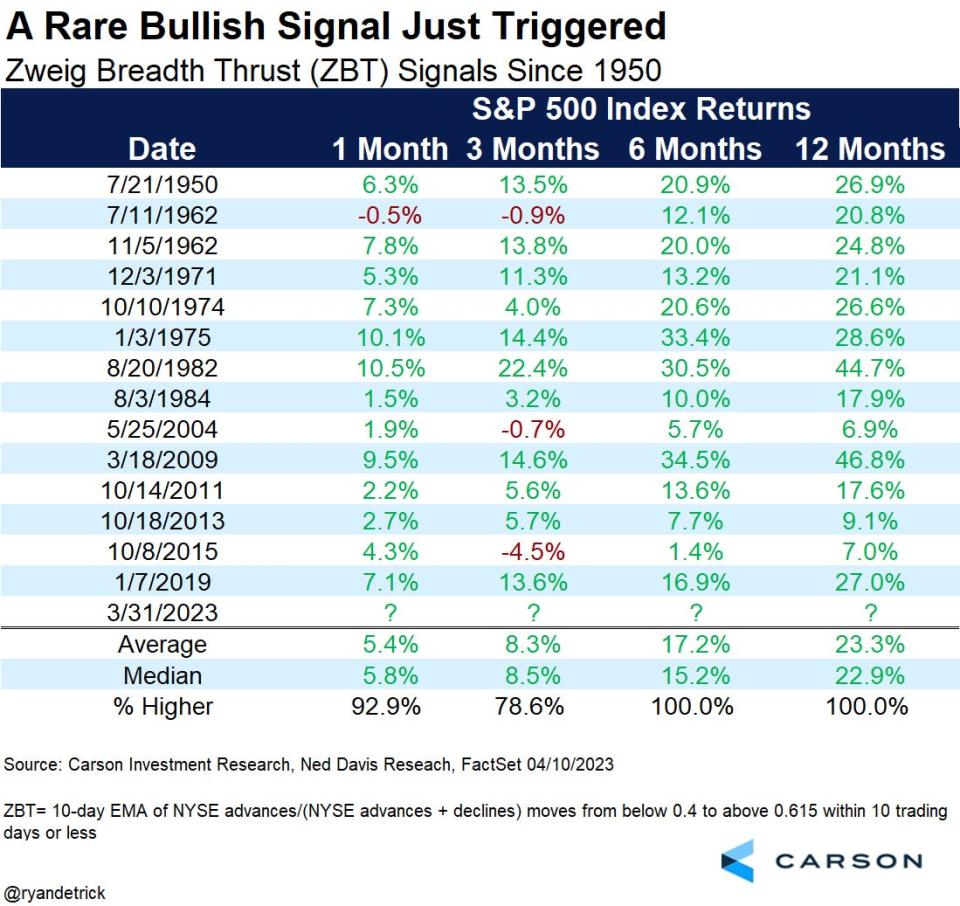

The Zweig Breadth Thrust indicator flickered for the first time since 2019, according to Carson Group’s Ryan Detrick.

-

“It’s only happened 14 other times since 1950 and the S&P 500 was higher a year later each time,” he said.

An incredibly rare bullish stock market indicator just blinked for the first time since 2019, suggesting that the 18% rally in the S&P 500 that began in mid-October has more fuel to continue higher.

That’s according to Carson Group chief market strategist Ryan Detrick, who pointed out that the “extremely rare” Zweig Amplitude Push Indicator has just been activated.

It measures overall participation among individual issues in the stock market and was developed by investor and author of “Winning on Wall Street” Martin Zweig.

The indicator is calculated by taking a 10-day moving average of the number of advancing shares divided by the number of advancing shares plus the number of declining shares. The calculation derives a percentage, and when it falls below 40% and then rises above 60% in 10 days or less, the indicator is triggered.

“Although the calculation is a bit fuzzy, the bottom line is that a lot of stocks went from oversold to overbought in a short period of time,” Detrick told Insider on Monday. “This is what you tend to see at the start of new bullish phases.”

The last time the Zweig Thrust Indicator was triggered was in early 2019. Before that, the indicator flashed in October 2015, October 2013, October 2011, and March 2009, just two weeks after the S&P 500 hit its generational low during the Great Financial Crisis.

“It’s only happened 14 other times since 1950 and the S&P 500 was higher a year later each time,” Detrick said, adding that both the median and one-year average returns were 23%. Meanwhile, the average six-month return after the Zweig Thrust indicator is triggered is 17%.

In just two instances since 2000, the Zweig Thrust Indicator flashed and the S&P 500 fell to a new low: in late 2015 and early 2004. However, while the S&P 500 moved lower in the short term, the index still moved significantly. greatest one year after signal activation.

There have been several breadth push indicators that flickered during the ongoing bear market rally last summer. But notably, none of them were Zweig’s Breadth Push indicator and ultimately turned out to be a false signal as the S&P 500 fell to new lows.

“Last summer’s big rally didn’t see a Zweig breadth push indicator, as that rally eventually faltered. So perhaps this is another hint that this rally from the October lows is legitimate,” Detrick said.

Mark Ungewitter, portfolio manager at the Charter Trust company, said Zweig push indicator it is unique in that it “adds a dimension of ‘velocity’ via an exponential moving average, to a standard measure of intensity.”

And while the indicator is not a surefire sign that the pain in the stock market is over, it is definitely a good sign for bullish investors. “It’s definitely not bearish, although it might not be immediately bullish,” Ungewitter said.

Read the original article on Business Insider