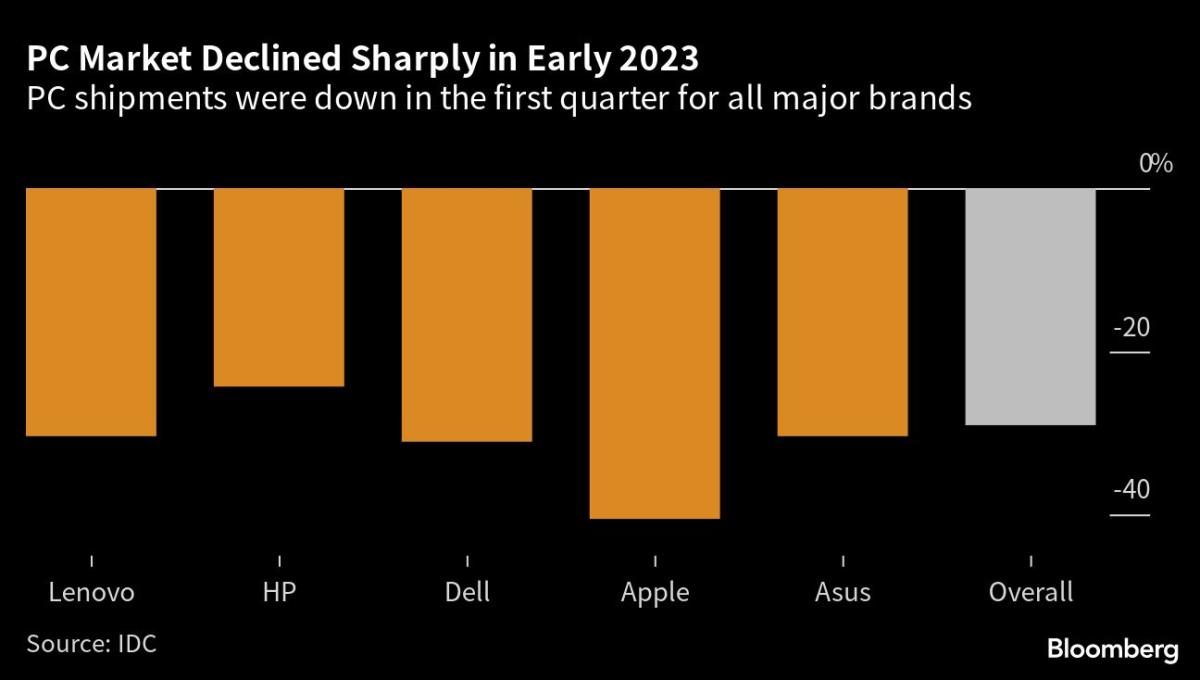

(Bloomberg) — Shipments of Apple Inc. personal computers fell 40.5% in the first quarter, the worst drop since the last three months of 2000, after weak demand and a glut of supply across the industry will hit the Mac maker especially hard.

Bloomberg’s Most Read

Combined shipments of all PC makers fell 29% to 56.9 million units, and dipped below early-2019 levels, as the surge in demand driven by remote work from the company evaporated. era of the pandemic, according to the latest IDC report. Among the market leaders, Lenovo Group Ltd. and Dell Technologies Inc. posted falls of more than 30%, while HP Inc. fell 24.2%. No major brand was spared from the slowdown, with Asustek Computer Inc. rounding out the top 5 with a 30.3% drop.

The report is a particular blow to Apple, whose shipments had been largely halted since the start of the pandemic. Still, the company had been priming investors for weaker results on some of its hardware, with a shaky economic backdrop threatening to dampen enthusiasm for Apple products.

The PC market has seen declines for several quarters, and a rebound is still possible in the second half of the year, said Anurag Rana, an analyst at Bloomberg Intelligence. Apple was hit especially hard by increased exposure to the consumer market and tougher comparisons with a strong period a year earlier, he added.

The last time Apple suffered such a steep drop in demand for Macs, the tech industry was dealing with the dotcom bust. Steve Jobs had only been back as CEO for a few years, and the company recently released an unsuccessful computer known as the Cube.

As it weathers the latest recession, Apple is preparing new models that could help stimulate demand. The company is preparing to launch its next slate of laptops and desktops later this year, Bloomberg reported, including a new iMac.

During a February earnings call, chief financial officer Luca Maestri said the company expects Mac revenue to decline by double-digit percentage in the quarter ending in March. During the same call, CEO Tim Cook said the successful launch of a computer product last year means current MacBook sales numbers face tough comparisons and the company continues to face a “challenging” economic environment.

The slowdown in consumer spending over the past year has led to double-digit declines in smartphone shipments and a cumulative glut among the world’s top memory chip vendors. Samsung Electronics Co., which provides memory for portable devices as well as desktop and laptop computers, said last week it will cut memory production after reporting its lowest profit since the 2009 financial crisis.

Apple shares were down 1.9% at 2:39 p.m. in New York. Dell shares rose 2.2%, while HP gained 1%.

One silver lining is that demand for cooling is giving manufacturers the time and space “to make changes as many factories begin to explore production options outside of China,” IDC said in the report. Apple is gradually diversifying the geography of its manufacturing base as rising tensions between Washington and Beijing threaten to disrupt its carefully orchestrated supply chain.

Read more: Apple looks beyond China as it tries to remake Cook’s supply chains

Looking ahead to 2024, IDC researchers envision a potential rebound for PC makers, driven by a combination of aging hardware that will need to be replaced and an improving global economy.

–With the assistance of Gao Yuan and Brody Ford.

Bloomberg Businessweek Most Read

©2023 Bloomberg L.P.