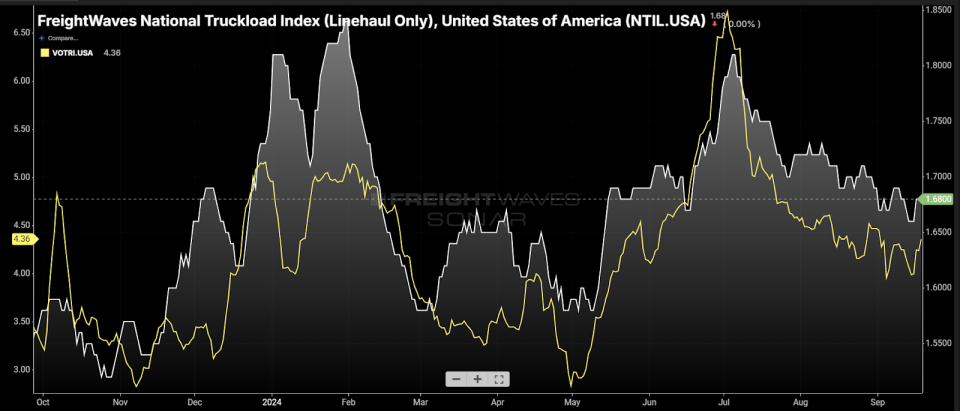

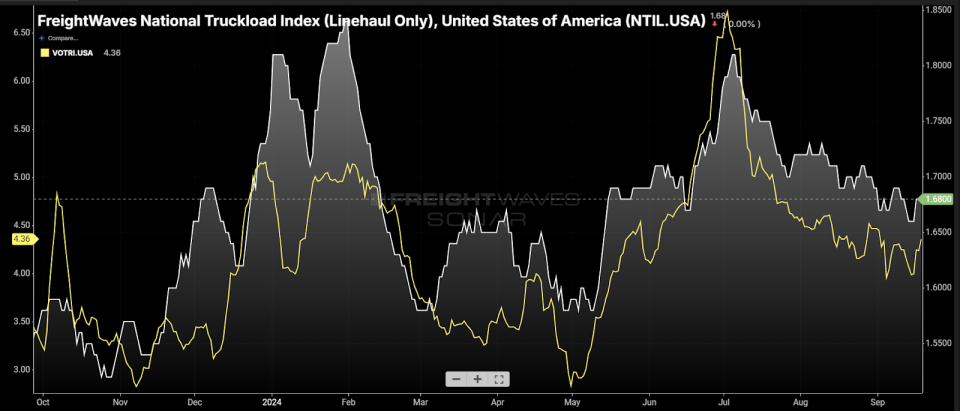

Chart of the week: National Truck Loading Index (Linear Transport Only), Van Outbound Tender Rejection Rate – USA SONAR: NTIL.USA, VOTRI.USA

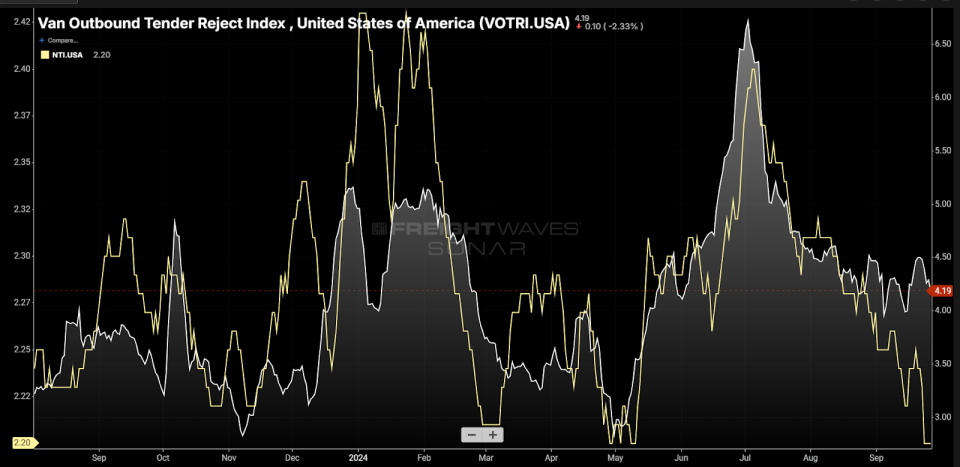

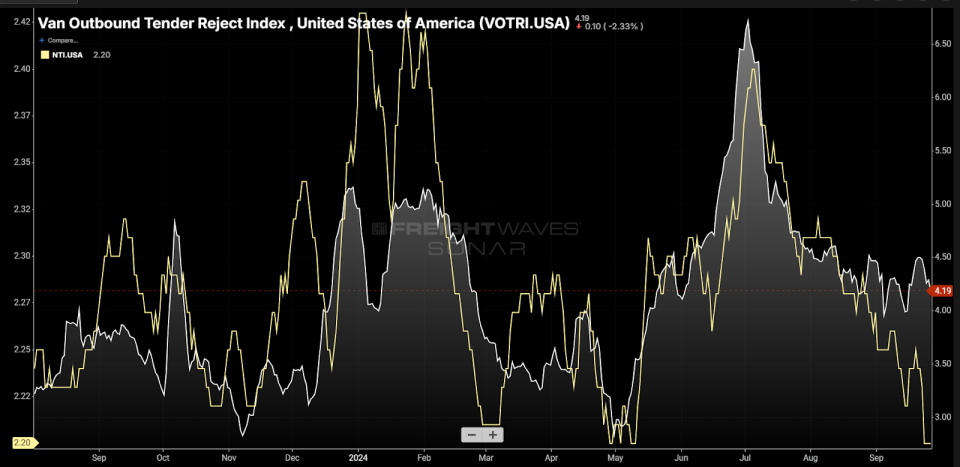

Spot rates, excluding estimated total cost of fuel (NTIL), have fallen 3% since the beginning of August. Dry van tender rejection rates (VOTRI), which measure the percentage of loads that carriers cannot cover for their customers, are on average about 30 basis points lower. In other words, the market that seemed to be showing signs of tightening in the summer has changed course over the last quarter.

For those less familiar with the United States transportation market, spot rates generally increase when it is harder to find a truck to cover transportation and decrease when it is easier. The spot market is the wild west of the trucking market. It represents the most extreme levels of volatility and polarized edges of the industry.

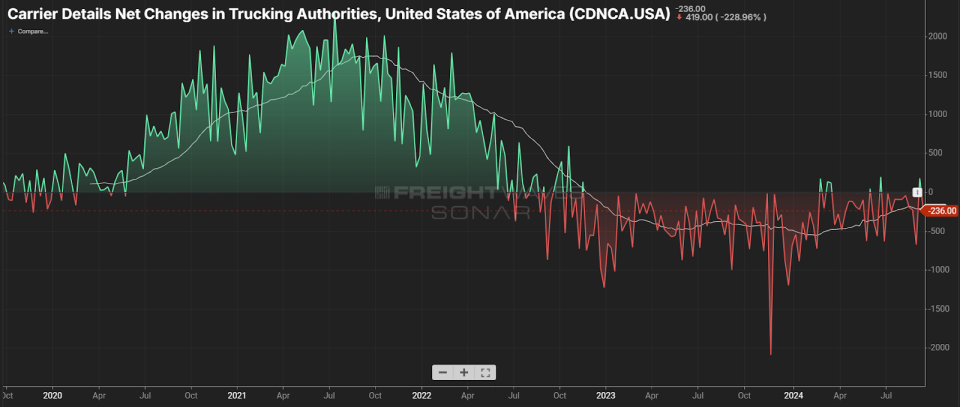

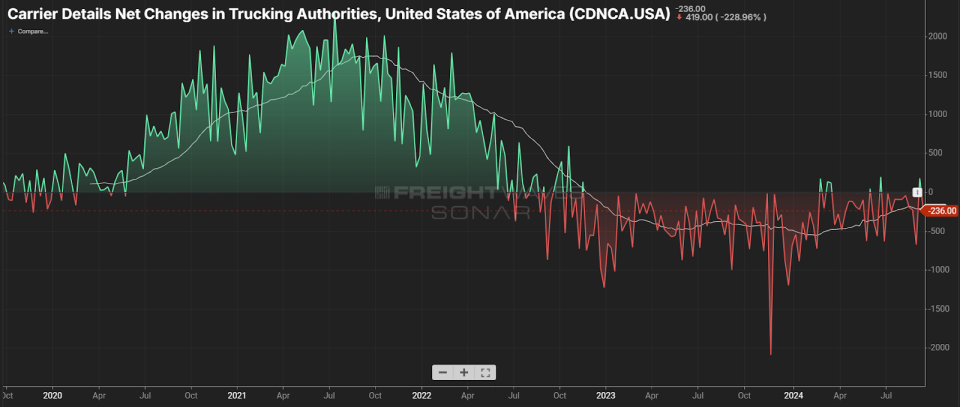

Spot rates are very useful for looking at short-term trends, but lose value when looked at over several years due to inflation and compounding. Operating costs for airlines have increased more than 30% in the last five years, putting invisible upward pressure on fares. Unfortunately for many operators, they have not been able to pass on much of these costs due to an extremely competitive environment. A flood of new entrants during the pandemic era is largely to blame.

Detailed analysis of net changes in active operating authorities from the Federal Motor Carrier Safety Administration shows that there was a record 50% growth in newly registered carrier-owned operating authorities from 2020 to mid-2022. This growth rate quadrupled the rate that occurred in the 2018-19 market. The result of this was also a sharp and prolonged market decline, which led to numerous exits of traders.

The pandemic demand bubble has been bursting in the national transportation market for more than two and a half years. More than 200 carriers per week leave the net inbound space. The vast majority of these outlets are small fleets and owner operators consisting of fewer than five trucks and most with less than three years of experience.

So far, the deterioration in capacity has only led to a few short periods of slight market vulnerability.

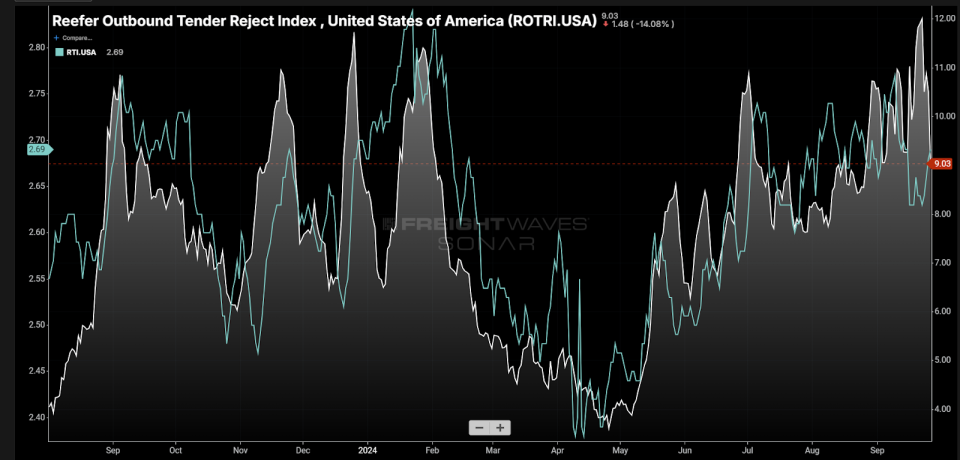

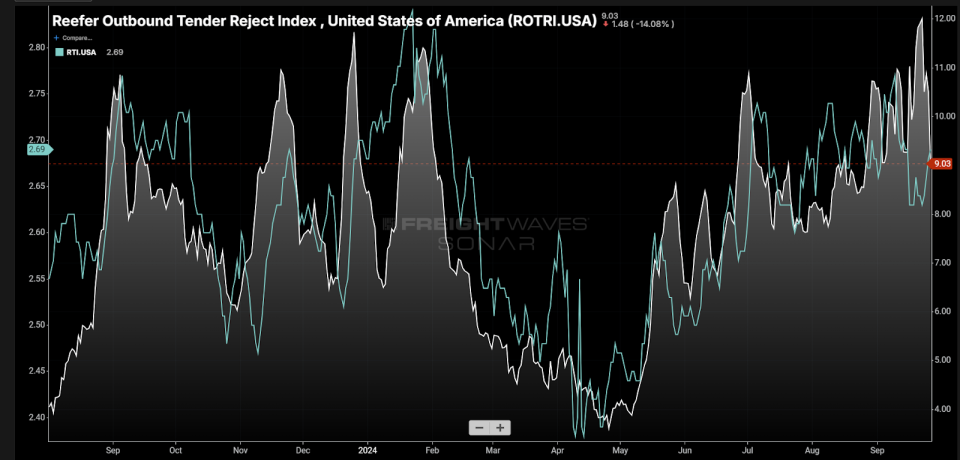

Last year’s refrigerated truck (reefer) market was the first to show signs of tightening. Spot (RTI) and rejection (ROTRI) rates jumped before Labor Day and rode a roller coaster ride into January before falling back to record lows. The reefer market has since recovered more sustainably, but has stumbled over the past week.

The dry van market, which accounts for most of the rental truck market activity, has also had its share of moments. The polar drop in Arctic air in January caused spot sales and rejection rates to return to Christmas levels as shippers were paralyzed for a few days.

Over the summer, spot and rejection rates soared as an unexpected influx of imports hit the West Coast, putting pressure on carriers’ networks. However, there was enough slack in the ability to recover and the market is now trending weaker after showing increasing signs of vulnerability.

Hurricanes and strikes

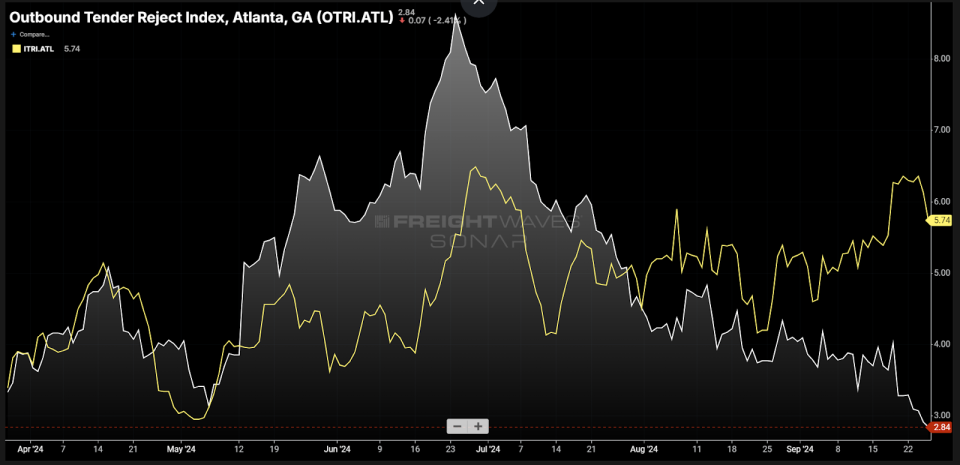

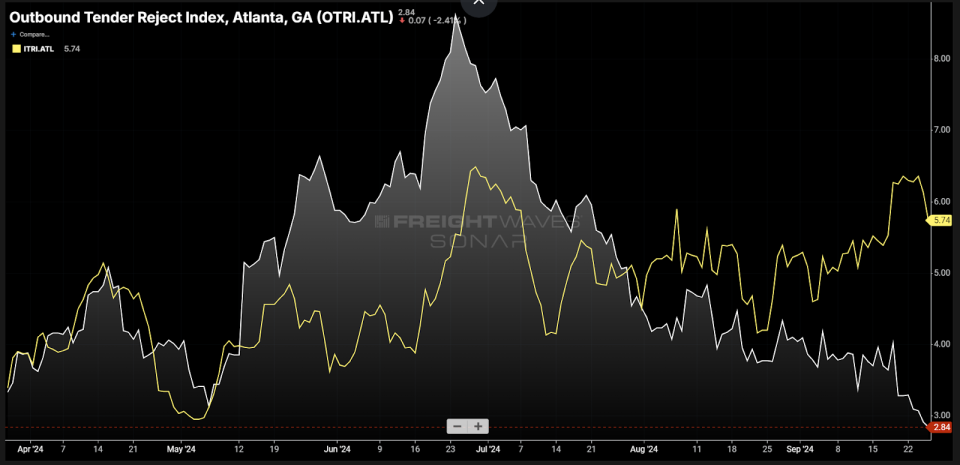

Hurricane Helene landed as a major Category 4 storm, with much of its impact on infrastructure affecting inland markets in the Southeast.

Atlanta’s exit rejection rates plummeted before the storm, while entry rejection rates rose. This could cause some level of short-lived disruption, but probably not a market disruptor like Harvey was in 2017.

The International Longshoremen’s Association strike also has some potential depending on whether it happens and for how long, but many shippers have been preparing for it for several months.

Is this the new normal?

The potential good news for transportation service providers is that while the spot market has collapsed and many of the disruptive events have faded in the short term, rejection rates continue to trend upward over the course of the year. one year. The likelihood of a sustained market turnaround this fall has faded, but that doesn’t eliminate the possibility of a sharp turnaround in 2025.

Capacity declines at its fastest rate during the winter. If this trend continues and the market remains weak through the holidays, the probability of a serious supply shock increases substantially.

This market is definitely not sustainable. It will change. The fact that capacity continues to flow at record levels indicates that supply is sinking towards demand on the curve. Timing is always the hardest to predict and change will likely come when many have let their guard down.

And who can blame them, as this has been the longest and most severe freight industry downturn in modern times?

About the chart of the week

The FreightWaves Chart of the Week is a selection of SONAR charts that provide interesting data to describe the state of the freight markets. One chart is chosen from thousands of potential charts in SONAR to help participants visualize the freight market in real time. Each week, a market expert will post a chart, along with commentary, live on the home page. After that, the week’s chart will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presents the data in graphs and maps, and provides commentary on what transportation market experts want to know about the industry in real time.

FreightWaves’ product and data science teams release new data sets every week and improve the customer experience.

To request a demo of SONAR, click here.

The post Freight Market Green Shoots Fade Heading into October appeared first on FreightWaves.