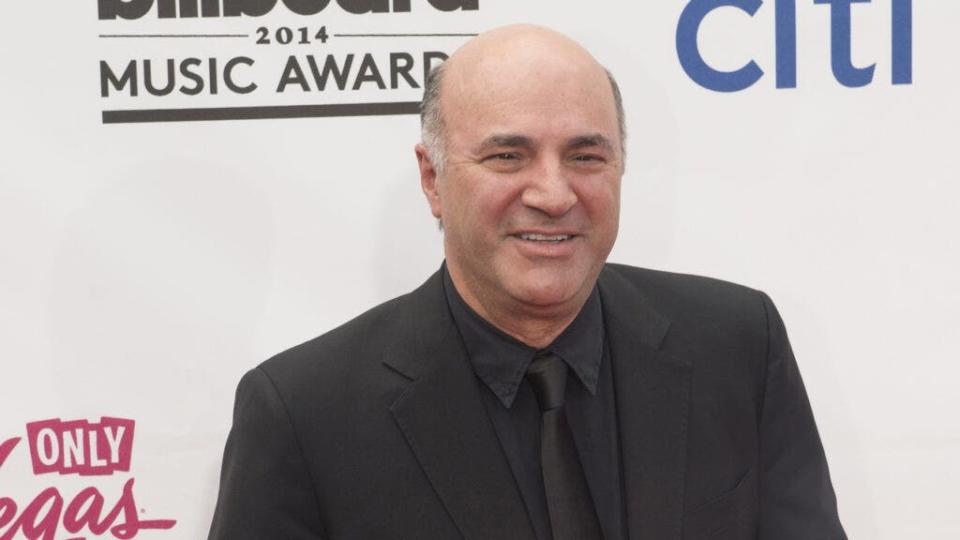

Kevin O’Leary, a renowned investor known for his no-nonsense approach to business, has a unique strategy for dealing with family members who ask him for money. He has had his fair share of family members come to him with big ideas and high hopes, looking for a sizable investment. And with O’Leary’s financial situation, it’s not surprising. The Canadian businessman and Shark Tank star has a net worth of around $400 million.

Don’t miss:

But while he is generous, he also has boundaries that help prevent family and finances from colliding. In a short YouTube video, O’Leary explained his actions when family members ask him for money. Recognize the old truth: “More money, more problems.” O’Leary says: “It’s a great thing because it gives you freedom, but it makes your life harder because a lot of people want something from you for free, especially your family members. This is a big problem.”

Trending: Amid the current electric vehicle revolution, previously overlooked low-income communities now houses a great investment opportunity for only $500.

O’Leary clarifies that people come to expect something for nothing just because you have money. And to handle this, he’s developed a simple method that keeps things clear and avoids awkward Thanksgiving dinners.

When a family member approaches him for money, whether to open a restaurant or launch a new business, he offers them a unique gift. In the case you mention, it is $50,000. It’s not a loan, it’s not an investment, just a gift. But there’s a problem: “You never ask me for money again. Ever.” O’Leary’s rule is simple: after that verification, there will be no more handouts, no future expectations, and no financial entanglements. As he humorously adds, he hands over the money and then “goes back to polishing his balls.” It’s a clean breakup that leaves no room for future financial disputes or awkward family interactions.

Trending: Innovative Buy Now, Pay Later Trading App for Stocks Tackles $644 Billion Margin Lending Market. Here’s How to Get Capital with Just $500

For those who don’t have a portfolio like O’Leary’s, his approach still offers a valuable lesson. Setting clear boundaries is crucial when lending or gifting money to family. Getting caught up in the emotions and obligations that come with helping your loved ones is easy, but things can get complicated without clear rules. A good approach for the rest of us might be to give only what we can afford to lose (whether it’s $50, $500, or $5,000) and make it clear that this is a one-time deal. No loans, no conditions, no awkward family gatherings.

Managing family and money can be complicated, but O’Leary’s approach shows that it’s all about setting expectations and meeting them. And maybe, just maybe, it’s also about having a little humor to keep things from getting too tense.

It’s always smart to consult with a financial advisor before making major decisions, especially when it comes to a family. They can help you determine what makes the most sense for your situation and set the right boundaries. It’s not just about money: it’s about keeping relationships intact while making decisions that work for everyone. A little guidance can go a long way to ensuring your finances and family ties remain strong.

Read next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click Now to Get Best Trading Ideas Dailyplus unlimited access to cutting-edge tools and strategies to gain an advantage in the markets.

Get the latest stock analysis from Benzinga?

This article ‘You Never Ask Me for Money Again’: Kevin O’Leary Explains Instead of Investing in Family Members’ Businesses, He’s Giving Cash Away with a Caveat originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.