For the better part of two years, the bullfighting have had a firm grip on Wall Street. A resilient U.S. economy, coupled with enthusiasm around the rise of artificial intelligence (AI), have helped lift the ever-growing Dow Jones Industrial Average (DJI INDEXES: ^DJI)benchmark S&P 500 Index (SNP INDEX: ^GSPC)and focused on growth Nasdaq Composite Index (Nasdaq Index: ^IXIC) to multiple all-time closing highs in 2024.

However, optimism is not universal when it comes to investing. Some of the most prominent and followed billionaire money managers, including Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) Warren Buffett, Appaloosa’s David Tepper and Fundsmith’s Terry Smith have been sending an ominous warning to Wall Street with their trading activity.

Some of Wall Street’s biggest investors are taking a backseat

While no fund manager is an exact carbon copy of another, Buffett, Tepper and Smith are very similar. While they may have different areas of expertise or dabble in investment areas that the other two might not (for example, David Tepper tends to be a bit of a maverick and isn’t afraid to invest in distressed assets, including debt), all three tend to be patient investors who focus on locating undervalued or under-appreciated companies that they can hold for long periods in their respective funds. It’s a really simple formula that has worked well for all three billionaire investors.

When Form 13Fs are filed with the Securities and Exchange Commission each quarter, professional and everyday investors flock to these reports to see which stocks, industries, sectors and trends have piqued the interest of Wall Street’s brightest investing minds. However, the latest round of Form 13Fs held a surprise for investors who closely follow the trading activity of Buffett, Tepper and Smith.

The quarter ending in June marked the seventh consecutive quarter in which Warren Buffett sold net stock. He disposed of more than 389 million shares from his largest shareholders. Apple during the second quarter, and more than 500 million shares in total since October 1, 2023, has generated cumulative net stock sales of $131.6 billion since the beginning of October 2022.

Despite advising investors not to bet against the United States and emphasizing the value of long-term investing, Buffett’s short-term actions have not aligned with his long-term ethos.

But he is not alone.

David Tepper’s Appaloosa ended June with an investment portfolio of 37 stocks worth about $6.2 billion. During the second quarter, Tepper and his team added to nine of these positions and reduced or completely sold their fund’s stake in another 28, including Amazon, Microsoft, Target platformsand NvidiaTepper dumped 3.73 million Nvidia shares, equivalent to more than 84% of Appaloosa’s previous position.

UK stock picker extraordinaire Terry Smith ended June with a 40-stock portfolio worth about $24.5 billion. He added more holdings in just three of those 40 stocks: Fortinet, Texas Instrumentsand Oddities Technology — while reducing its fund’s position in the other 37.

These patient and historically optimistic investors are sending an undeniably clear message: It’s hard to find value on Wall Street right now.

Stocks are historically expensive and that’s a problem

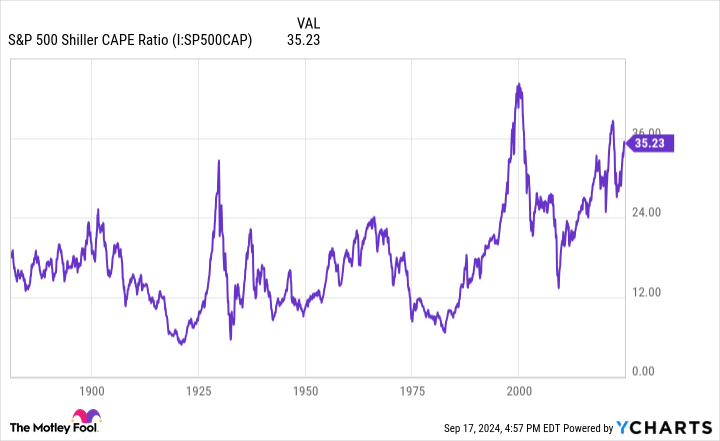

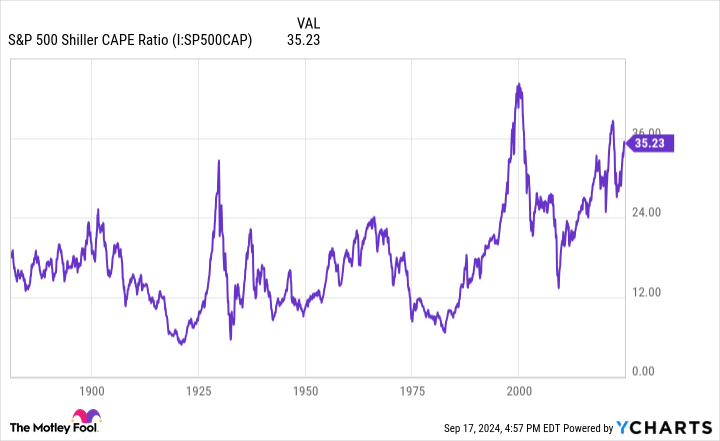

While “value” is a completely subjective term, one valuation tool indicates that stocks are at one of their highest levels in history, dating back to the 1870s. I’m referring to the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also known as the cyclically adjusted price-to-earnings ratio (CAPE ratio).

Most investors are probably familiar with the traditional price-to-earnings ratio, which divides a company’s stock price by its trailing 12-month earnings per share (EPS). While the price-to-earnings ratio typically works pretty well for established companies, it falls short for growth stocks that reinvest a lot of their cash flow. It can also be negatively impacted by one-time events, such as COVID-19 lockdowns.

The Shiller price-earnings ratio is based on the average of inflation-adjusted earnings per share over the past 10 years. Given the earnings history of a decade, short-term events do not negatively impact this valuation model.

As of the close on Sept. 16, the S&P 500’s Shiller P/E stood at 36.27, just below its 2024 high of about 37, and more than double the 153-year average of 17.16, when backtested to 1871.

To be fair, the Shiller P/E has spent much of the past 30 years above its historical average due to two factors:

-

The Internet democratized access to information, giving ordinary investors more confidence to take risks.

-

Interest rates have remained at or near historic lows for more than a decade, encouraging investors to pile into growth stocks with higher multiples that can benefit from low borrowing costs.

But when viewed as a whole, there are only two other periods in history when the S&P 500’s Shiller P/E maintained a higher level during a bull market. It peaked at 44.19 in December 1999, just before the dot-com bubble burst, and briefly topped 40 during the first week of January 2022.

Following the peak of the dot-com bubble, the S&P 500 lost nearly half of its value, while the Nasdaq Composite lost more than three-quarters before regaining its footing. Meanwhile, in the 2022 bear market, the Dow Jones, S&P 500 and Nasdaq Composite all lost at least 20% of their value.

In 153 years, there have only been six occasions when the S&P 500’s Shiller P/E has exceeded 30 during a bull market, including the current one. After the previous five instances, the minimum The S&P 500 has fallen by 20%, and the Dow Jones Industrial Average lost as much as 89% during the Great Depression.

The point is that prolonged stock valuations can only be sustained for so long. While Warren Buffett would never bet against America and Terry Smith is always on the hunt for undervalued assets, neither of the two billionaire fund managers feels compelled to put their capital to work. Indeed, Berkshire Hathaway had a record $276.9 billion in cash at the end of June, and Buffett still is not a buyer of shares… except shares of his own company.

In short, some of Wall Street’s most successful long-term value investors want little to do with the stock market right now, and that’s a very clear warning that investors should heed.

Where to invest $1,000 right now

When our team of analysts has a stock tip, it can be useful to listen. After all, Stock market advisor The average total return is 762%, an outperformance that far outpaces the market compared to the S&P 500’s 167%.*

They just revealed what they believe to be the Top 10 Stocks for investors to buy right now…

See all 10 actions »

*Stock Advisor performance as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, a subsidiary of Amazon, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Fortinet, Meta Platforms, Microsoft, Nvidia, and Texas Instruments. The Motley Fool recommends the following options: January 2026 $395 call options on Microsoft and January 2026 $405 call options on Microsoft. The Motley Fool has a disclosure policy.

Billionaires Warren Buffett, David Tepper and Terry Smith are sending a very clear warning to Wall Street: Are you paying attention? was originally published by The Motley Fool