Stock splits do not change the value of a company, but they often signal that management expects the company to continue to perform well, and that strong operating performance can lead to earnings that create wealth for shareholders.

If you have $1,000 or more to invest that you don’t need for daily expenses or paying off debt, you’ve come to the right place. Read on to learn more about two high-quality companies that have recently split their stocks. Both are poised to offer big rewards to their investors.

Stock Split to Buy #1: Walmart

Inflation may be moderating, but the sharp rise in the price of food, housing and other basic goods in recent years has many people looking for discounts wherever they can. In an increasingly expensive world, Walmart (NYSE: WMT)With its prices, it has become an oasis for these bargain-hunting consumers.

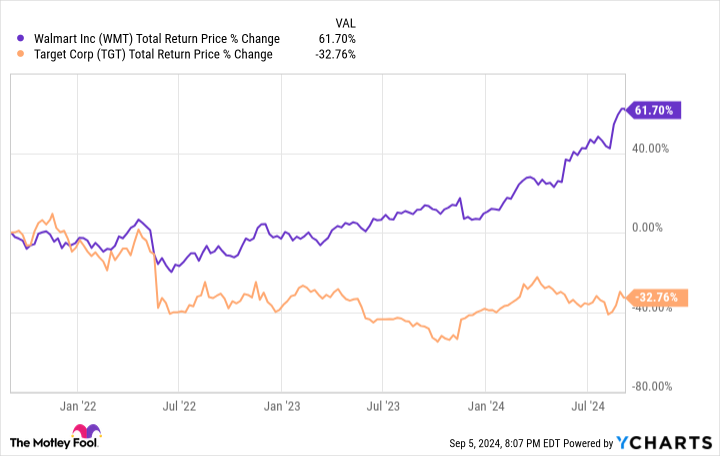

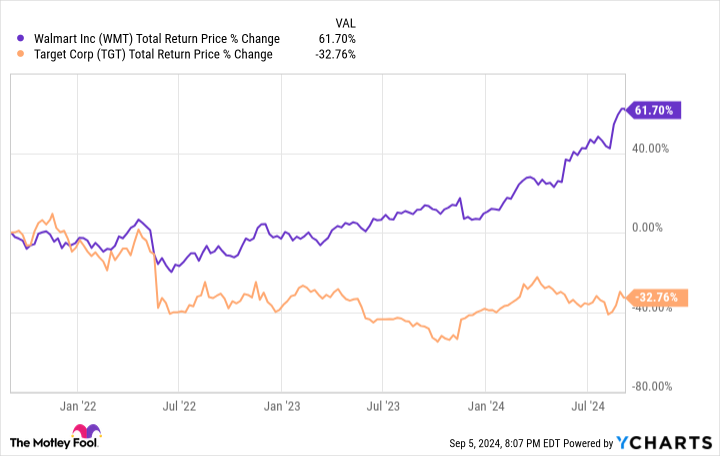

A wide selection of low-cost food and other household items is allowing Walmart stores to generate strong sales even as shoppers cut back on non-essential purchases. This is one reason it has performed better. Aim and other competitors that rely more on discretionary sales.

The retailer’s online sales are also growing rapidly. Rising demand for curbside pickup and delivery services drove a 21% increase in Walmart’s e-commerce revenue in its most recent quarter.

A growing army of third-party merchants has further boosted sales on the company’s online marketplaces. These sellers are also fueling the expansion of Walmart’s lucrative advertising business, whose sales rose 26%.

Better yet, its investments in automation and artificial intelligence (AI) are driving profits. The company’s operating income rose more than 8% to $8 billion, while revenue rose 5% to $169 billion.

Walmart, in turn, opted to reward its shareholders with a 3-for-1 stock split in February. With its value-focused strategy clearly resonating with consumers, investors can expect the retail leader to continue delivering strong returns.

Stock Split to Buy #2: Nvidia

While Walmart saves people money, Nvidia (NASDAQ: NVDA) is helping its customers create game-changing innovations. The semiconductor leader’s chip designs are at the heart of the AI revolution.

Cloud computing giants like Microsoft and Alphabet are ramping up their spending on AI infrastructure. Nvidia’s chips are the best on the market, making it a big beneficiary of this powerful trend. The chipmaker’s revenue rose 122% year over year to $30 billion in its most recent quarter. Net profits rose an even more impressive 168% to $16.6 billion.

But the party is just getting started. Nvidia CEO Jensen Huang estimates that $1 trillion worth of data center equipment will need to be upgraded to new, accelerated computing infrastructure to meet the torrid demand for AI. As a leading supplier of AI chip designs, his company stands to benefit from this massive spending more than any other.

With its business firing on all cylinders, Nvidia dazzled investors with a 10-for-1 stock split in June. Wall Street analysts believe there is still plenty of room for improvement. For example, Rosenblatt Securities analyst Hans Mosesmann thinks the stock is headed toward $200 a share, boosted by strong sales of its upcoming Blackwell chips. That would represent gains of more than 85% for investors who buy shares today.

Plus, if you invest in Nvidia stock now, you’ll likely be buying along with its management. The board increased its share buyback program by $50 billion on Aug. 26.

Should You Invest $1,000 In Nvidia Right Now?

Before you buy Nvidia stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 stocks that made the cut could yield outsized returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $630,099!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of September 3, 2024

Alphabet executive Suzanne Frey is a member of The Motley Fool’s board of directors. Joe Tenebruso has no positions in any of the stocks mentioned. The Motley Fool has positions in, and recommends, Alphabet, Microsoft, Nvidia, Target, and Walmart. The Motley Fool recommends the following options: January 2026 $395 call options on Microsoft and January 2026 $405 call options on Microsoft. The Motley Fool has a disclosure policy.

The Best Stock Splits to Invest $1,000 in Right Now originally appeared on The Motley Fool