-

Nasdaq 100 and S&P 500 declines in September present buying opportunity, says Ned Davis Research.

-

Weak seasonality data and excessively pessimistic readings suggest a strong rebound is coming in the fourth quarter, NDR said.

-

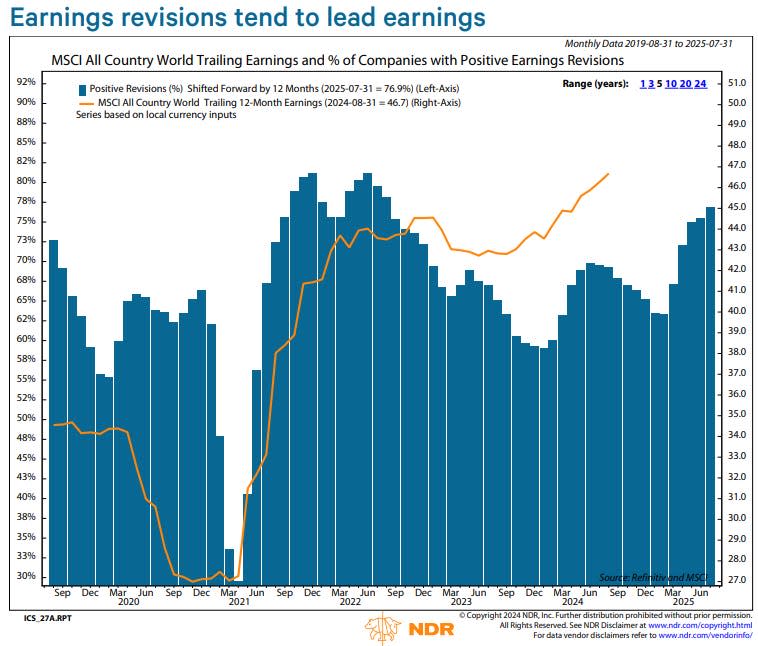

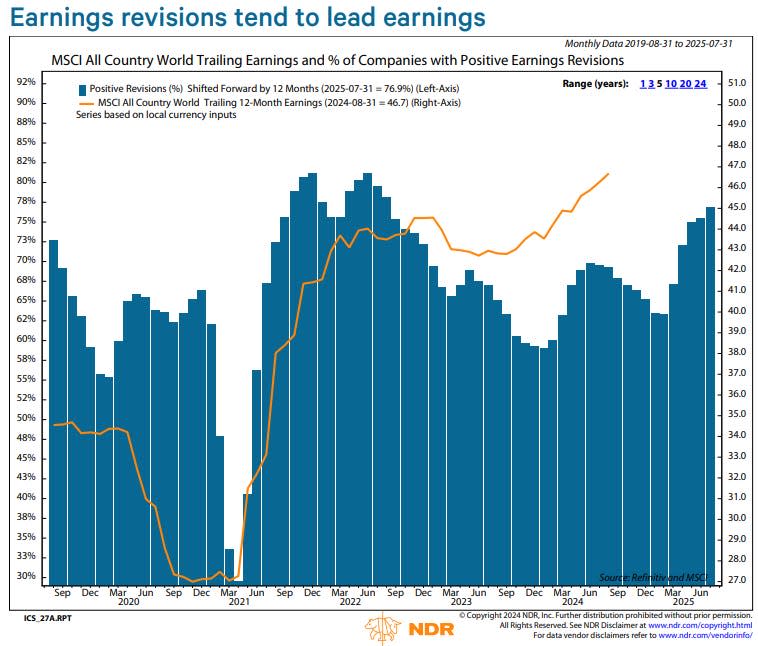

NDR sees no signs of a sharp bear market, with earnings revisions and economic indicators positive.

A 6% drop in the Nasdaq 100 and 4% drop in the S&P 500 since the beginning of September represents an attractive buying opportunity for investors, according to Ned Davis Research.

The research firm said in a note Friday that the weakness in stocks so far this month is more than typical, given the weak seasonal data, but is also a great opportunity given that the market is heading into its best three-month period of the year.

“With September’s weakness dampening optimism and sending sentiment indicators into excessively pessimistic readings, stocks would likely begin a persistent climb similar to the first quarter’s advance, supported by fourth-quarter seasonal trends,” said NDR strategist Tim Hayes.

He added: “While a comparison of three-month declines shows that August-October has been the weakest, October-December has been the strongest.”

Hayes finds it encouraging that, according to NDR’s internal readings, the stock market, economy and corporate earnings show no signs of being vulnerable to a sharp bear market decline similar to what happened in 2022.

Analyst earnings revisions continue to trend higher, historically a leading indicator of corporate earnings.

“As with revisions, economic performance is a leading indicator of earnings growth, which is currently supportive of the earnings outlook. While the probability of a recession has increased from its lows in May and June, it remains bullish for stocks,” Hayes explained.

Taken together, that means the current stock market decline is more likely to be a run-of-the-mill correction that will ultimately prove healthy for the sustainability of the ongoing bullish rally that began in October 2022.

“The current volatility is just that, not the sign of a new bear market. It should create a buying opportunity in the context of the continuing bull market, before a new rally in the fourth quarter,” Hayes said.

Read the original article on Business Insider