-

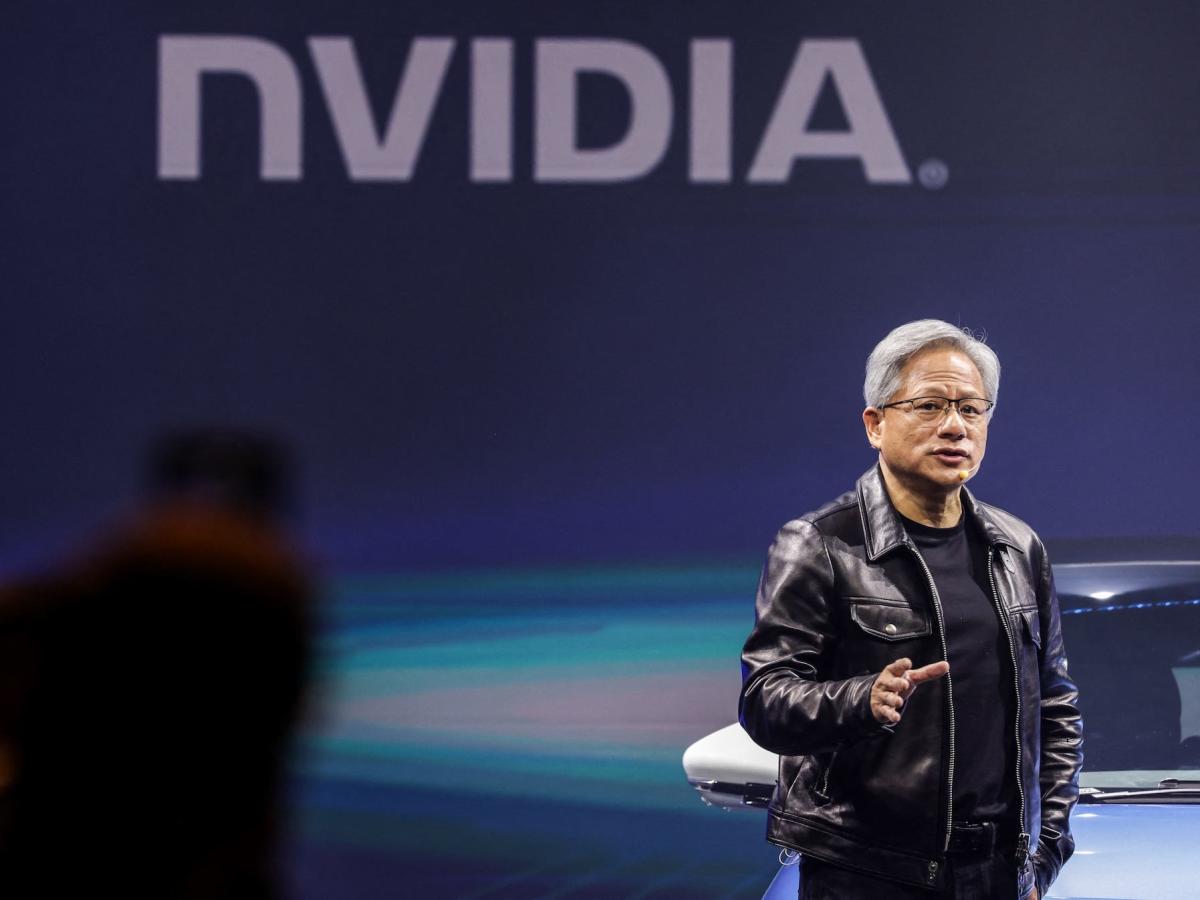

Nvidia shares have fallen since it reported earnings last week.

-

Bank of America says the drop opens up an attractive buying opportunity.

-

The chipmaker’s shares are trading near their lowest valuation in five years, the bank said.

Nvidia bulls may feel paralyzed by the sudden onslaught of headwinds blowing against the company, but for Bank of America, the drop in the stock price over the past week offers an attractive buying opportunity.

Shares of the semiconductor giant plunged on Tuesday, wiping out $279 billion in market value, the biggest one-day drop in U.S. corporate history.

The pullback came after the company’s recent earnings report missed the market’s most optimistic expectations, raising fears that the artificial intelligence rally could be losing steam.

On Wednesday, Nvidia shares briefly continued their slide, following a report that the company had received a subpoena from the Department of Justice. In total, the stock has fallen as much as 15% since Nvidia released its second-quarter earnings in late August.

For Bank of America, the post-earnings drop represents a buying opportunity.

In a note published Thursday, the bank said Nvidia is now hovering around its lowest valuation in five years.

“While market forces could enhance near-term volatility in the stock, we continue to find NVDA’s valuation attractive at 27x CY25/FY26E consensus P/E (or just ~20x P/E at the high end of the $5+ CY25 EPS estimate),” analyst Vivek Arya wrote.

By comparison, Nvidia’s price-to-earnings ratio has ranged from the mid-20s to the mid-60s over the past half-decade.

Investors who buy shares now could face a 54% gain, based on BofA’s price target of $165 a share.

This appears achievable, as Nvidia will remain a key beneficiary of AI investment and will not always be pressured by headwinds, the bank said. For example, weak supply-side fundamentals should fade in the near term, analysts noted.

While investors are disappointed by delays to the company’s next-generation Blackwell chip, shipments should be confirmed in the coming weeks, BofA estimates.

In any case, the bank does not expect demand for older-generation Hopper chips to disappear, given how strong demand for AI is.

As for regulatory hurdles, Nvidia has since denied receiving a subpoena from the Justice Department.

Bloomberg, which first reported the subpoena, later reported that the Justice Department had sent a civil investigative demand, citing a source familiar with the matter.

While BofA does not assume any impact from these developments, it noted that government cases against large U.S. technology companies are not uncommon.

Finally, skepticism about AI’s potential remains a non-issue, the bank said, at least through 2026. Those concerned that the AI spending spree has yet to show results simply need to be patient, the analysts wrote.

“The tech industry is in for at least another 1-2 years of intense development of the NVDA Blackwell chip with its 4x increase in AI training and 25x+ increase in inference. The efforts so far with the first wave of large language models (LLMs) using NVDA Hopper were just the teaser,” BofA wrote, anticipating that real AI capabilities will be unlocked with upcoming LLMs.

Read the original article on Business Insider