Now that the first half of the year is behind us, we can take stock, and what we see illuminates both hopes and risks. On the positive side, stock markets have posted strong gains in the first half; the S&P 500 is up nearly 17% and the tech-heavy Nasdaq is up 24%. On the negative side, gains are limited and concentrated in the technology sector; semiconductor maker Nvidia, up more than 150% so far this year, alone accounts for about a third of the S&P’s gains.

The limited base alone may not scare investors: It relies on the latest artificial intelligence technologies, which are quickly proving their worth in new products and services. But it is also an election year, and as we all know, anything can happen at the ballot box in November. The recent debate between President Joe Biden and former President Trump, the presumptive challenger, only served to muddy the waters further.

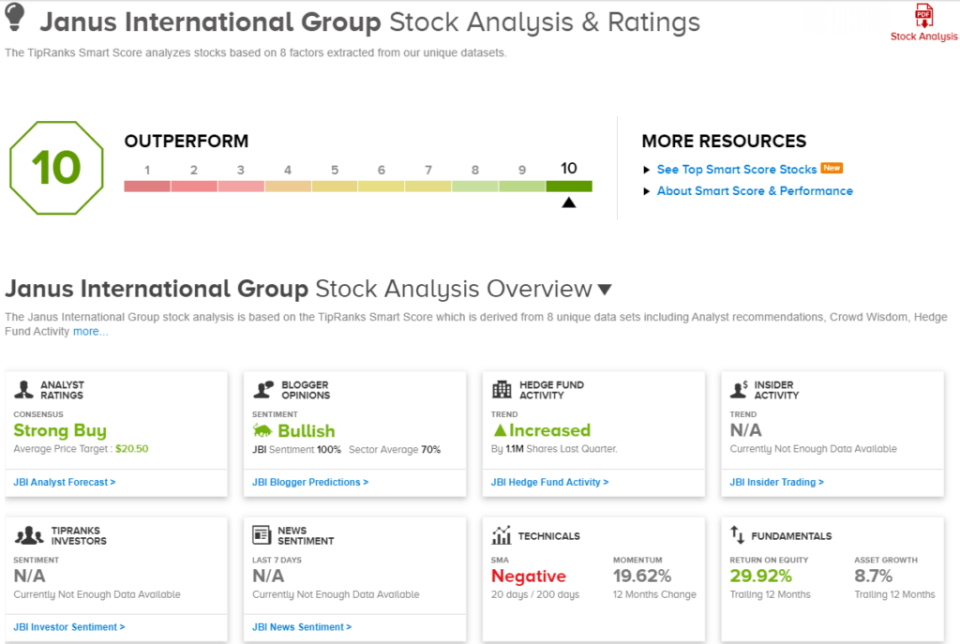

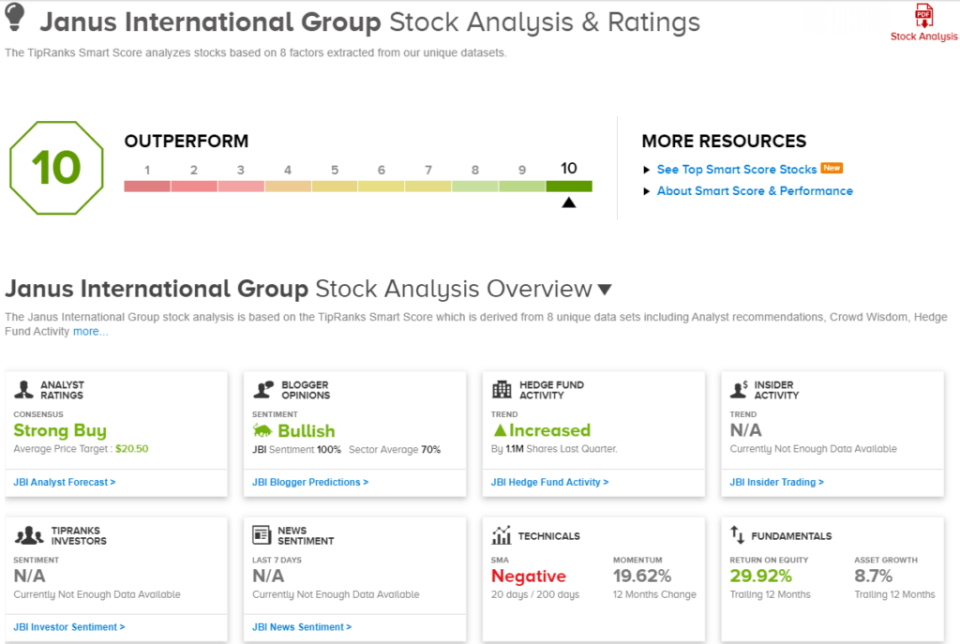

We can filter out some of those murky waters with the right tool, like TipRanks’ Smart Score. This AI-powered data-gathering and matching algorithm gathers and sorts accumulated stock market data and uses it to rate each stock based on a set of factors that have proven to be accurate predictors of future performance. The result is given as a simple score, on a scale of 1 to 10, with the “perfect 10” being stocks that deserve further analysis.

So let’s take a closer look at two of the top-rated stocks (the “Perfect 10”), as they deserve. According to the TipRanks database, Wall Street analysts recognize these stocks as good buys and predict strong upside potential for both. Below are the details.

Janus International Group (International Banking Institute (JBI))

We’ll start with a construction-related company, a firm focused on a product most of us don’t even think about, even though we use it every day: doors. Janus, a design and manufacturing company, provides door and access solutions to the commercial, industrial and construction sectors. The company works with builders and contractors, offering a variety of door solutions, ranging from the most basic to the high-tech. Janus incorporates leading technologies in materials, electronics and sensors, ensuring that its doors are more than just portals.

In terms of specifics, Janus offers lines of doors and entry systems for self-storage facilities, light industrial structures and commercial buildings. These product lines include steel rolling doors, smart entrances, corridor systems and a range of doors made from different materials and with different levels of weather and security protection. Janus typically works with corporate clients.

Janus is also known for its Nokē system, an intelligent entry system designed to enhance doors and entrances in the storage niche. The Nokē system offers benefits to both storage facility owners and customers, including increased security, automated lock controls, and overlocking processes. Janus touts this system as one of many it can offer to bring new technological innovations to its world-class storage door systems.

In addition to its commitment to providing the highest quality in high-end door products, Janus has also been committed to expanding its presence in the business. In late May, the company announced that it had acquired Terminal Maintenance and Construction, or TMC, a leading provider of terminal maintenance services in the trucking industry. TMC operates primarily in the southeastern U.S. and its acquisition will support the expansion of Janus’ Facilitate business division, which provides a full range of facility maintenance services.

In early May, Janus beat expectations when it reported its first quarter 2024 financial results. The company’s earnings release showed revenue of $254.5 million. While up just 1% from the prior-year period, this revenue total was $1.6 million better than anticipated. Overall, Janus’ non-GAAP earnings per share (EPS) of 21 cents per share was 2 cents above estimates, and total net income of $30.7 million was up more than 18% year over year.

Jefferies analyst Philip Ng has covered this stock and sees plenty of potential for continued growth. He notes that Janus is performing well across its business and writes, “Despite a mixed backdrop for self-storage REITs, JBI has seen continued momentum, particularly in new construction, and its order books have remained stable. JBI is delivering solid growth and strong margins, and capital deployment provides good optionality. With the stock trading at 7.0x 2025E EV/EBITDA, we see a path for JBI to re-rate higher now that its free float has improved and it is discovered by a broader shareholder base.”

The five-star analyst continues to give this stock a Buy rating, with a $20 price target that indicates there is room for a 63% upside in the stock over the one-year horizon. (To watch Ng’s track record, click here)

While Janus only has three recent analyst reviews, all are positive: a Strong Buy consensus rating from Wall Street. The stock is selling for $12.25, and its $20.50 average price target implies a one-year gain of 67%. (See JBI Stock Forecast)

Atmus Filtration Technologies (ATM University)

Next on our list is Atmus, an industrial company that offers a portfolio of differentiated, high-quality filtration solutions in the global market. In short, the company offers a full line of filters and filtration products to a variety of industries, including customers in the fields of agriculture; power generation; rail, maritime, and road transportation; mining, oil and gas extraction; it’s a long list, as Atmus has hundreds of thousands of end users.

Atmus began as, and for a long time remained, a subsidiary of diesel engine major Cummins. In May 2023, Cummins began the process of spinning off Atmus as a fully independent entity; that process was completed earlier this year, when Cummins sold its remaining stake in the filtration company.

As an independent operator, Atmus boasts a market capitalization of $2.38 billion. The company is a leader in filtration technology and protects its product portfolio and intellectual property with more than 1,250 patents (active or pending) worldwide, as well as approximately 600 trademark registrations and applications. The company’s filtration technology is used in a wide range of fuel, lubricant and air systems, connected to a variety of engines and power plants. Atmus has 5 technical centers and 10 manufacturing facilities, and recorded more than $1.6 billion in sales last year.

Atmus recently reported its first quarter 2024 results, its fourth financial report since its shares first went public last year. Overall, the company reported revenue of $427 million, while overall it reported non-GAAP earnings of 60 cents per share.

Northland analyst Bobby Brooks covers Atmus and explains why investors should pay attention to this issue: “ATMU’s Fleetguard is the leading brand of emissions/efficiency parts for medium and heavy duty vehicles, on and off-highway. ATMU was spun off from CMI (NR) last year, and CMI divested its remaining stake in March. All in all, we believe ATMU’s extremely macro-resilient business, accelerated revenue growth potential, margin expansion opportunities post-spin-off, and clean results create a compelling investment case.” (To watch Brooks’ track record, click here.)

Brooks rates the stock an Outperform (Buy) rating, with a $36 price target that implies a one-year upside potential of 26%.

Zooming out a bit, we see that ATMU stock has received six recent analyst reviews, and all of them are positive, giving the stock its Strong Buy consensus rating. Shares are priced at $28.55, and their average price target, $36.17, suggests the stock has room to gain 27% over the next 12 months. (See ATMU Stock Forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important that you do your own analysis before making any investment.