About a year ago, shares of the online travel booking platform Stock Reserves (NASDAQ:BKNG) surpassed $3,000 per share for the first time. Now they are approaching $4,000 per share. And if any of those stock prices are important to you, then Booking Holdings CEO Glenn Fogel would prefer that he not buy these stocks. You are not the type of investor the company is looking for.

In a recent interview with Barron, Fogel was asked why Booking hasn’t split its stock yet, considering some people think it’s too expensive at around $4,000 per share. A stock split would reduce the price per share and increase the number of shares. Fogel responded by saying, “I don’t think I want that kind of investor.”

That’s kind of a big statement considering most investors. do focus on this.

A 2023 article in the Journal of Risk and Financial Management noted a steady increase in a stock’s trading volume during the month leading up to a stock split. Traders were more active when they knew a stock split was coming; It’s clearly a big problem for a lot of people.

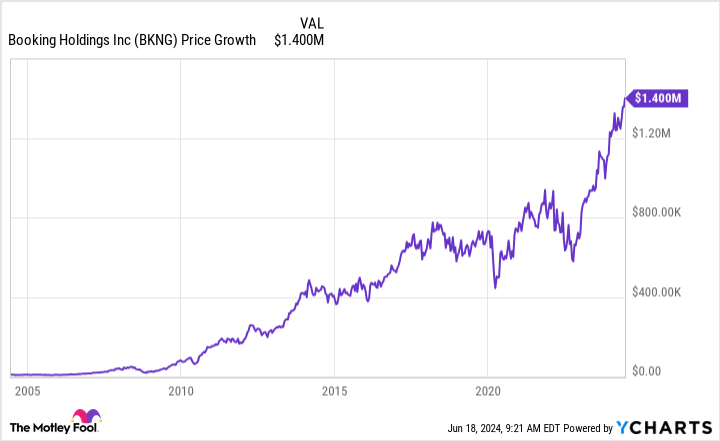

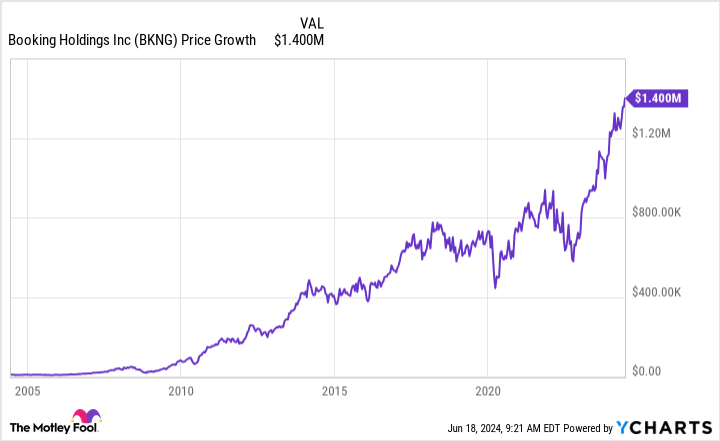

However, before split-loving investors shy away from Booking Holdings stock, they should consider that a 20-year-old investment held until today would have been a thing of beauty. An investment of $10,000 in June 2004 would be worth about $1.4 million today. And it did so without the help of a single stock split.

This is what Fogel has in common with Warren Buffett

Booking Holdings shares could approach $4,000. But that’s child’s play for Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) considering its Class A shares are trading at over $600,000 per share at the time of writing. And that price doesn’t bother CEO Warren Buffett at all. On the contrary, he prefers it that way.

At Berkshire Hathaway’s annual meeting in 2004, Buffett said, “We’re not looking for people who think it would be a more attractive stock if, instead of selling for $90,000 a share, it sold for $9 a share.” Thus, Fogel is in good company: Neither he nor Buffett are looking for investors focused on stock price and stock splits.

Buffett reluctantly created Berkshire Hathaway Class B shares in 1996 (they trade around $400 today). But the motivation wasn’t to make Berkshire’s price more attractive. Rather it was in response to the complicated derivative products that appeared at the time. Therefore, the Class B shares are not inconsistent with Buffett’s stance on stock splits and the type of investor Berkshire hopes to attract.

But because Aren’t these companies looking for investors with split shares? Simply put, these investors tend to focus more on trivial, short-term matters rather than things that lead to extraordinary long-term returns. But Buffett, Fogel and other top CEOs are focused on the long term and want their investors to focus in the same place. If they focus on something else, they will not be happy with the progress made in the right areas.

About stock splits in his interview, Fogel went on to say, “I don’t think that’s where people should focus their thoughts.” The stock split does not affect the value of the business.

At that 2004 meeting, Buffett also said, “I think not splitting up…has attracted a group of shareholders that are really as close to an investment-oriented group as possible.”

Why long-term investors don’t care about splits

A stock is an ownership stake in a company. The price of that ownership interest can fluctuate from day to day. But if the business becomes larger and more profitable over the years, there is a good chance that the ownership stake will become more valuable. That’s why the “investment-oriented” people mentioned by Buffett are thinking about the future and analyzing the things the company can do to create value.

Stock splits are not one of those things.

Booking Holdings turned a $10,000 investment into $1.4 million by increasing its revenue and profits by astonishing amounts. And looking ahead, management believes it has great opportunities to maintain its progress.

Booking Holdings is looking to leverage artificial intelligence (AI) to deliver a more personalized platform experience, which management hopes will lead travelers to book more aspects of their trips, all in one place. He calls this vision the “connected journey” and it has a real advantage for investors.

Instead of sending travelers to book directly with travel companies, Booking Holdings hopes travelers will book everything directly on its own platform. This could improve loyalty to the platform and there is a cash flow benefit to doing business this way: customers pay Booking Holdings directly and the company holds the cash until the date of travel.

It’s a low-key way in which Booking Holdings seeks to improve its business in the long term. And it can have a much larger positive impact than any stock split ever could.

Should I invest $1,000 in Booking Holdings right now?

Before you buy Booking Holdings stock, consider this:

He Varied and Dumb Stock Advisor The analyst team has just identified what they believe are the 10 best stocks for investors to buy now… and Booking Holdings was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when NVIDIA made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow success plan, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. He Stock Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 actions »

*Stock Advisor returns from June 10, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Berkshire Hathaway and Booking Holdings. The Motley Fool has a disclosure policy.

Do you love stock splits? This $100 billion company says you’re not the investor it’s looking for. was originally published by The Motley Fool