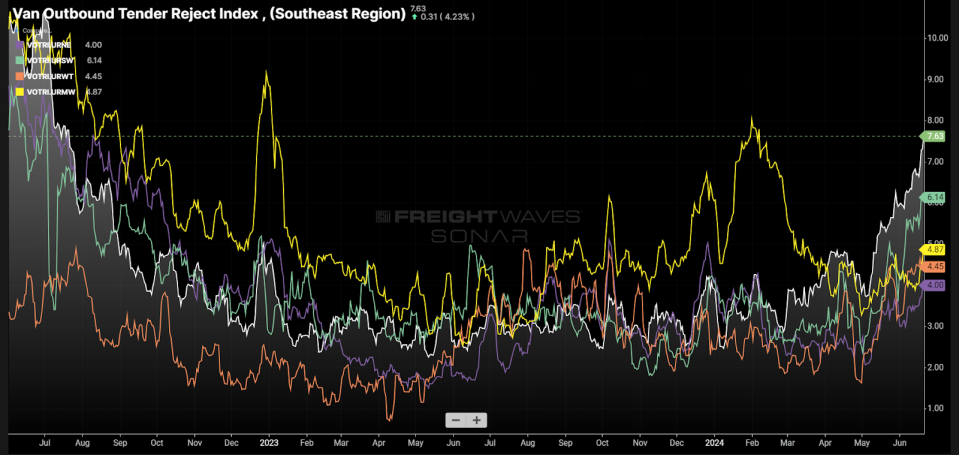

Chart of the week: Inbound Marine TEU Index – US SONAR: VOTRI.URSE, VOTRI.URNE, VOTRI.URSW, VOTRI.URWT, VOTRI.URMW

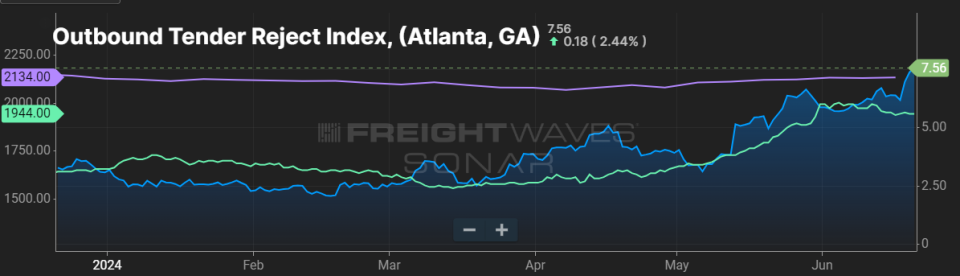

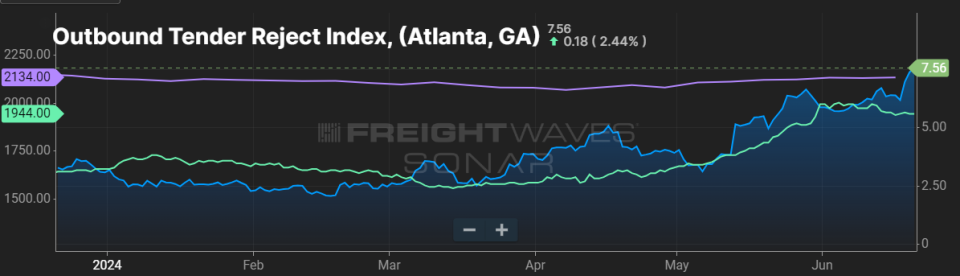

Southeast regional dry van rejection rates (the rate at which truck carriers reject loads from contract carriers) have surpassed all other regions this summer, reaching their highest level since July 2022. This breaks a trend of almost two years of low volatility for the region.

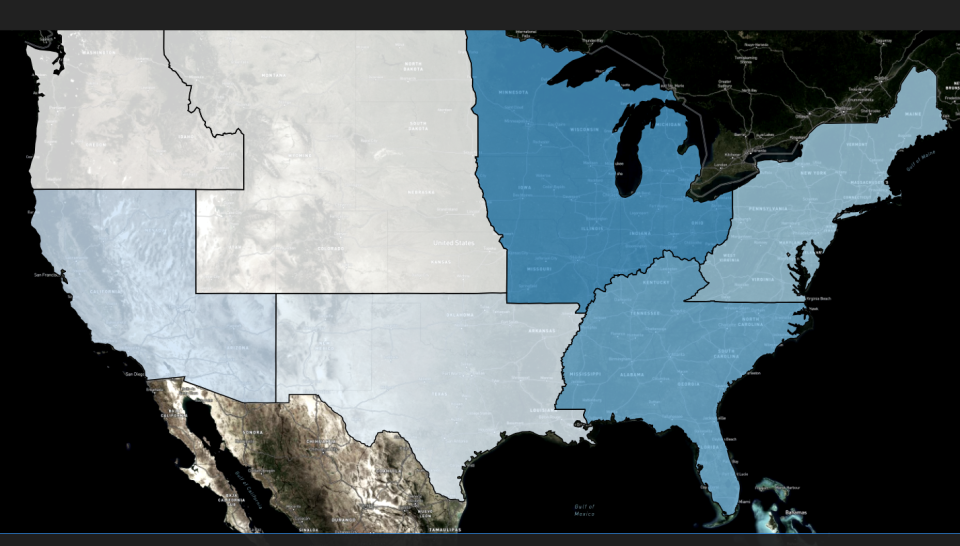

The Southeast region is the second largest freight issuing region in the United States, behind the Midwest. Includes states east of the Mississippi and south of Indiana and Virginia. The largest source market is Atlanta. It is also where many companies are based and where many drivers live.

The importance of this region having the highest rejection rates is simply that it is breaking a multi-year pattern of relatively loose capacity conditions and minimal volatility.

Last summer, the Southeast peaked with a 3.52% rejection rate for dry van loads ahead of the July 4 holiday. Most tellingly, rejection rates ranged between 2.5% and 3.5% throughout the year.

This year, rejection rates have exceeded 3.5% since the beginning of March and are now above 7.5% for the first time in 23 months.

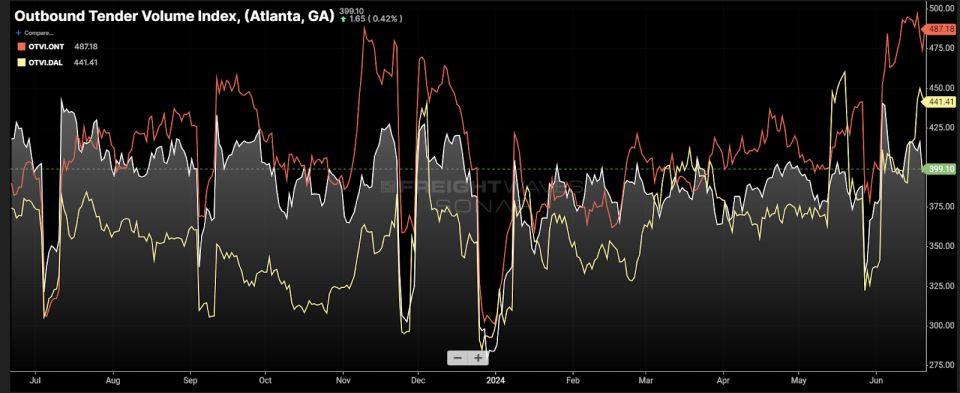

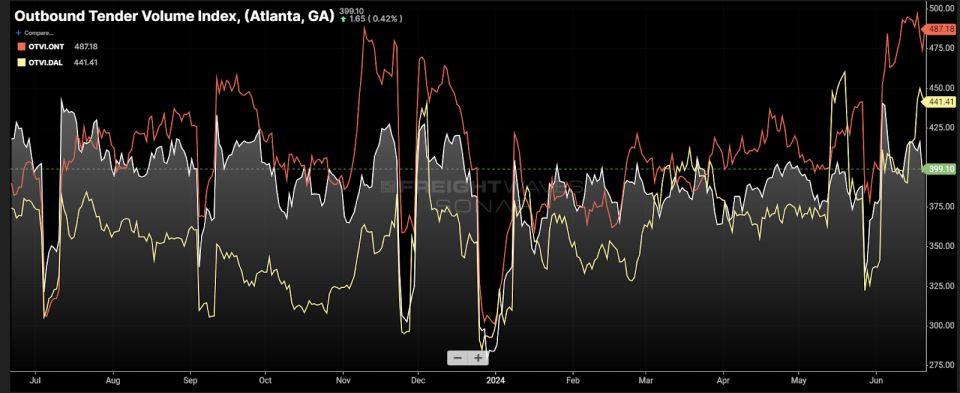

Regional hub Atlanta has been the nation’s second-largest outbound market in 2024, accounting for approximately 3.4% of total outbound bids in SONAR bid data. Ontario, California, is in first place with 3.6% since the beginning of the year. Dallas is in third place, but increases 3.3%.

Atlanta’s departure rejection rate has doubled since last summer and has increased faster than the Ontario and Dallas markets this year. Interestingly, increased demand does not appear to be a driving force behind deteriorating carrier compliance, at least at the market level.

Bidding volumes remain relatively stable in June compared to the levels they have been at for most of the year, outside of a post-Memorial Day blip. The explanation may lie in the substantial increase in the level of demand in the Ontario market since the beginning of May. Ontario’s OTVI has increased 20% since May 1 and appears to continue growing.

While capacity remains abundant in the domestic freight market, the flow of goods is not balanced. Operators have to constantly rebalance their networks to account for changes in demand. Covering Southern California requires a significant amount of capacity due to the lack of inbound freight relative to the rest of the country. Cargo loads originating in the Los Angeles area average the longest in the U.S. due to the influence of the country’s largest port complex.

Carriers tend to prioritize coverage of loads originating in Southern California because they are the most disruptive and generate the most revenue.

On the other hand, the Midwest may be a beneficiary of booming West Coast regional freight demand. Many of the loads leaving Los Angeles end up in the Midwest and Northeast. Subsequently, rejection rates are relatively low in both regions.

Spot rates from Atlanta to Harrisburg, Pennsylvania, have increased 16% since the beginning of May, according to FreightWaves TRAC data, approaching the average contract rate. If spot rates exceed contract rates, rejection rates could skyrocket, causing significant service deterioration and forcing carriers to once again compete with each other for capacity.

It seems there is still a lot of capacity available in the market, but not in the right places. This regional capacity shortfall may be temporary as we approach the seasonal peak of summer shipping around the Fourth of July, but it is just one more example showing that the domestic truckload market is becoming increasingly vulnerable to the interruptions.

About the chart of the week

The FreightWaves Chart of the Week is a selection of SONAR charts that provide interesting data to describe the state of the freight markets. One chart is chosen from thousands of potential charts in SONAR to help participants visualize the freight market in real time. Each week, a market expert will post a chart, along with commentary, live on the home page. After that, the week’s chart will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presents the data in graphs and maps, and provides commentary on what transportation market experts want to know about the industry in real time.

FreightWaves’ product and data science teams release new data sets every week and improve the customer experience.

To request a demo of SONAR, click here.

The post Cracks Appear in Trucking Capacity in the South appeared first on FreightWaves.