While Tesla’s recent Investor Day might have lacked the impact some investors were hoping for, CEO Elon Musk doubled down on the need for a sustainable energy economy and stressed that it doesn’t have to come at the expense of other needs.

“There is a clear path to a sustainable energy Earth,” Musk said. “It does not require destroying natural habitats. It doesn’t require us to be austere and stop using electricity and get cold or anything.”

“In fact,” Musk added, “you could support a civilization much larger than Earth, much more than the 8 billion humans that could actually be sustainably supported on Earth.”

Of course, it’s not just Musk who has such a forward-thinking agenda. There are many companies in the public markets that pursue these goals and also offer opportunities for investors.

With this in mind, we dove into the TipRanks database and pulled the details for two sustainable energy stocks that have received the seal of approval from Wall Street analysts and offer solid upside potential. Let’s take a closer look.

Power plug (PLUG)

The first stock we’ll look at is a leader in a sector that Musk historically hasn’t been very interested in. However, while he was previously known as a major hydrogen skeptic, at the recent investor day he acknowledged that green hydrogen could still have a role to play in helping the world pivot towards a sustainable energy future.

That is certainly Plug Power’s agenda. The company is at the forefront of the burgeoning global green hydrogen economy, for which it is building an end-to-end green hydrogen ecosystem. Its activities range from production, storage and delivery to power generation, all designed to help customers achieve their goals while decarbonizing the economy. However, the pursuit of that goal has caused the company to rack up losses.

The problem in the most recent quarterly report, for 4Q22, was that Plug Power also failed to meet expectations at the other end of the scale. The company delivered record sales of $220.7 million, representing a year-over-year increase of 36.3%, but missed consensus expectations by $48 million. And while gross margins improved from the negative 54% that showed in 4Q21, they still showed negative 36% with the company posting a $680 million operating loss over the course of 2022. On the bright side, the hydrogen specialist emphasized which remains on course to generate revenue of $1.4 billion in fiscal 2023, above Street’s expectation of $1.36 billion. The company also expects to generate a gross margin of 10%.

Taking an optimistic view, JP Morgan analyst Bill Peterson believes the company can overcome “near-term challenges”, although it will have to prove it is up to the task.

“We continue to believe that Plug has good order book coverage across its various businesses, although the conversion of the order book to sales will largely depend on focused execution,” the analyst explained. “Plug continues to see strong customer demand across all of its business segments despite near-term customer readiness delays, and the top-line growth potential continues to impress, and especially for electrolysers and stationary power…we see room for continued gross margin improvements through 2023 from scale, efficiencies, and subsidies so Plug could meet its 2023 profitability targets.”

To this end, Peterson rates PLUG stock an Overweight (ie Buy), while his $23 price target leaves room for ~67% 12-month gains. (To see Peterson’s history, click here)

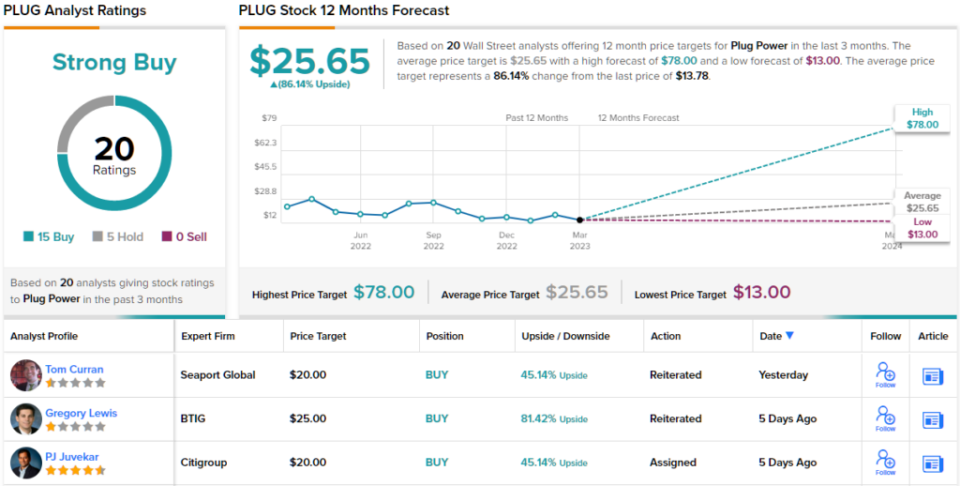

Most analysts agree with JP Morgan’s view; Based on 15 Buys vs. 5 Holds, the stock claims a Strong Buy consensus rating. There is a lot of upside projected here; At $25.65, the median target suggests the stock will climb a further 86% in the next year. (See PLUG stock forecast)

Brookfield Renewable Partners (BEP)

Next, we have clean energy powerhouse Brookfield Renewable, a big player in renewable energy and climate transition solutions. The company owns and operates renewable energy assets in various segments, including hydroelectric, wind, large-scale solar, distributed generation and carbon capture, among other renewable technologies. Brookfield is a global concern with its world-class assets located on four continents that are adopting more sustainable and cleaner power generation practices: North America, Europe, South America and Asia-Pacific (APAC).

After several quarters of sustained growth came to a halt in 3Q22, the company corrected that in the most recent quarterly report, for 4Q22. Revenue increased 9.2% over the same period last year to $1.19 billion, beating Street’s forecast by $10 million. FFO (funds from operations) grew from $214 million, or $0.33/unit in 4Q21 to $225 million, which is equivalent to $0.35/unit. Funds from operations for the full year exceeded $1.0 billion ($1.56 per unit), representing an 8% year-over-year increase.

The company also pays a juicy dividend, which since 2011 has grown by at least 5% every year. The company raised it again in February, by 5.5%, to a quarterly payment of $0.3375. This currently yields an attractive 4.8%.

In assessing the prospects for this renewable energy player, Jones Research analyst Eduardo Seda highlights the advantages of the company’s long-term contract model.

“We note that approximately 94% of BEP’s 2022 generation production (on a pro rata basis) is contracted to public power authorities, charging utilities, industrial users and Brookfield Corporation, and that power purchase agreements (PPP) of BEP have a weighted value. -Average remaining duration of 14 years in a proportional manner”, explained Seda. “As a result, BEP can enjoy both the visibility and long-term stability of its diversified revenue and cash flow generation, and furthermore, the growth of its distribution, which is built on long-term sustainability.”

These comments support Seda’s buy rating in BEP, which is supported by a $37 price target. If the analyst’s thesis goes as planned, investors will see annual returns of ~32%. (To view Seda’s history, click here)

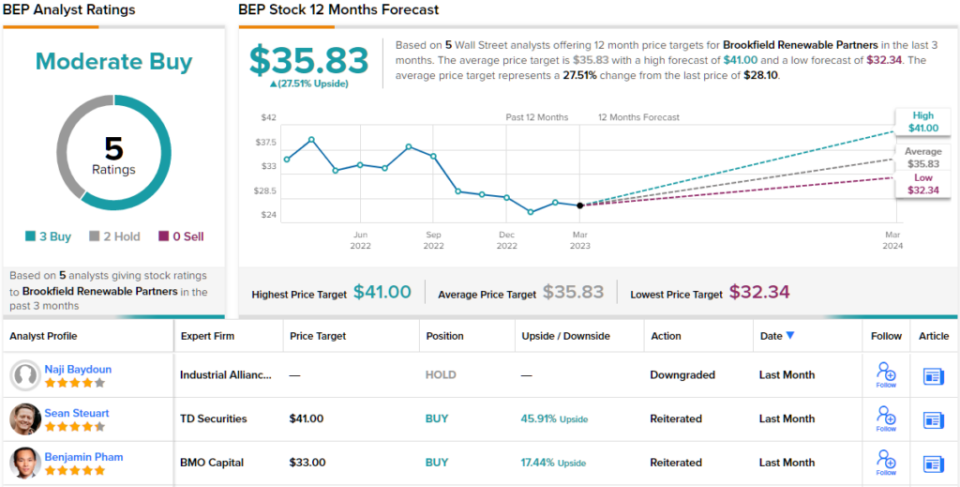

Elsewhere on the street, the stock receives 2 additional Buys and Holds each culminating in a Moderate Buy consensus rating. Shares are selling for $28.10 and their $35.83 average price target suggests room for 27.5% upside potential over the next 12 months. (See BEP Stock Forecast)

To find good ideas for trading stocks at attractive valuations, visit TipRanks Best Stocks to Buy, a recently launched tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.