(Bloomberg) —

Bloomberg’s Most Read

Saudi Arabia said it sees a recovery in oil demand in Asia and Europe as prices for most crude shipments to the regions rise.

While oil futures have weakened slightly this year, many traders and energy executives see them rising, perhaps as high as $100 a barrel, as China’s economy recovers after the lifting of coronavirus lockdowns and inflation. in other major economies it slows.

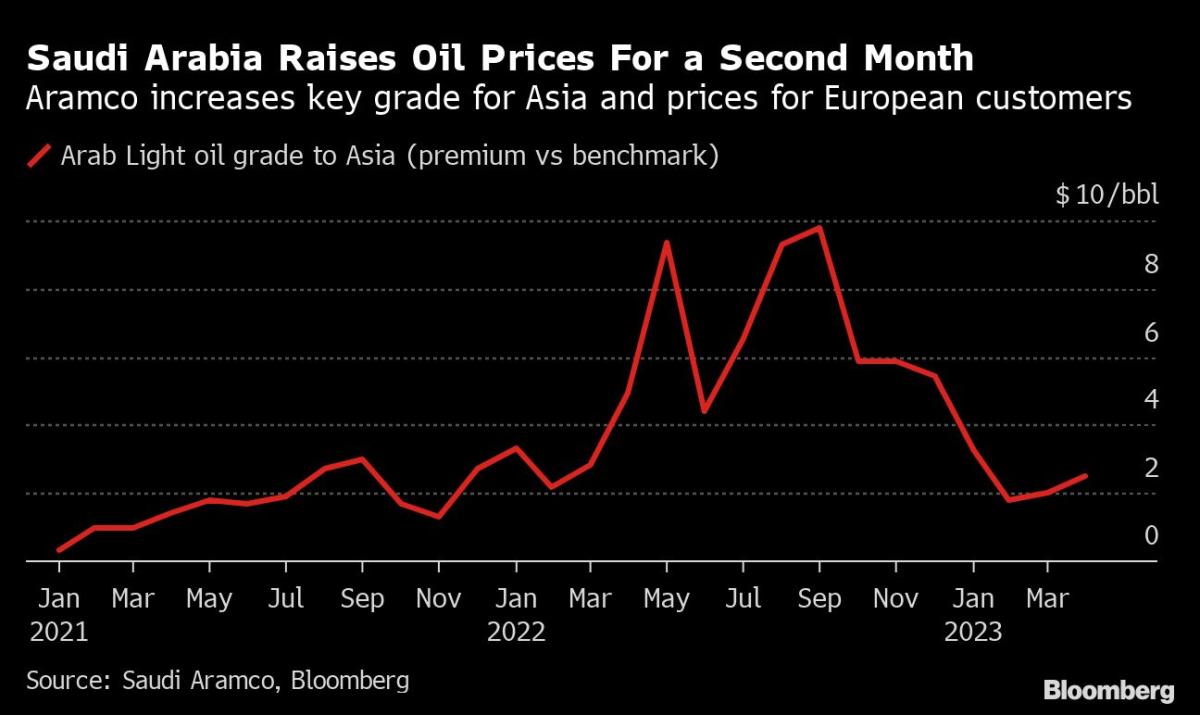

State-controlled Saudi Aramco raised most of its official selling prices for Asia in April. The company’s main light Arabic grade rose to $2.50 a barrel above the regional benchmark, 50 cents above the March level.

That was in line with a Bloomberg survey of refiners and traders, which forecast a 55-cent rise. It is the second month in a row that Aramco has raised prices for Asia, its largest market.

Prices for US customers remained unchanged. Those from northwest Europe and the Mediterranean rose to as much as $1.30 a barrel.

Brent crude has fallen 1% this year to just over $85 a barrel. It has fallen from around $115 since mid-2022, with a slowdown in the global economy and higher interest rates offsetting supply disruptions caused by the Russian invasion of Ukraine.

Aramco’s chief executive suggested last week that he sees a change.

“The demand from China is very strong,” Amin Nasser told Bloomberg in Riyadh on March 1. It’s also “great” in Europe and the US, he said.

Saudi Arabia is the world’s largest oil exporter and leads the OPEC+ producer group along with Russia. The 23-nation alliance has suggested it will not ramp up production until at least next year.

Aramco sells about 60% of its crude shipments to Asia, most of it under long-term contracts, the prices of which are revised every month. China, Japan, South Korea and India are the biggest buyers.

The company’s pricing decisions are often followed by other Gulf producers, such as Iraq and Kuwait.

Aramco prices for April ($ per barrel)

Asia (vs Oman/Dubai)

US (vs. ASCI)

North West Europe (off ICE Brent)

Mediterranean (opposite ICE Brent)

–With the assistance of Anthony Di Paola.

(Updates with futures prices).

Bloomberg Businessweek Most Read

©2023 Bloomberg L.P.