March has entered the scene and comes after two contrasting months. The year began with stocks racing to end the miserable action of 2022, pushing higher from the gates. However, February turned out to be a wake-up call for those anticipating an all-out bull market, as many stocks pared a large chunk of those gains.

What’s next? Morgan Stanley chief investment officer Mike Wilson says the initial 2023 rally was a “bull trap.” Wilson predicts more pain for investors, calling March a “high-risk month for the bear market to resume.”

That said, Wilson’s fellow analysts at the banking giant have identified an opportunity in certain stocks that they believe could offer protection against the bear’s growl. We ran two of their recent recommendations through the TipRanks database to see what other experts do with these options.

Coursera, Inc. (COURT)

We’ll start with Coursera, one of the largest online learning platforms in the world. The company connects people to college-level online courses, for degree credit, for professional development, and even for fun. The company has more than 118 million registered students taking courses with more than 300 industry and university partners, including names like Duke University, the University of Michigan, and Google.

The peak of the COVID pandemic in 2020 placed great importance on remote activities, for work, school and play, and although the pandemic has receded, the demand for those remote activities remains high. Coursera has capitalized on that fact to generate ever-increasing revenue.

In the last reported quarter, 4Q22, the company posted a top line of $142.18 million, for a 23% year-over-year gain. For the full year 2022, Coursera revenue grew 26% year-over-year to reach $523.8 million.

While the company’s top line is growing, and even topping fourth-quarter forecasts, investors have been cautious. Coursera typically posts a net quarterly loss, and the recent Q4 launch was no exception, though the loss did moderate. In the fourth quarter, the company reported a non-GAAP loss of $6.5 million, approximately 1/4 of the net loss of $24.1 million reported in the prior-year quarter. This most recent net loss translates to 4.6% of revenue.

The company also offered disappointing guidance. Coursera forecasts 1Q23 revenue in the range of $136 million to $140 million, compared to a forecast of $142.8 million; for all of 2023, guidance is $595 million to $605 million, versus a forecast of $618.5 million.

Morgan Stanley analyst Josh Baer acknowledges that this company forgot about the latest financial update, but points to several important factors that support an optimistic version of Coursera. He writes: “While we have a mixed view of the fourth quarter results overall, we continue to view Coursera as 1) one of the best-positioned platforms to enable digital transformation in the larger education industry, 2) a company that is approaching break-even for FCF, with steadily improving EBITDA margins on a path to >20% EBITDA in the long term, and 3) low investor sentiment and expectations, all together creating an attractive risk/risk ratio. reward”.

Taking this together, Baer considers it appropriate to rate COUR shares Overweight (ie Buy), with an $18 price target to indicate room for 55% upside growth next year. (To see Baer’s track record, click here)

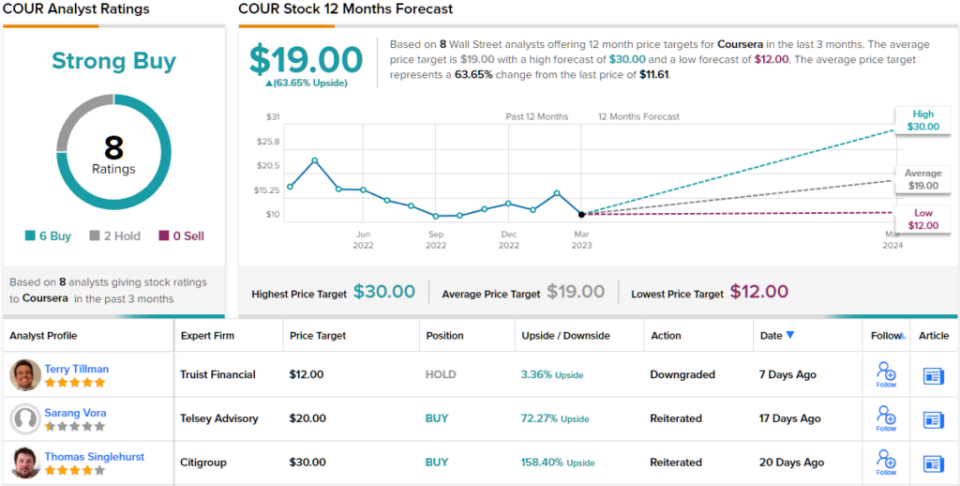

Morgan Stanley’s view is far from the only bullish view here. Coursera has 8 recent analyst reviews, with a 6 to 2 breakdown in favor of Buy over Hold for a Strong Buy consensus rating. The stock is trading at $11.61 and its $19 average price target suggests strong one-year upside potential of 64%. (See COUR stock forecast)

Neurocrine Biosciences, Inc. (NBIX)

The second Morgan Stanley pick we’ll look at is Neurocrine, a commercial- and clinical-stage biopharmaceutical company focused on creating new treatments for neurological, neuroendocrine, and neuropsychiatric diseases. The company has four approved drugs on the market, two as wholly owned products and two jointly with AbbVie, as well as an active pipeline of Phase 2 and Phase 3 clinical studies.

The company’s main approved product, and its main headline-maker, is ingrezza (valbenazine), a drug approved on the market for the treatment of adults with tardive dyskinesia, a movement disorder that causes uncontrollable movements of the face and tongue. and sometimes from other parts of the body. . The drug was approved in 2017 and has since become a major driver of Neurocrine’s product revenue. In the last reported quarter, 4Q22, the company showed a total of $404.6 million in product sales; of that total, $399 million came from the sales of ingrezza. For 2022 as a whole, ingrezza sales generated a total of $1.43 billion.

Having a solid money maker not only gives Neurocrine a ready income stream, but also makes the company show positive net earnings. The company’s non-GAAP diluted EPS for the fourth quarter was $1.24, up from just 4 cents in the year-ago quarter, though the figure fell below the forecast of $1.44. That being said, for all of 2022, non-GAAP diluted EPS came in at $3.47, compared to just $1.90 in 2021.

On the clinical side, Neurocrine has additional lines of research underway for valbenazine, as a treatment for multiple conditions, including chorea due to Huntington’s disease, dyskinetic cerebral palsy, and schizophrenia. The key catalyst expected from these relates to the trajectory of Huntington’s disease; the company submitted the new drug application to the FDA last December and has a PDUFA date of August 20, 2023.

In addition, adult and pediatric studies of crinecerfont, a treatment for congenital adrenal hyperplasia in adults and children, are in Phase 3. The company has announced that enrollment in both studies is complete and top-line data is expected in the second half of 2023.

Analyst Jeffrey Hung, in his comments on Neurocrine for Morgan Stanley, clearly explains why he believes the company is poised for continued success.

“We believe Neurocrine is well positioned for Ingrezza’s continued performance in 2023 with favorable upside potential from multiple data readings,” Hung explained. “We are encouraged by the company’s expectations of 300bp leverage in SG&A in 2023 and additional growth potential in future quarters of the long-term care environment. While expectations for Ingrezza’s continued strong sales remain high, we continue to see a favorable setup for NBIX stock with multiple data readings expected later this year.”

These comments support Hung’s Overweight (ie Buy) rating on NBIX stock, while his $130 price target implies a ~28% one-year gain waiting in the wings. (To view Hung’s history, click here)

Of the 19 recent analyst reviews for this stock, 12 are to Buy and 7 to Hold, for a Moderate Buy consensus rating. Shares are currently trading at $101.18, and the $125.83 average price target indicates room for 24% growth in the coming year. (See NBIX Stock Forecast)

To find good ideas for trading stocks at attractive valuations, visit TipRanks Best Stocks to Buy, a recently launched tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.