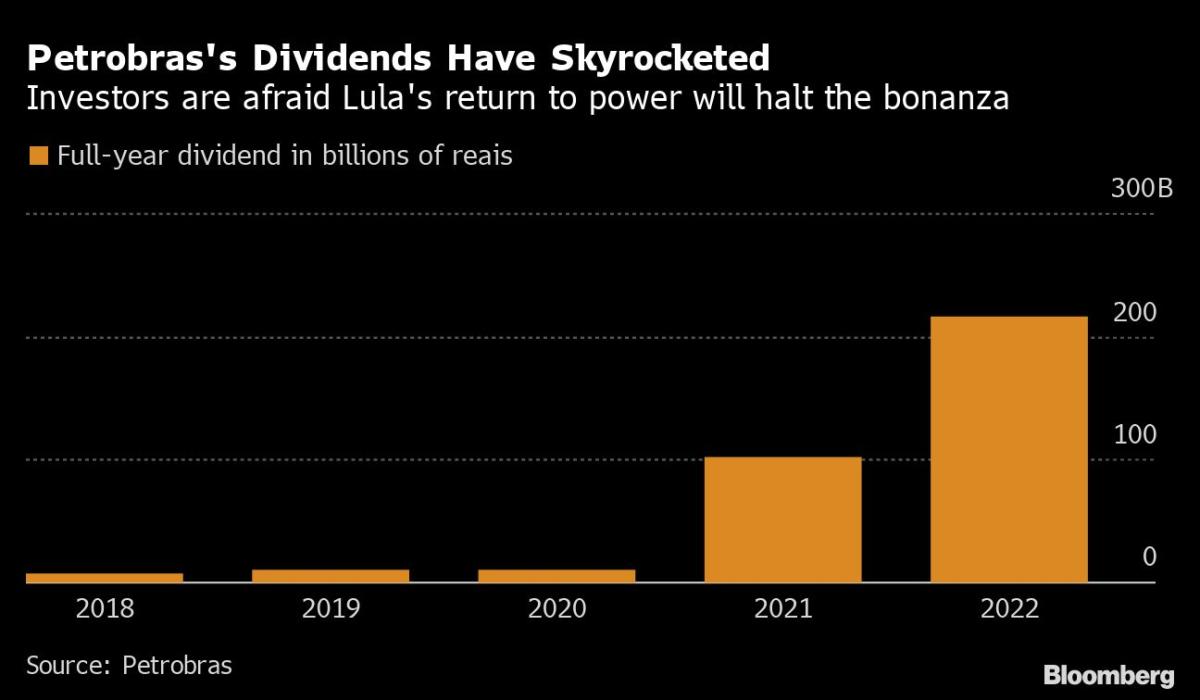

(Bloomberg) — Petroleo Brasileiro SA posted a record full-year dividend in 2022, rewarding investors who stuck with Brazil’s state-controlled oil producer despite concerns about political intervention by President Luiz Inacio Lula da Silva.

Bloomberg’s Most Read

The company’s board approved 35.8 billion reais ($6.9 billion) in fourth-quarter dividends, the Rio de Janeiro-based producer said in a statement. He also suggested setting aside 6.5 billion reais of dividends in a reserve, which would require shareholder approval and reduce the dividend payout to 29.3 billion reais.

Petrobras is the second largest dividend payer in the oil industry behind Saudi Aramco, according to data compiled by Bloomberg. Strong dividends have helped compensate investors for underperforming stocks over the past year.

Oil majors around the world are flush with cash after oil prices soared last year, putting them under scrutiny for windfall profits at a time when consumers are suffering from inflation. Petrobras was hit with a four-month oil export tax this week.

While the dividends are a relief to investors who have held on to the stock, they are expected to decline in the future. Jean Paul Prates, whom President Luiz Inacio Lula da Silva chose as Petrobras chief executive, has criticized the previous administration for paying record dividends without investing in renewable energy and refinery expansions.

The dividends are the result of a major change at Petrobras in the last six years. It trimmed what was once the largest debt of any oil company, boosted production and reduced expenses, leaving Prates with what analysts consider a well-run company with a strong balance sheet.

Analysts and investors are concerned that under Prates, Petrobras will start subsidizing fuel to help the government control inflation and invest in underperforming businesses such as refining. Its asset sales have been suspended for 90 days and it has been under pressure to cap fuel prices.

Petrobras’ fourth-quarter net income of 43.3 billion reais was higher than the same period last year and the previous quarter due to easing oil prices.

(Updates to include details on earnings at all times)

Bloomberg Businessweek Most Read

©2023 Bloomberg L.P.