Energy stocks outperformed last year, with the sector overall gaining 59% in a year when the S&P 500 fell 19%. That’s serious performance, the kind that will always delight investors, and it has traders and analysts closely watching the energy sector in this first quarter of 2023.

So far, the energy sector is holding back from the action. Inflation seems to be cooling off and the Federal Reserve has indicated that it may take a slower pace for future interest rate hikes, both developments that have benefited growth stocks over cyclical stocks like energy.

However, going forward, we are likely to see an increase in the price of oil at the end of 1H23. China is reopening its economy, boosting demand, while Russia’s exports, which plunged when that country invaded Ukraine last year, are back to near pre-war levels. Seasonal increases in demand in the US, during the Northern Hemisphere spring and summer, will also support prices, and this will likely be reflected in share prices.

Against this backdrop, Wall Street analysts are scrutinizing the energy sector, looking for stocks that are poised for gains of 40% or more. Potential gains of that magnitude are worth a second look, and we’ve pulled the details on two of those names.

TXO Power Partners (TXO)

The first energy stock we’ll look at is new to the public markets, having made its IPO earlier this year. TXO Energy Partners operates as a limited master partnership, with operations in the Texas-New Mexico Permian Basin and the New Mexico-Colorado San Juan Basin. The company focuses on the profitable exploitation of conventional oil and gas sites in its core areas of operations.

TXO Energy Partners has a diverse portfolio of conventional assets spanning different types of hydrocarbon production methods. These include coalbed methane production, which is primarily in the San Juan Basin, as well as flood-based CO2 and water production, which is primarily in the Permian Basin. As of July 1, 2022, the company’s total proven reserves were 143.05 million barrels of oil equivalent, with 38% of the reserves being oil and 82% under development.

The shares opened for trading on January 27. The initial public offering saw the sale of 5 million common units, and when it closed on February 6, the company announced that the underwriters had exercised their option to purchase an additional 750,000 common shares. Overall, the IPO raised $115 million in total gross proceeds. The stock is currently priced at $23.74, which is an 8% increase from the first day’s closing value.

Covering these recently public actions for Raymond James, 5-star analyst John Freeman sees his non-fracking profile as a potential net asset.

“Base rate of decline of TXO [is] a true differentiator compared to its peers,” Freeman opined. “TXO has a peer-leading ~9% annual base decline rate, a product of its conventional asset base. This allows for minimal capital investment (relative to peers) to maintain and increase production levels (no external financing needed to finance capex, contrary to E&P historical MLPs), resulting in a Higher free cash flow profile compared to unconventional peers.

The analyst is also a big fan of the management team, noting, “The entire TXO management team held senior positions at XTO Energy before leading TXO. In fact, from the initial public offering to the sale of XOM, XTO achieved an annualized return of ~26%, outperforming the S&P by approximately 8 times over that time period.From a technical standpoint, TXO’s management team has operated in over 15 US shale basins with several decades of experience.

In line with this bullish stance, Freeman describes TXO stock as a strong buy. His price target, set at $34, suggests he has ~43% one-year upside potential. (To view Freeman’s history, click here)

Turning now to the rest of the street, other analysts are on the same page. With 100% Street support, or 3 Buy ratings to be exact, the consensus is unanimous: TXO is a strong Buy. The $33.33 average price target brings the upside potential to 40%. (See TXO Stock Forecast)

Offshore Diamond Drilling (DO)

The second energy stock we’ll look at is another oil and gas drilling company, this one focused on the difficult realm of offshore hydrocarbon drilling. Diamond Offshore operates a fleet of deepwater rigs, including semi-submersibles and dynamically positioned drillships. The company’s ultra-deep water platform ocean courage was recently awarded a $429 million, four-year project contract with Petrobras of Brazil.

Diamond Offshore suffered greatly during the corona pandemic period and entered bankruptcy proceedings in April 2020, under Chapter 11. The company completed its financial restructuring to emerge from Chapter 11 bankruptcy in April 2021, and the DO ticker resumed public listing in March 2022.

We’ll see Diamond’s 4Q22 and full-year results tomorrow, but we can look back at its 3Q22 report to get an idea of where the company stands. For the third quarter, Diamond reported its second consecutive quarter of sequential revenue increases, with a top line of $226 million. This marked a 10% gain over the second quarter, while beating consensus estimates of $181.39 million. In summary, Diamond went from a second-quarter loss of $21.9 million, or 22 cents per share, to net income of $5.5 million, or 5 cents per share diluted in earnings. This was a big blow, as analysts had expected a loss of 31 cents per share.

It was a solid turnaround for the company and was supported by strong performance from the company’s operating platforms. Diamond’s fleet of deepwater drilling rigs showed revenue efficiency of 97.3% overall, and the black hawk of the ocean The rig earned a performance bonus when it completed its first well in Senegal. In addition, the drill ship Candle started a major contract in the Gulf of Mexico, and this year may see options for up to seven additional wells.

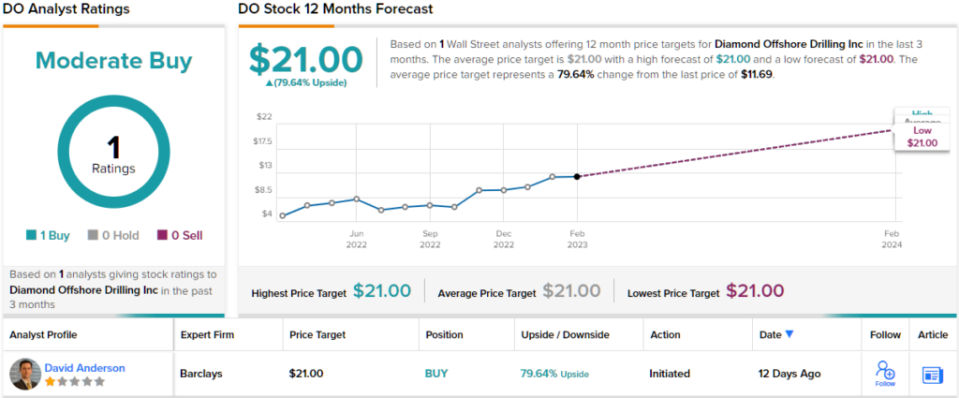

Analyst David Anderson of British banking giant Barclays has taken over Diamond’s coverage and believes the company is in a strong position to generate future earnings.

“After a transition year in 2022 following its exit from bankruptcy in April 2021, we expect DO to deliver significant EBITDA growth from 2023 to 2025 after breaking even in 2022. This year will be only the first step, moving higher in 2024 and 2025 driven primarily by five rigs expiring in 2024…presenting a good opportunity for price change,” Anderson wrote.

This generally bullish stance leads Anderson to rate the stock an Overweight (ie Buy), with a $21 price target implying a solid 79% upside potential over the one-year time horizon. (To see Anderson’s history, click here)

Some actions go unnoticed, and Diamond is one of them. Anderson’s is the only recent analyst review of this company, and it’s decidedly positive. (See Diamond Stock Forecast)

To find good stock trading ideas at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the noted analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.