Say ‘electric vehicle’ these days, and Elon Musk is probably the first association that comes to mind. It’s a headline-making machine, after all, but his company Tesla has shown that the EV market can be profitable for automakers and investors alike.

But cars aren’t the only game in town for investors looking to buy into the EV space, and worthwhile stocks don’t need to be Tesla-level priced. Electric vehicles bring with them a range of supporting technologies and infrastructure, from battery manufacturers to charging companies, and savvy investors can find affordable opportunities in that support network.

Today, we will analyze the cargo companies. While they may not exude the same appeal as automakers, those cars won’t get very far without the charging infrastructure their supporting companies will make available. In fact, the EV charging infrastructure market is expected to reach more than $207.5 billion by 2030.

We can test the opportunity here by looking at some of those pure play load actions. Using the TipRanks platform, we have identified two of those names; each has a ‘Strong Buy’ rating from the analyst community and offers great upside potential. We’re talking more than 50% here.

global beam (BEEM)

The first stock we’ll look at is Beam Global, a company working on clean energy products for electric vehicle charging. Beam has charging products in operation in 13 US states, in 96 cities. Chief among these products is the EV ARC, the first off-grid, permit-free, and rapidly deployable EV charging system.

The system is designed for off-grid use, drawing power from its built-in solar panels, and sized to fit in or around standard parking spaces – any parking lot can become an electric vehicle charging point. No major construction work is needed for the deployment, so no zoning or local permits are required either.

Last November, the company reported a quarterly record of $6.6 million in total revenue for the third quarter of fiscal 2022, for a year-over-year increase of 227%. These gains were buoyed by a series of recent victories the company has won in winning new contracts, including a $29.4 million order from the US Army; an $11.6 million order from the Department of Veterans Affairs; and a $5.3 million request from the City of New York.

In the weeks since the third quarter launch, Beam has announced additional positive news, including, in January, contract order extensions with the state of California and the federal government totaling more than $6.6 million. On a smaller scale, also in January, Beam received an order from Dallas County, Texas for $500,000 for 6 off-grid EV ARC systems.

A common factor in these new orders is the company’s ability to quickly deploy the product and get it into action with a minimum of fuss. That’s the main takeaway investors need to understand about Beam, according to Northland analyst Abhishek Sinha.

“Rapid deployment ability and scalability, lowest total cost of ownership, invulnerability to blackouts, being independent from an EV charging company, having a proprietary solar storage and tracking solution make BEEM products differentiate a lot from what the market has to offer. BEEM’s products are arguably much more expensive ($60K/unit) compared to a normal Tier 2 charger ($2-4K/unit). However, after taking into account the cost of construction work (excavation, trenching, electrical installation) and electricity costs, BEEM products are less expensive. In all cases where BEEM has deployed its units so far, the cost of their unit was less than the avoided cost of the construction work that would have been required to deploy the chargers where they were deployed,” Sinha explained.

In summary, Sinha wrote: “Given the recent defeat in the EV charging space, we believe BEEM offers a differentiated proposition and an attractive entry point.”

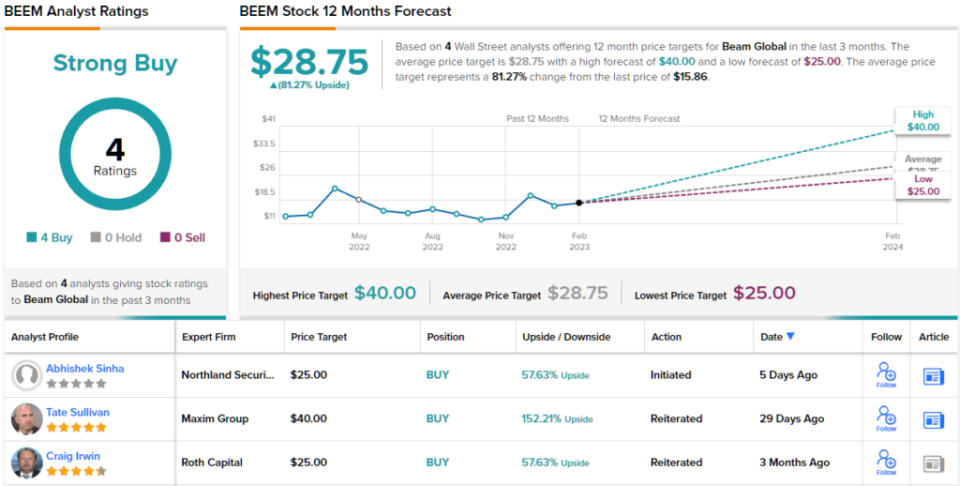

To this end, Sinha gives BEEM shares a $25 price target, suggesting a solid 58% upside potential over the next 12 months. His bullish target supports his Outperform (ie Buy) rating. (To see Sinha’s track record, click here)

So, that’s Northland’s point of view, what does the rest of the Street think of BEEM’s prospects? Everyone is on board, as it happens. The stock has a Strong Buy consensus rating, based on 4 unanimous recent buys. Additionally, the $28.75 average target suggests the stock has room for ~81% growth in the coming year.

(See BEEM Stock Forecast)

NV embedding box (WBX)

The next company we’ll look at, Spain-based Wallbox, has created a suite of smart and adaptable EV charging solutions. The company’s product line includes a range of chargers to support a wide variety of customer needs: commercial and residential vehicle charger connections, Type 1 and Type 2. Residential charger installation models even have the added feature of bi-directional operability, allowing customers to offload power from a fully charged EV at home, or even on the power grid.

Wallbox posted record revenue in its last reported quarter. In that report, for 3Q22, the company posted a top line of €44.1 million (US$47.3 million), representing an increase of 140% year-over-year. The company’s earnings were supported by several factors, including the sale of some 67,000 chargers, a total that was up 93% year-on-year.

In addition, Wallbox saw a greater presence in the US market. The company commissioned production lines at its new facility in Arlington, Texas during the third quarter, and experienced revenue growth in the North America segment that reached a whopping 535% in the quarter. Finally, Wallbox registered the first orders for its new 400 kilowatt DC Hypernova fast charging station, and a product specifically designed to meet current US government subsidy requirements.

It is interesting to note that the massive growth in EV charging, exemplified by Wallbox’s results in North America, presents an opportunity for M&A activity in this sector. EV charger companies large and small will be looking to scale up and expand product portfolios to meet insatiable consumer demand, and M&A, if money is available, is a fast track to that end. Shell’s recent acquisition of Volta, for $169 million in cash, is a case in point, making Volta’s network of advertising-supported charging stations on the site available for Shell to expand.

In fact, Canaccord analyst George Gianarikas sees the desire of larger companies to expand by exploiting smaller companies, through lucrative contract deals or M&As, as a net benefit to Wallbox, and predicts that the company will be based on its relationship with BP.

“We view the strategic focus on EV charging as a positive for Wallbox as the company continues to be a core asset given its best-in-class and differentiated product set… Plus US NEVI opportunities , we think this BP contract continues to be a strong tailwind. for Wallbox for the next few years”, said Gianarikas.

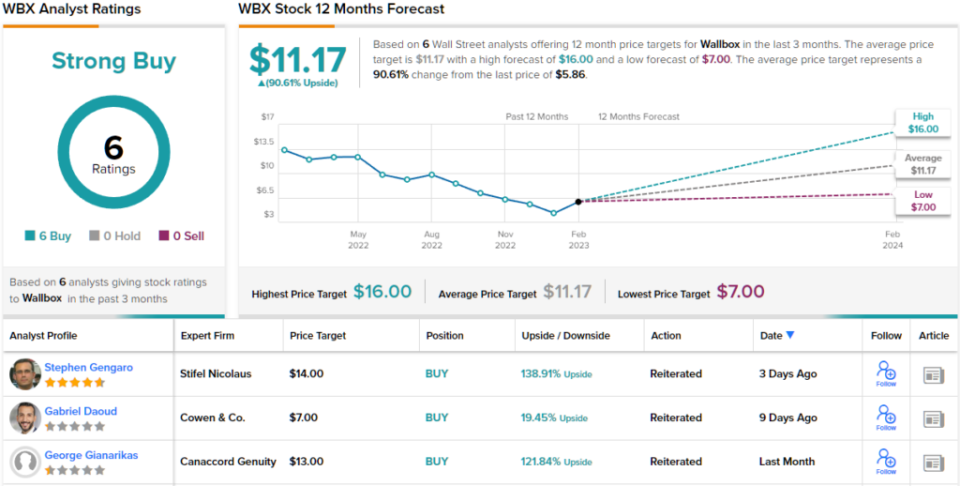

These comments provide solid support for Gianarikas’ Buy rating on WBX shares, and his $13 price target implies a 122% one-year upside potential. (To see Gianarikas’ track record, click here)

Do other analysts agree? They are. Only Buy ratings, 6 to be exact, have been issued in the last three months. So the message is clear: WBX is a Strong Buy. The stock is priced at $5.86 and its $11.17 average price target indicates room for ~91% growth going forward. (See WBX Stock Forecast)

To find good stock trading ideas at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the noted analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.