Our digital world is powered by information technology, and that technology will only become more autonomous and more ubiquitous. And that, in turn, only underscores the continuing importance of online security. With the growth of digital automation, it’s more important than ever right now to start reaffirming digital protections.

In this context, Gabriela Borges from Goldman Sachs has set her sights on the cybersecurity sector. The analyst sees several industry dynamics that are favorable to long-term investors, including: “(1) Multi-product platforms have gained momentum and are closer to solving the challenge of staying innovative in sub-segments historically defined by cycles of boom and bust products. (2) The industry is less cyclical as the mix moves away from hardware and toward SaaS, and given the constant prioritization of security spending in enterprise budgets.”

Borges does not leave us with a macro view of the industry. The analyst moves on to dig down to the micro level and selects two cybersecurity stocks that she sees as likely long-term winners.

In fact, Borges is not the only one who sings praises to these actions. According to the TipRanks platform, each boasts a “Strong Buy” consensus rating from the broader analyst community and offers double-digit upside potential for the coming year. Let’s take a closer look.

CrowdStrike Holdings (CRWD)

The first Goldman pick we’ll look at is CrowdStrike, the producer of the high-end Falcon Endpoint Protection line and a leader in the cybersecurity ecosystem. CrowdStrike’s products have set an industry standard for online network protection and digital security, and include a range of cloud-based modules for a wide variety of applications. The company makes the products available by subscription through the Software-as-a-Service model.

The company reported some strong metrics in its latest quarterly report, for the third quarter of fiscal 2023. Revenue increased 53% year-over-year to $581 million, and annual recurring revenue, at $2.34 billion, increased 54%. In summary, CrowdStrike reported fiscal third-quarter earnings of 40 cents per share, based on non-GAAP measures, beating the consensus estimate of 32 cents per share.

However, the company provided revenue guidance that missed estimates. Specifically, fourth-quarter revenue is expected to be in the range of $619.1 million to $628.2 million, below Street’s estimates of $634.2 million.

While acknowledging that current market conditions act as a drag on the stock, Goldman Sachs’ Gabriela Borges believes it is well positioned for strong growth.

“We expect to see a moderation in the growth rate…driven primarily by slower growth in the TAM endpoint and a slower pace of market share gain, and we think the market understands this well. In the medium term, 1) we expect to see steady growth in handsets (80%+ ARR), based on our bottom-up market share model which suggests next-generation handset technologies have close to 50% share of the present; 2) We expect to see outsized growth in the cloud, where our industry conversations suggest CrowdStrike is competitive given its core competencies in data collection and monitoring,” Borges opined.

“Taken together with strong FCF generation today and a reset to numbers in 3Q23 (2023 Street revenue has been revised down 3% over the last 3 months), we think the risk/reward ratio is attractive.” “, summarized the analyst.

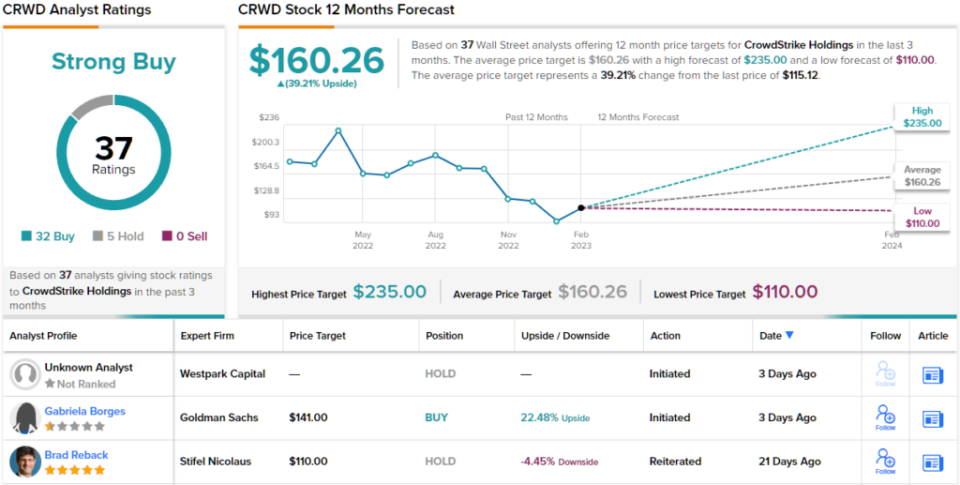

In general, Borges believes that this is a stock worth keeping. The analyst rates CRWD’s stock a Buy, and his $141 price target suggests 22% upside over the next 12 months. (To see Borges’ trajectory, click here)

In all, CrowdStrike has 37 recent analyst reviews on file, including 32 Buys and just 5 Holds, for a Strong Buy consensus rating. Shares are selling for $115.12 and the average price target, now at $160.26, implies a 39% one-year gain. (See CRWD stock forecast)

Palo Alto Networks (PANW)

The next stock on Goldman’s radar is Palo Alto Networks, another big name in digital security. This company’s combination of cutting-edge cyber technology and firewall products offers customers a high level of protection for online systems, including protection against malware attacks, and also enables the automation of online security operations and network. Palo Alto also makes its enterprise-grade security software available to home and small business users looking to protect their network and cloud applications.

Over the past several years, Palo Alto has built an ever-increasing revenue stream based on its product line and industry-leading reputation. In the last reported quarter, for fiscal 1Q23, the company reported $1.56 billion in the top line, based on $175 billion in total billing. These figures represented year-over-year increases of 25% and 27% respectively. The company’s order book, a key indicator of future work and revenue, stood at $8.3 billion as of October 31 of last year.

In the bottom line, Palo Alto posted an adjusted 83 cents a share, beating estimates of 69 cents a share. The company ended its fiscal first quarter with free cash flow of $1.2 billion and nearly $2.1 billion in cash on hand. We’ll see next week, when Palo Alto reports fiscal second-quarter earnings, how its performance holds up.

Meanwhile, Goldman’s Borges sees a clear path for the company, presenting it in straightforward prose: “We see Palo Alto as a portfolio of cloud, endpoint and network products at different stages of product maturity, each leveraging the centralized domain experience. in user interface/user experience (UIUX), marketing, security intelligence, and machine learning. Coupled with a successful M&A strategy, we expect to see sustained growth of ~20% over the next 5 years with top quartile software KPIs, a path to GAAP profitability this year, and active capital allocation.”

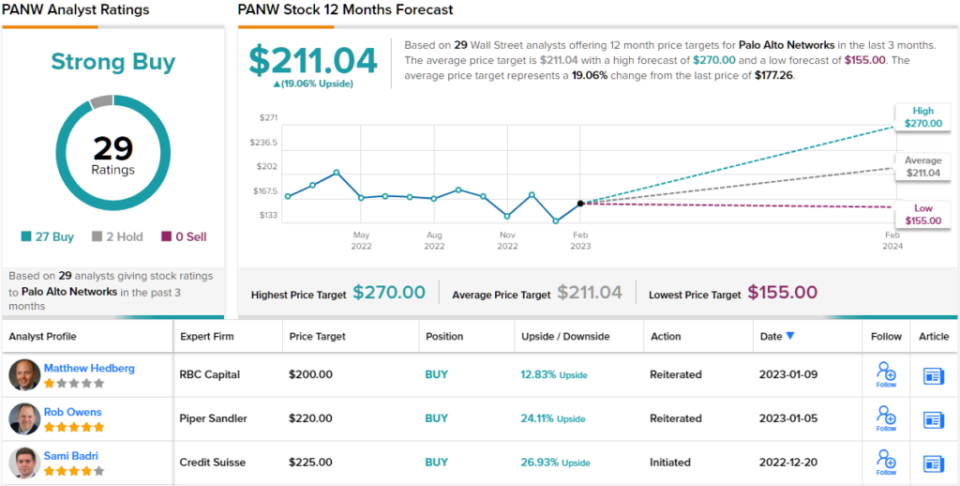

From here, Borges gives PANW shares a Buy rating, with a $205 one-year price target suggesting a potential upside of 19%.

The consensus Strong Buy rating on this stock shows that Street is clearly in line with Goldman’s bullish view; Of the 29 recent analyst reviews, 27 are Buy and only 2 Hold. PANW shares have an average price target of $211.04, up 19% from the trading price of $172.02. (See PANW Stock Forecast)

To find good stock trading ideas at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the noted analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.