Markets move in cycles, some big, some small. 2021 saw a strong uptrend, the strongest in decades; it was followed by a strong downtrend, the strongest in decades, in 2022. This year opened with a rebound that lasted through most of January. And in February, there was a pause. A brief pause, probably, before the next stage begins, at least according to Oppenheimer’s chief technical strategist, Ari Wald.

Wald notes that the S&P 500 has reversed last year’s downward streak and that despite the volatility so far this month, that reversal remains intact above 3,950. In fact, the S&P 500 Index now stands at 4,137 and is heading higher again.

“While we expect the bull market to continue,” Wald says, “we reiterate that it won’t be a straight line bull either. Still, the point is that investors should think in terms of buying weakness rather than selling strength, in our view. With the top-down headwinds easing, we also recommend placing more emphasis on identifying emerging relative strength and less emphasis on market timing. With this in mind, we argue that the financial sector is positioned to lead the next stage of progress.”

Elaborating, Wald adds: “Capital Markets is our top industry insight for financial sector exposure based on its long-term trend of higher relative lows since 2012. The industry is supported by a broader internal breadth and it is also closer to a relative breakout, per our analysis.”

Against this background, we’ve used the TipRanks database to get details on two stocks, from the capital markets industry, that Oppenheimer has selected as Top Ideas for 2023. Are these the right stocks for your portfolio? Let’s take a closer look.

KKR & Co Inc. (KKR)

The first Oppenheimer pick we’re looking at is KKR, a global investment and asset management firm, serving a global clientele. KKR follows a model that connects third-party capital with the capital markets business, providing the resources to do everything from taking companies through the listing process to signing new market deals and investing in debt and capital. The company mobilizes long-term capital for these purposes, generating strong returns over time for investors and fund shareholders.

As of the end of 4Q22, the company had more than $504 billion in total assets under management, up from $470.6 billion a year earlier. The asset management portfolio generated more than $693 million in revenue, with another $1.835 billion coming from the insurance services segment, for total GAAP revenue of $2.53 billion for the quarter. This was down from $4.05 billion in the same quarter last year, but exceeded Wall Street expectations of $1.41 billion. The company remains solidly profitable, as adj. EPS hit $0.92, beating Street’s call of $0.85.

Overall, KKR ended 2022 with strong capital metrics. The company had $108 billion in uncalled commitments, representing available capital for implementation, and while last year was a tough economic environment, KKR raised $16 billion in capital during 2022.

In his coverage of this stock for Oppenheimer, 5-star analyst Chris Kotowski continues to take a bullish stance on KKR’s prospects despite the challenges ahead. He writes: “We are not out of the woods yet, as challenges remain from the backdrop of 2022; however, we find continued confidence in the KKR engine given its resilience on all fronts (fundraising, deployment, performance) and continued flexible growth bolstered by balance sheet, both organic and strategic… We continue to believe that KKR It’s a very compelling investment.”

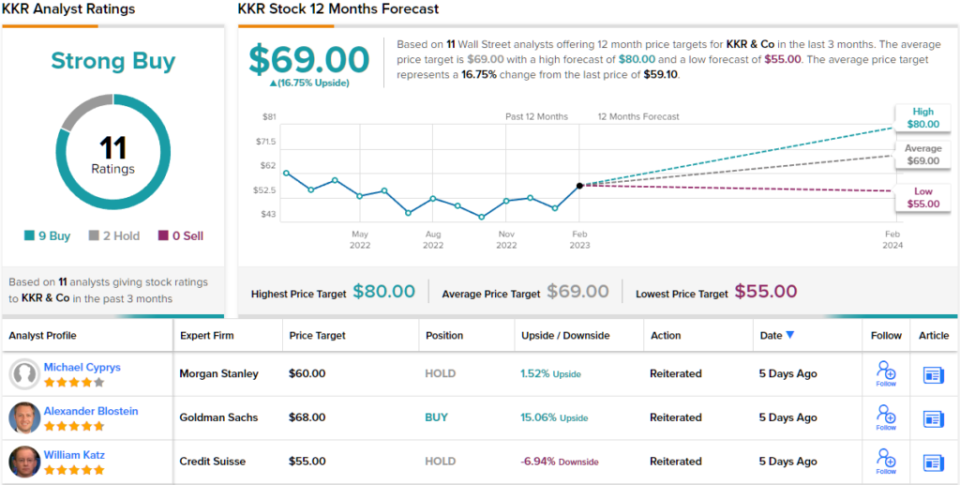

Kotowski goes on to reiterate his Outperform (ie Buy) rating on KKR stock, and his $80 price target implies a 35% one-year gain waiting in the wings. (To see Kotowski’s history, click here)

Overall, KKR shares have a Strong Buy rating from the analyst consensus, showing that Wall Street agrees with Kotowski’s assessment. The qualification is based on 9 purchases and 2 holds established in the last 3 months. (See KKR Stock Forecast)

Goldman Sachs Group (GS)

The next stock we’re looking at is one of the biggest names in banking, the Goldman Sachs Group. GS is an international banking holding company, one of the companies listed on the Dow Jones Industrial Average and a renowned player in trading and investment, asset management and securities services. Goldman primarily serves other institutions such as banks, corporations and governments, but is known to accept a small number of very high net worth individual clients.

In last month’s financial statement for the fourth quarter and full year of 2022, the bank reported year-over-year declines in both revenue and profit. Starting at the top line, Goldman had $10.59 billion in revenue, down 16% from the prior-year quarter. In summary, earnings plunged 66% from a year earlier to $1.33 billion, or $3.32 per share. Both figures fell short of Street’s expectations.

Common stockholders, however, haven’t done too badly. Goldman maintained an ROE of 10.2% for all of 2022 and 4.4% for the fourth quarter; these figures can be compared with the 11% and 4.8% of the previous year. Overall, in a year plagued by high inflation and rising interest rates, GS shares delivered a solid return for investors.

Oppenheimer’s Chris Kotowski sees stock returns as a key point here, writing: “Even if a sluggish investment banking environment persists, we would expect GS to maintain a double-digit ROTCE and think stocks are oversold.” in just 1.2x tangible book… Goldman’s relatively new senior management team has embarked on a series of initiatives to increase ROTE, which has averaged about 11% in recent years, to at least 15%. that this effort has a high chance of success because the company has a strong franchise and there are multiple revenue, cost, and capital optimization strategies that can be implemented, but the market is still pricing the stock as if returns were flat indefinitely . .”

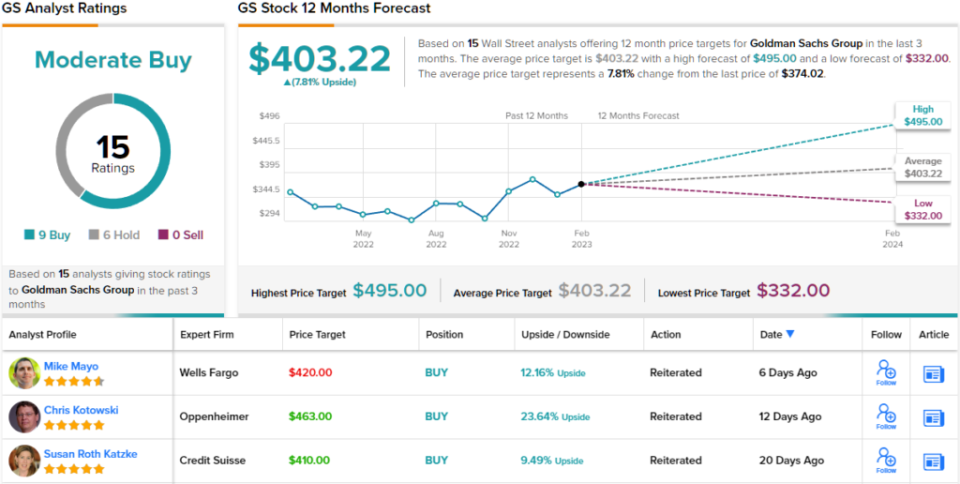

Looking ahead, Kotowski sets an Outperform (ie Buy) rating on GS stock, along with a $441 price target that suggests ~24% one-year upside potential.

So we have a 5-star analyst going bullish on this one, but what do the rest of the Street think of the GS outlook? The stock has collected 15 recent analyst reviews, and they include 9 Buys and 6 Holds, for a Moderate Buy consensus view. (See Goldman Sachs Stock Forecast)

To find good stock trading ideas at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the noted analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.