Few companies are as proven and enduring as the food and beverage giant. PepsiCo (NASDAQ:PEP)The company has been performing well for decades, showering investors with dividends and generating wealth for generations. The stock has been steadily losing value in recent weeks and is approaching 52-week lows.

Years of inflation have left consumers facing higher food prices, and confidence is falling. Investors have already seen companies like McDonald’s cite lower consumer spending as a barrier to their business.

So should investors stay away or is now the time to buy shares?

Here are four reasons why long-term investors should buy stocks like there’s no tomorrow.

1. Best in class brands

PepsiCo’s world-class food and beverage brands have been its pillar of strength, creating decades of growth and wealth for its shareholders. The stock price has appreciated more than 10,000% over its lifetime, and the dividend has grown more than 5,300%. PepsiCo’s brands include top-tier beverages such as Pepsi, Mountain Dew, Gatorade and Lipton, while its food products include names like Doritos, Cheetos, Lay’s, Quaker and many more.

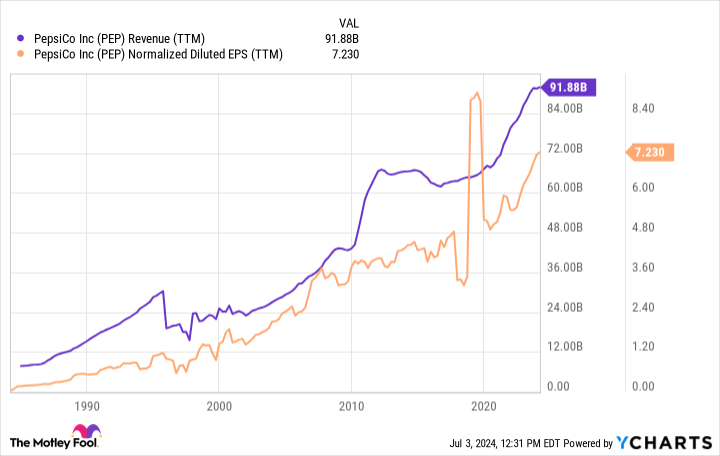

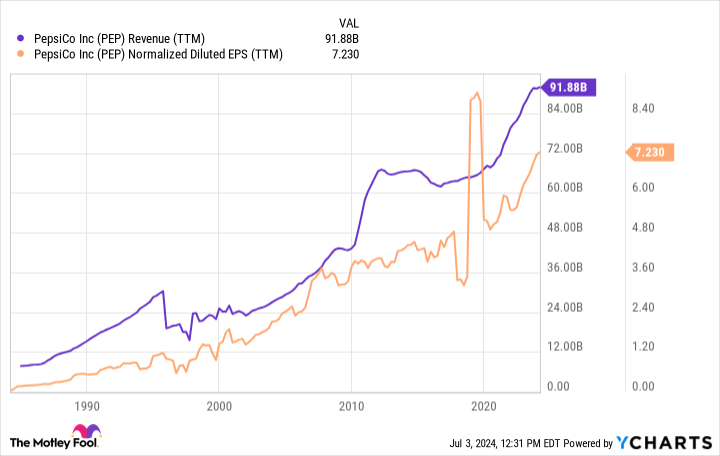

Dominating the supermarket aisles means that PepsiCo products get prime shelf space and pricing power because consumers generally buy what they know and love. In addition, food and beverage products are small value itemsPepsiCo can get away with raising prices by a few cents because it doesn’t drastically affect consumers’ budgets. Decades of population growth and price increases have steadily boosted revenues to more than $91 billion annually.

2. It remains an excellent dividend generator

PepsiCo is a dividend booster because it offers yield and Growth. Investors who buy today will get a solid 3.3% initial yield. On top of that, PepsiCo has raised its dividend by an average of 6.6% over the past five years. Its most recent increase of 7.1% shows that management is confident in the company’s prospects. Remember, PepsiCo has raised its dividend for 52 consecutive years (a Dividend King), so maintaining inflation-beating dividend growth after all this time is impressive.

It is worth noting that the dividend is well secured by a payout ratio that is 66% of PepsiCo’s estimated earnings for 2024. Earnings are high enough that PepsiCo can comfortably pay the dividend and still invest in the business or buy back shares. This consistent growth that outpaces inflation is why the stock has performed so well for so long.

3. Solid growth prospects

The most important question for investors is whether PepsiCo can continue to grow at this rate. After all, the company, which sells snacks and bottled drinks, is now a $225 billion giant. Fortunately, PepsiCo’s growth formula still seems to have some teeth.

The beauty of PepsiCo is its multiple growth levers. It is moving forward steadily while raising prices, selling more products to a growing global population, and acquiring and launching new product brands. Some of PepsiCo’s recent successes include newer beverage brands like Bubly and Starry. It has also invested in the energy drink industry by acquiring Rockstar in 2020 and signing a major partnership with Celsius in 2022.

Management currently expects organic revenue growth of 4% year-over-year in 2024 and earnings per share growth of 7% in 2023. Analysts looking further ahead expect more of the same. Consensus estimates call for earnings growth averaging more than 7% annually over three to five years.

4. A stellar business at a fair price

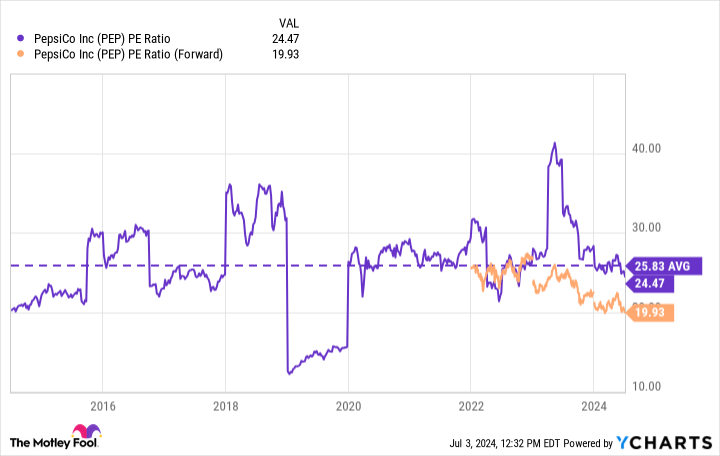

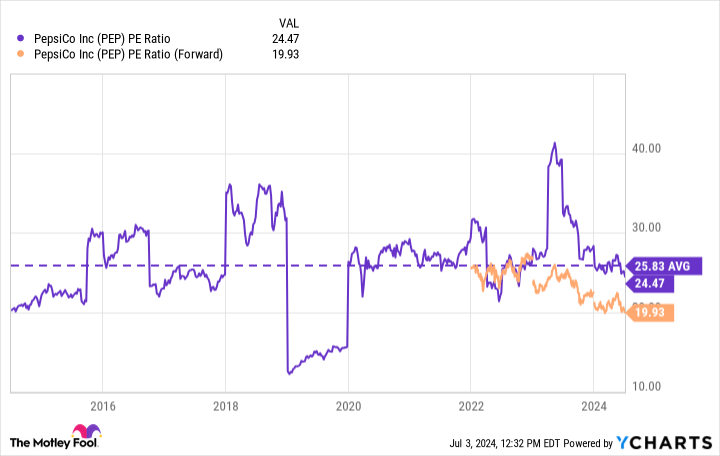

The market sometimes does dumb things. Lower consumer spending could put some pressure on PepsiCo’s prices, and the stock market appears to be incorporating that into share prices. The stock is down more than 17% from its peak. PepsiCo has had a price-to-earnings ratio of nearly 26 on average over the past decade, and the stock has now fallen below 20 times this year’s estimated earnings:

Is it worth trading at a discount? While PepsiCo may be feeling some pressure while consumers are struggling, it’s hard to argue that the business is fundamentally worse off, especially when the outlook remains consistent with the company’s past performance. Want to discount the stock? That’s already happened. Barring an unexpected collapse in the business, PepsiCo stock looks like a fantastic business that’s trading at a fair price today.

To apply Buffett’s advice, investors should not hesitate to buy a wonderful company like PepsiCo at a fair price.

Should you invest $1,000 in PepsiCo right now?

Before you buy PepsiCo stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and PepsiCo wasn’t among them. The 10 stocks that made the cut could produce monster returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $771,034!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of July 2, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in Celsius and recommends this company. The Motley Fool has a disclosure policy.

4 Reasons to Buy PepsiCo Stock Like There’s No Tomorrow was originally published by The Motley Fool