Nvidia (NASDAQ: NVDA) has been one of the best-performing stocks over the past five years, up an astonishing 2,430%. Given those gains, the question many investors are now asking is whether it’s too late for new investors to buy in and reap above-average returns.

Let’s look at four reasons why Nvidia stock is still worth buying like there’s no tomorrow.

1. AI infrastructure development is still in its early stages

Nvidia has been a big beneficiary of the growing interest in artificial intelligence (AI), as its graphics processing units (GPUs) are the backbone of the computing server infrastructure used to train large language models (LLMs) and run AI inferences. So far, demand for its GPUs and other chips has been insatiable, as cloud computing companies and other tech giants have ramped up their AI-related spending, trying to stay ahead of the demand curve.

Concerns are beginning to emerge that companies may be overbuilding the capacity they need, but most show no signs of slowing their spending. In fact, management at both companies is Target platforms and Alphabet He says the biggest risk associated with corporate spending on AI is under-investing and missing out on the huge potential opportunity.

For its part, Meta has said that training its new Llama 4 LLM will likely require nearly 10 times the processing power of Llama 3. To handle that workload, it would need 160,000 GPUs compared to Llama 3’s 16,000. Meanwhile, xAI’s new Grok 3 LLM is projected to require 100,000 GPUs, up from the 20,000 used by Grok 2.

The exponential need for more computing power and GPUs as LLMs advance shows a very long potential growth runway for Nvidia.

2. Nvidia’s software unit gives it a broad competitive advantage

Nvidia is not the only company producing GPUs. Advanced Microdevices (NASDAQ: AMD) operates in this space and other companies are trying to get in on the act, hoping to tap into the giant market that Nvidia currently controls.

It gained that control because the company’s chips long ago became the industry standard thanks in large part to its CUDA software platform. The software platform was created by Nvidia in 2006 as a way for developers to directly program Nvidia GPUs. The company gave away the software program for free in order to sell more chips. As a result, CUDA became the primary software program in which developers learned to program GPUs.

This reliance on CUDA helped create a wide advantage for the company’s GPUs. While AMD has since developed its own software platform, ROCm, it is not widely considered to be as good as CUDA. Additionally, the time and cost of retraining people on ROCm or other software platforms is high.

CUDA helps Nvidia control the entire GPU stack, from hardware to software to necessary firmware updates. Meanwhile, all of its technology is backward compatible, creating a seamless transition for customers to build out their AI infrastructure and not have to worry about expensive hardware they purchased a few years ago becoming obsolete.

Nvidia’s competitive advantage helped it capture more than 80% of the market share in the GPU market. In the second quarter, its data center GPU business saw revenue soar 154% year-over-year to $26.2 billion. In comparison, AMD’s data center business grew revenue 115% to $2.8 billion.

3. Nvidia has accelerated its innovation cycle

In addition to the broad lead Nvidia has built with its CUDA software platform, the company has also accelerated its innovation cycle. It now plans to introduce updated GPU architecture platforms nearly every year, up from the previous two years. The company is currently seeing strong demand for its Hopper GPU architecture platform, which is due to be introduced in 2022. It plans to begin shipping chips designed with its new Blackwell GPU architecture in the third quarter of this year (a brief delay prevented its introduction in the second quarter).

Meanwhile, Nvidia has already announced plans to introduce its next-generation Rubin architecture in early 2026. Its launch schedule also shows its Ultra platform coming out in 2027. As noted above, all of its platforms are backwards compatible with CUDA, so customers don’t have to worry about their chips becoming obsolete.

This accelerated cycle of innovation will allow the company to do two main things. First, it should help it maintain its technological leadership in the hardware sector as more competitors enter the market. Second, constant innovation should help the company maintain its pricing power. Nvidia’s chips are expensive and have high gross margins, so it needs to stay ahead of the curve, which it clearly intends to do.

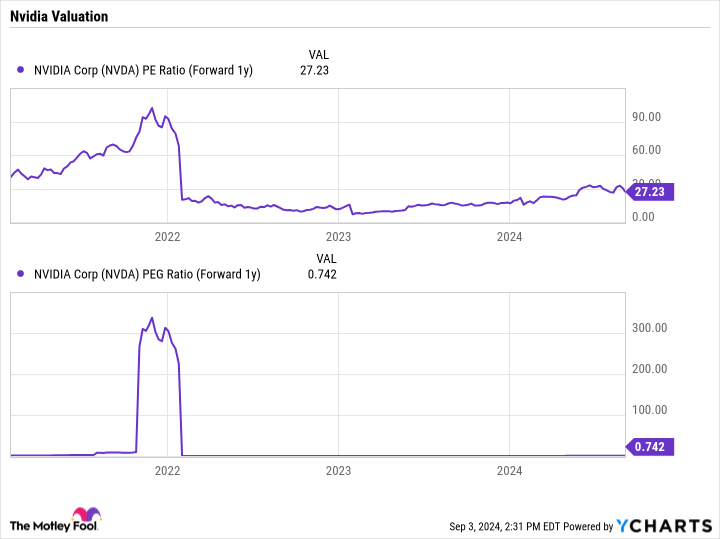

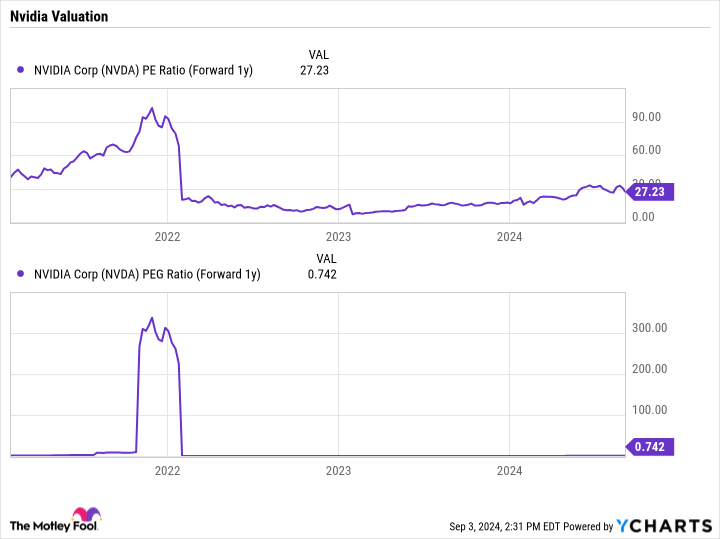

4. Nvidia stock remains relatively cheap by some valuation metrics.

Trading at a forward price-to-earnings (P/E) ratio of about 27 and a price-to-earnings-to-growth (PEG) ratio of just over 0.7, Nvidia stock remains cheap for a company that has seen triple-digit revenue growth. That kind of growth can’t last forever, but given the exponential computing power needed to advance AI and its wide moat, Nvidia still has plenty of room for growth ahead.

Now that the stock price has recently pulled back from its highs, it seems like a good time to buy Nvidia stock like there’s no tomorrow.

Should You Invest $1,000 In Nvidia Right Now?

Before you buy Nvidia stock, consider the following:

He Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the Top 10 Stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 stocks that made the cut could yield outsized returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, You would have $656,938!*

Stock market advisor offers investors an easy-to-follow blueprint for success, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. Stock market advisor The service has more than quadruple the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor performance as of September 3, 2024

Randi Zuckerberg, a former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Alphabet executive Suzanne Frey is a member of The Motley Fool’s board of directors. Geoffrey Seiler holds positions at Alphabet. The Motley Fool holds positions at and recommends Advanced Micro Devices, Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

4 Reasons to Buy Nvidia Stock Like There’s No Tomorrow was originally published by The Motley Fool