While AI leader Nvidia (NASDAQ: NVDA) reported stellar first-quarter earnings, computer processor and graphics card maker Advanced Micro Devices (NASDAQ:AMD) relatively underperformed, just meeting expectations. This led to a drop in the stock price after the earnings release. However, investors should keep in mind that NVDA is a few quarters ahead of AMD. AMD is showing impressive growth in its AI-powered data center revenue, which will ultimately be reflected in margins and earnings. Therefore, I am bullish on AMD stock.

AMD’s modest first-quarter results failed to impress investors

On April 30, AMD reported first-quarter earnings per share (EPS) of $0.62, in line with analyst estimates. The figure was just 3.33% higher than the first quarter of fiscal 2023 of $0.60 per share. First-quarter revenue grew 2.2% year-over-year to $5.47 billion, also roughly in line with consensus estimates. Strong data center segment revenue somewhat offset weakness in the embedded devices and gaming segments, but overall first-quarter results were lackluster.

Crucially, data center revenue growth continued to impress, growing by an impressive 80% YoY during the quarter, driven by the launch of its latest MI300 AI accelerators, Ryzen and EPYC processors. Disappointingly, however, gaming revenue fell 48% YoY due to a decline in gaming chip sales. Additionally, adjusted gross and operating margins were not encouraging, coming in at 52% (78.4% for Nvidia) and 21%, respectively.

Next up, AMD’s revenue guidance came in line with expectations. For the second quarter, total revenue is expected to be around $5.7 billion (+/- $300 million). On the positive side, however, management has upgraded guidance for data center GPU sales, which are now expected to be $4 billion versus the previously forecast $3.5 billion. The company’s adjusted gross margin is expected to be approximately 53%.

AMD’s AI product roadmap shows strong growth potential

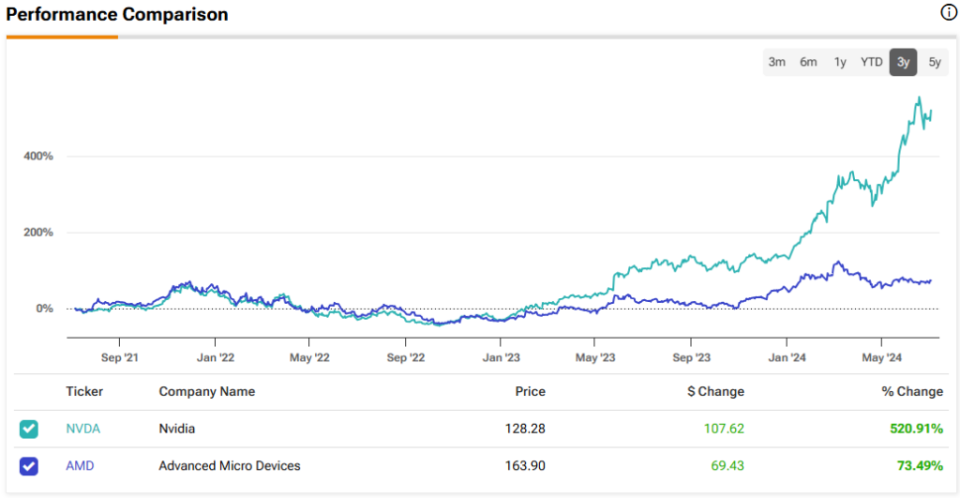

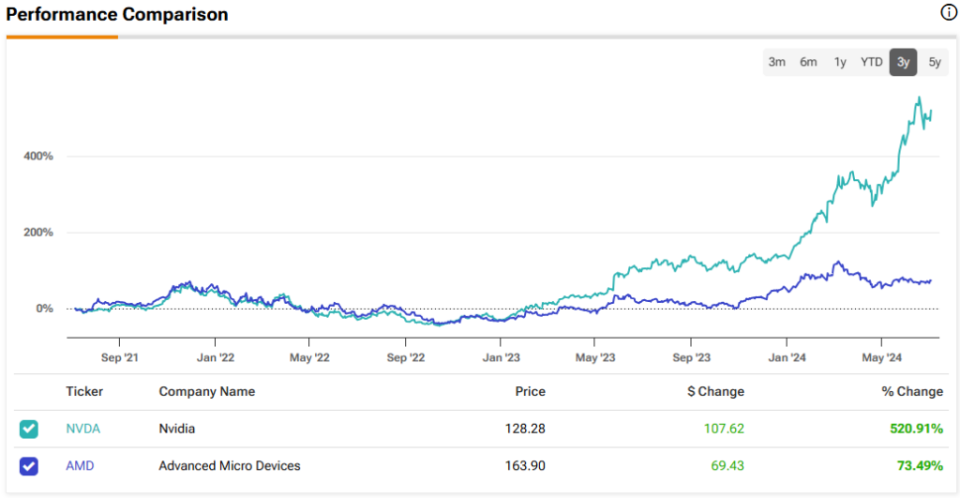

A relatively disappointing first quarter and fears of declining AI demand led to a 28% drop in AMD shares from their all-time high of $227 in March 2024 to around $164 today.

However, investors should keep in mind that AMD is NVDA’s closest competitor. It is well known that AMD GPUs are a cheaper alternative to NVDA GPUs. Given the clear gap between demand and supply due to limited manufacturing capacity, the rise in popularity of AI creates an opportunity for AMD chips to fill that gap.

For example, Microsoft (NASDAQ: MSFT) recently announced that its cloud computing customers using Azure can opt for AMD MI300 chips alongside NVDA’s H100 GPUs. This will give customers an alternative in the event of general supply constraints or individual customer budget limitations. Notably, AMD’s MI300 accelerator, which competes with NVDA’s H100 chips, costs 33% less.

While Nvidia currently leads the AI and GPU markets with over 80% market share, AMD’s competitive pricing and performance improvements could help it gain market share over time. It’s worth noting that MI300 is considered the fastest-growing product in AMD’s history. Launched just two quarters ago, it has already surpassed the $1 billion sales milestone.

It is no surprise then that AMD management has been steadily increasing MI300 sales forecasts over the past three quarters. There is a strong likelihood that the upward sales trend will continue in the coming quarters as well.

It is important to note that AMD has a wider variety of offerings compared to NVDA. While NVDA is known for its powerful GPUs for data centers, AMD offers a wider range that includes CPUs for PCs and GPUs for the gaming industry. During the COVID-19 pandemic, the PC market saw a huge demand. Now, it is time for users to switch to new PCs with improved technology. AMD is a key supplier for the high-end PC market and is sure to benefit from the increase in PC demand.

Additionally, both NVDA and AMD continue to introduce their newest products, including accelerators and processors. While AMD launched its MI300 accelerators in December 2023, NVDA launched its Blackwell GPUs in March 2024.

In response to NVDA’s pace of innovation, AMD CEO Lisa Su also announced an annual cadence of new product releases at the Computex show on June 2. The product roadmap looked impressive, and more new releases year after year were expected to gradually increase revenue and profits.

It is worth noting that AMD has been steadily pursuing acquisitions to enhance its data center offering. For example, it acquired Xilinx in February 2022 and Pensando Systems in May 2022. Moreover, the acquisitions are yet to be integrated to their full potential and are expected to generate a $10 billion cross-selling opportunity, as cited by management. With its acquisitions, its total addressable market continues to grow, having increased to $300 billion today from just under $80 billion in fiscal 2020.

AMD’s valuation isn’t cheap, but it looks reasonable

Surprisingly, AMD trades at a high forward P/E multiple (47x), slightly higher than AI prodigy Nvidia, which trades at a forward P/E of 45x. What could be the reason for AMD’s high valuation despite lagging behind NVDA’s inspiring results? The answer is clear: AMD is likely to follow NVDA’s footsteps in the coming years as its AI growth story is just beginning.

Now, let’s consider whether AMD is worth buying at current levels. Wall Street analysts expect AMD earnings per share to be about $5.59 in fiscal 2025 (with expectations for about $6.50 in fiscal 2026). If AMD maintains the same forward price-to-earnings multiple of 47x by then, its stock price will be about $275, or 68% higher than the current price.

Put another way, AMD stock is trading at a P/E of 28 times its fiscal 2025 EPS estimate, implying a 35% discount to its five-year historical average of 43 times.

Therefore, it makes sense to consider buying AMD stock at current levels, given the strong growth fundamentals in the AI space.

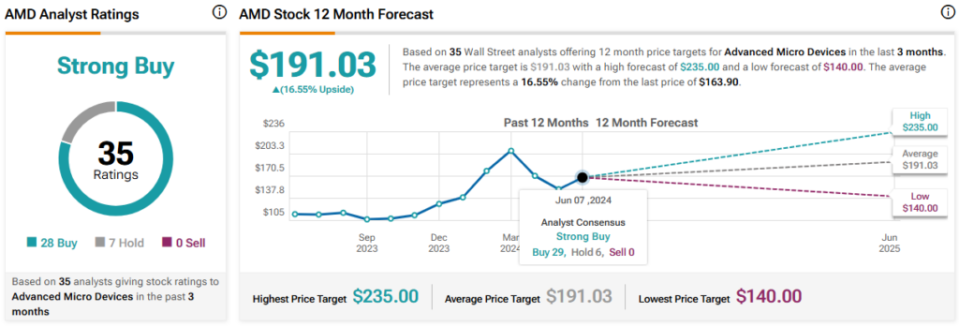

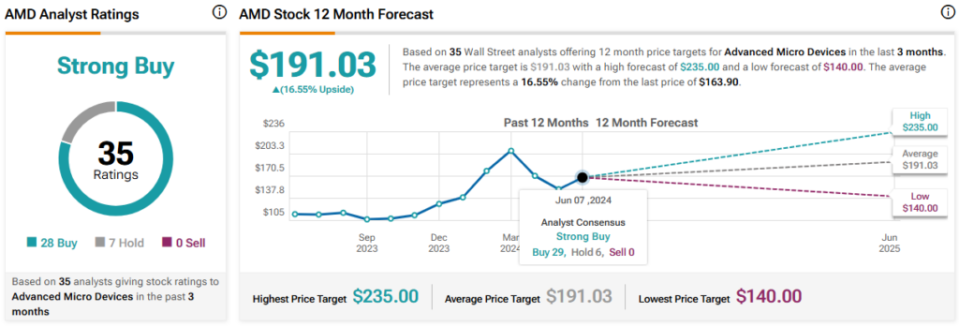

Is Advanced Micro Devices stock a buy, according to analysts?

Sentiment among Wall Street analysts is decidedly positive regarding Advanced Micro Devices stock. The stock has a Strong Buy consensus rating, with 28 Buy recommendations and seven Hold recommendations. The average price target for AMD stock of $191.03 implies an upside potential of 16.6% from current levels.

Conclusion: Consider AMD for long-term AI potential

There is clear demand for AI across a wide range of industries as companies look to build their own data center infrastructure. This implies that strong growth in AI chip, GPU, and CPU sales will continue for at least a few years. AMD’s advancements in AI and data center solutions position the company well for future growth, and its competitive pricing will help it gain market share over time.

Furthermore, AMD has a strong presence in the PC AI market and is likely to continue gaining market share. The impending PC refresh cycle with AI-powered PCs will boost AMD’s sales and margin in the coming quarters. Given my bullish stance, I view the current share price weakness as a buying opportunity.

Divulgation